COVID-19 Bulletin: December 21

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices slumped today on news of a new, highly infectious strain of COVID-19 in the U.K., with Brent slipping below $50. Prices were off more than 5% in early trading, with the WTI at $46.59/bbl and Brent at $49.64/bbl. Natural gas was 1.3% lower at $2.66/MMBtu.

- China’s largest refiner expects that domestic demand for oil products will peak by 2025 due to the rise of electric vehicles and greater dependence on renewable energy.

- Onshore oil production from companies that filed for bankruptcy in 2020 is set to decline by up to 25% in 2021.

- Saudi Arabian oil exports jumped in October, increasing 281,000 bpd from the previous month to a total of 7.38 million bpd.

- New investments in offshore oil and gas in Norway are likely to decline 4.2% in 2021, a smaller reduction than previous forecasts.

- Offshore drilling contractor Transocean will go forward with a $1.5 billion debt restructuring as the company attempts to stay afloat through pandemic-induced drops in oil demand.

- Royal Dutch Shell said it will post an additional $4.5 billion in impairment charges, signaling another bleak earnings quarter for big oil.

Supply Chain

- Up to 10 million packages per day are being delayed in the U.S., a result of converging factors that are sinking on-time delivery rates during the peak holiday season.

- The Port Authority of New York and New Jersey will cut its 2021 budget by 15% due to revenue losses suffered during the pandemic.

- Truck driver turnover rates increased significantly in the third quarter for both large and small truckload carriers, but average turnover rates in 2020 remain below 2019.

- Logistics companies operating in the U.K. have started chartering planes to keep supply chains open through expected road- and sea-congestion following a no-deal Brexit.

- Logistics conditions continue to deteriorate, with trucking demand exceeding availability, growing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- New COVID-19 cases in the U.S. hit a record-high 249,709 on Friday and eased to just under 200,000 on Saturday, as hospitalizations remained above 110,000 after 12 straight days of new highs.

- December is the U.S.’s worst month of the pandemic by a large margin, with COVID-19 fatalities already at 42,535, higher than any other month with a week and a half to go.

- California leads the nation in new COVID-19 cases, posting a record high of 54,532 infections Friday. The rising case counts have led Apple to temporarily shut all 53 of its California locations.

- New York reported more than 12,000 cases on Friday, the highest level since the pandemic began.

- North Carolina is reporting record new COVID-19 infections, while Tennessee set records for new infections and deaths last week.

- Hospitals nationwide could soon start having to make rationing decisions on which COVID-19 patients can get certain types of care, subject to shortages in resources and staff.

- U.S. regulators authorized the nation’s second COVID-19 vaccine over the weekend. Doses of Moderna Inc.’s vaccine began shipping Sunday, with 7.9 million doses of both Moderna’s and Pfizer/BioNTech’s vaccine set to be distributed by the end of the week.

- New Jersey is opening six vaccination “mega-sites” with the aim of inoculating 70% of residents within six months.

- A federal advisory panel recommends people over age 75 and front-line essential workers — including teachers, factory workers, police, firefighters and grocery store workers — be next in line to receive COVID-19 vaccines.

- Shipments of Pfizer/BioNTech’s COVID-19 vaccine are struggling to reach rural hospitals without the infrastructure needed to store the doses at the unusually low temperatures required.

- Health experts are beginning to document state data on the number of people vaccinated, with early counts suggesting the U.S. inoculated 556,208 people in the first week of vaccine rollouts.

- Treatment options for seriously ill COVID-19 patients have gone back to pre-pandemic basics in many hospitals as doctors have learned that decreasing the use of respirators and sedatives can send more people home sooner.

- The EEOC declared that employers can mandate that employees receive a COVID-19 vaccine.

- Sunday evening, Congressional lawmakers tentatively agreed to a roughly $900 billion economic relief package that would include stimulus checks up to $600 per person alongside extending and increasing jobless aid past the new year.

- The $900 billion relief package includes $15 billion in aid to airlines after earlier support for the beleaguered industry expired two months ago.

- The Federal Reserve offered optimism on the outlook for U.S. banks last week, saying they are strong enough to survive the pandemic but could face hundreds of billions in losses on loans if poor economic conditions are prolonged.

- Small businesses are finding it increasingly difficult to get loans from U.S. banks, a result of the disappearance of many community banks alongside the lower margins on such loans for larger banks due to relatively high processing costs.

- Small liberal arts colleges are decreasing tuition for U.S. students in a bid to lure prospective freshmen in the middle of a pandemic, the first instance of colleges lowering or holding tuition rates flat in almost a quarter century. Meanwhile, applications to Ivy League colleges are at their highest-ever levels, up to 57% higher than in 2019.

- Restaurant chains reported new signs of pandemic-induced drops in demand last week, with Olive Garden’s parent company posting a 20.6% decline in same-store sales compared to the year-ago period.

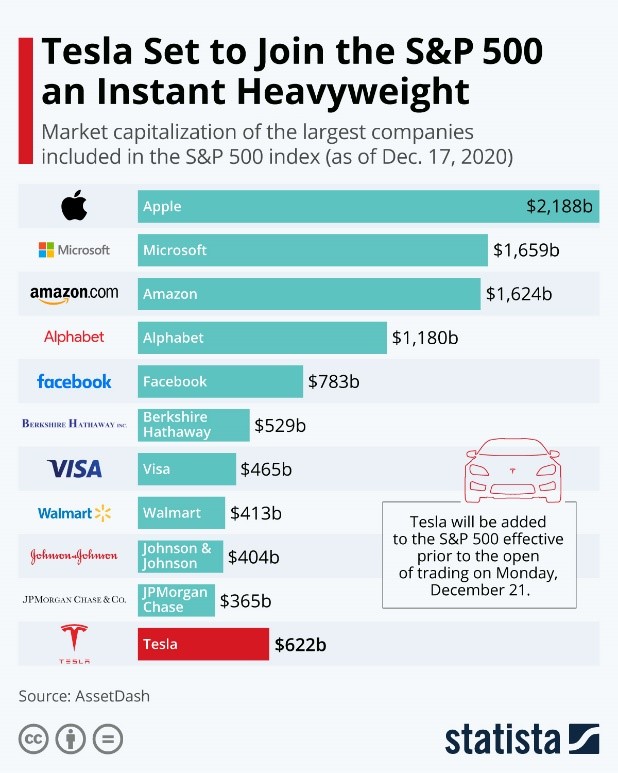

- Tesla joins the S&P 500 today, one of the largest companies ever added to the bellwether index:

International

- Countries around the world are barring trade and travel with Britain to keep out a highly infectious new strain of COVID-19 recently discovered in the country.

- British health officials say the strain spreads 70% faster than earlier variants and is responsible for a surge in cases in London.

- The country reported its highest one-day count of new cases, topping 36,000.

- More than 16 million Britons are now required to stay at home after a lockdown was imposed Sunday to contain transmission of the new strain.

- The lockdown imposes the highest-level restrictions yet, including banning activities during Christmas just two weeks after the government said it would ease holiday restrictions.

- The U.K. faces a food crisis as trade restrictions block international trade of vital goods with the country.

- The British pound dropped 2% against the U.S. dollar, its worst performance of the pandemic.

- New York’s governor warned that the strain could already be in the state from incoming flights at the John F. Kennedy international airport.

- A COVID-19 patient in Italy returning from the U.K. was found to have the new strain.

- Apple is shutting 12 stores in London due to increased transmission rates.

- Austria will enter its third national lockdown after Christmas, officials say.

- Italy is imposing a total lockdown over the Christmas holiday, the country’s first such lockdown since cases originally spiked in May.

- Mexico shut down nonessential activities in its capital city through January 10, facing a surge of new COVID-19 cases alongside Brazil and Peru.

- A cluster of more than 60 COVID-19 cases in Sydney, Australia, is threatening months of the country’s successful containment of the virus, as lawmakers imposed new restrictions on gatherings and hospitality venues.

- Canada has surpassed 500,000 cases of COVID-19.

- Record levels of COVID-19 cases in Japan are straining the country’s hospital resources.

- Thailand, which had largely brought the pandemic under control, reported a spike of 500 new COVID-19 cases linked to a wholesale seafood market on the outskirts of Bangkok.

- With more than 2 billion in current and future vaccine doses secured, the World Health Organization is signaling that the end of the pandemic is “in sight.”

- The total number of worldwide inoculations against COVID-19 are approaching 2 million, as vaccine rollouts begin in several countries.

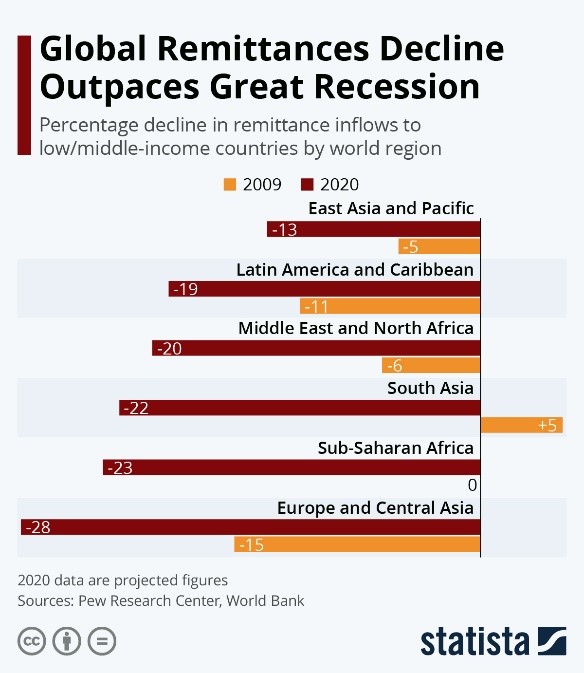

- A steep drop in global remittances during the pandemic is exacerbating the economic hardship for many poorer countries:

- Taiwan’s exports soared nearly 30% in November on strong overseas demand for electronics.

- Canadian retail sales in October grew 0.4% from the previous month on higher purchases of cars and a recovering labor market.

Our Operations

- M. Holland will be closed on Thursday and Friday, December 24 and 25, for the Christmas holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.