COVID-19 Bulletin: December 22

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices were lower in early trading today, with the WTI at $47.47/bbl and Brent at $50.48/bbl. Natural gas was higher at $2.77/MMBtu.

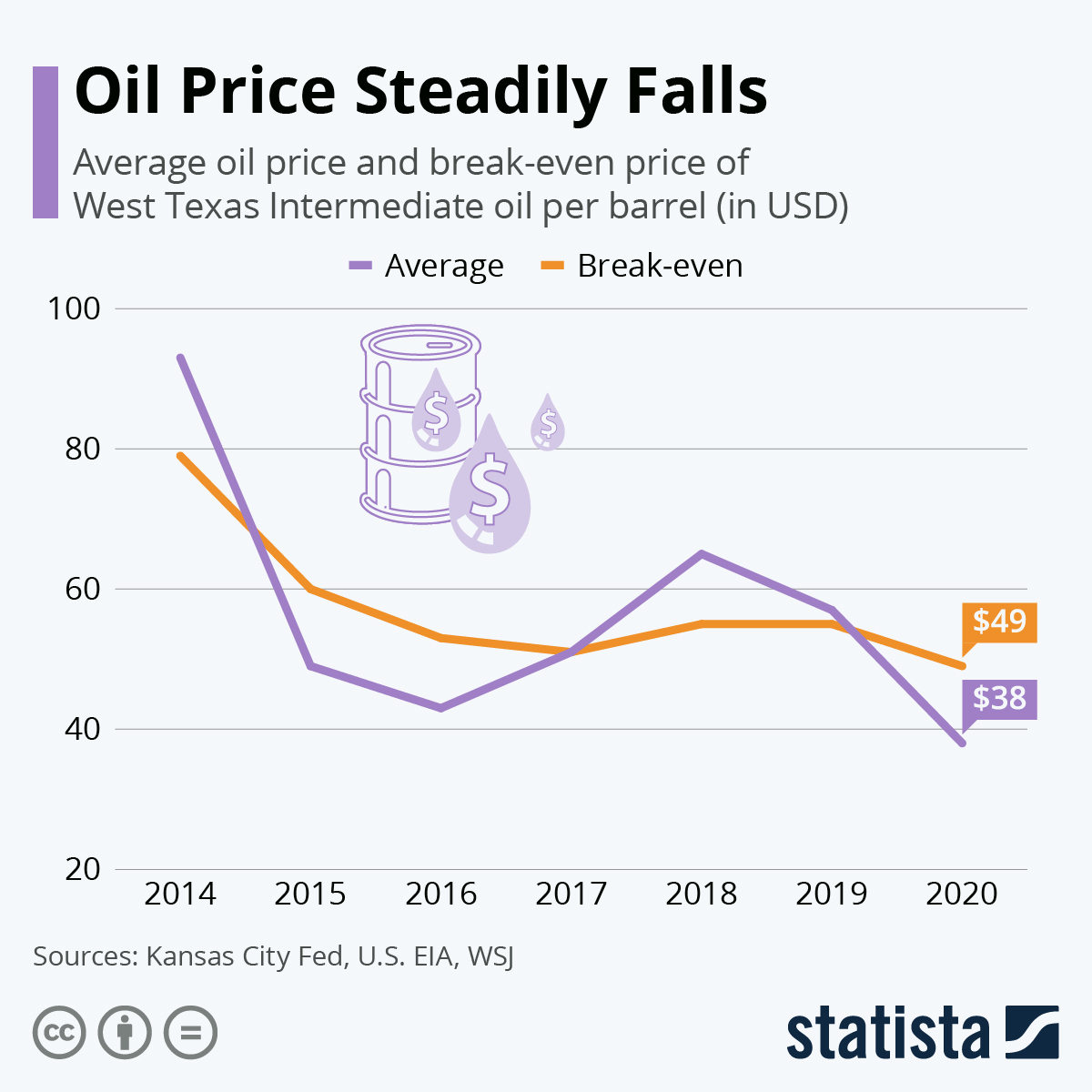

- For the first time in four years, the 2020 average WTI price has fallen below the cost of production as the shale industry closes the worst year in its history with more turmoil on the horizon:

- Russia will support further increases in OPEC+ production up to 500,000 bpd in February, matching the hike already agreed to by cartel nations for January.

- To attract capital and accelerate growth of its energy industry, China is lifting restrictions on foreign investment in all its energy sectors.

- Diamondback Energy will buy West Texas rival QEP Resources in a stock deal worth $2.2 billion, extending a run of low-premium takeovers in the U.S. shale patch.

Supply Chain

- A cross-country storm system could hit the U.S. East Coast on Christmas Eve, bringing a sharp cold front and the potential of snow from Ohio to New York.

- Schedule reliability for on-time arrivals of container ships in November reached their lowest level ever at just 50.1%.

- A historic crush of holiday packages is causing widespread delays and gridlock at the U.S. Postal Service, made worse by the service’s inability to turn down shipments like rival private competitors UPS and FedEx.

- The Port of New Orleans is moving forward with plans to build a $1.5-billion container ship terminal on the Mississippi River in St. Bernard Parish, Louisiana.

- The Port of Los Angeles approved a first-of-its kind Port Cyber Resilience Center to protect against cyberattacks that could disrupt port activity and cargo flow.

- Malware in the form of fake delivery notices from Amazon, UPS and FedEx is up 440% this year as hackers take advantage of rising e-commerce to penetrate computer systems and steal personal information.

- Logistics conditions continue to deteriorate, with trucking demand exceeding availability, growing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. recorded 190,519 new COVID-19 cases and 1,696 deaths yesterday, pushing total infections above 18 million.

- California has no more ICU beds available in the Los Angeles area and the San Joaquin Valley agricultural region, the governor said yesterday, adding that the state could face an unprecedented 100,000 total hospitalizations in January due to rising COVID-19 infections verging on 40,000 to 50,000 new cases per day.

- Texas suffered a record in daily COVID-19 infections last Thursday, and hospitalizations topped 10,000 for the first time since a summer peak, prompting the governor to receive a public vaccination shot.

- West Virginia, North Dakota, South Dakota, Colorado and Maine are so far leading states in fully distributing COVID-19 vaccine allocations from the federal government.

- U.S. health officials say there is no reason to believe the efficacy of COVID-19 vaccines will be reduced by a new, highly infectious coronavirus variant that recently appeared in the U.K. Scientists from BioNTech, Pfizer’s partner in one of the world’s most successful vaccines so far, say their vaccine is just as effective against the new strain in the U.K.

- New York will require inbound air passengers from the U.K. to be pre-screened for COVID-19 before boarding flights on three major carriers.

- Amazon is shutting one of its warehouses in New Jersey until December 26, citing caution against spreading COVID-19 after a spike in the state since Thanksgiving.

- The arrival of COVID-19 vaccines has prompted a hiring frenzy among pharmacies and supermarkets engaged in their distribution.

- Several medical companies are putting resources into developing treatments for “long-haul” COVID-19 symptoms, a mystifying occurrence that prolongs several side effects — including brain fog, extreme fatigue and shortness of breath — in 10% to 20% of infected people.

- Rural areas in the U.S. face higher fatality rates from COVID-19 than big cities, data shows.

- U.S. life expectancy is poised for the biggest drop since WWII, with COVID-19 now the third highest cause of death behind heart disease and cancer.

- U.S. airlines carried over 1 million passengers for the third straight day as Americans travel ahead of the holidays, a substantial risk for increased COVID-19 transmissions.

- Congress approved a nearly 6,000-page, $900-billion spending and relief bill that includes a wide swath of subsidies, direct payments to individuals, increased and expanded jobless aid, and tax breaks to most sectors of the U.S. economy.

- American Airlines was the first U.S. carrier to announce recalls of furloughed employees following Congress’s latest spending package, which contains new aid for airlines.

- Direct payments of $600 to eligible Americans will begin going out the week of December 28.

- The bill provides tax breaks for many industries, including downtown restaurants, the film industry and motorsports tracks, among others.

- Numerous climate change provisions are included in the bill, including new limits on greenhouse gas use in refrigerants alongside tax incentives for wind and solar energy.

- Nursing home occupancy is down 15% in 2020 from the year before as families face concerns about the pandemic’s dangers for elderly people and the isolation faced in long-term-care institutions.

- U.S. business inventories increased by more than expected in October, climbing by 0.7% after rising by 0.8% in September.

- Guitar Center, the nation’s largest seller of musical instruments, will go into and out of bankruptcy in less than a month on expected approval of plans to cut $800 million in debt through cash infusions.

- Nike’s digital revenue increased 84% in the quarter ended November 30, a confirmation of the company’s recent strategy shifts toward e-commerce activity.

- Apple is aiming to produce self-driving cars by 2024, helped in part by in-house battery technology that could reduce costs of power packs and extend the vehicle’s range.

International

- More than 1,500 trucks were stranded in England on Tuesday due to border closures, as the U.K. and France scrambled to address the gridlock following the discovery of a highly infectious new strain of COVID-19.

- Saudi Arabia, Kuwait and Oman are suspending international flights from the U.K. due to the new, highly contagious COVID-19 strain that recently appeared there. The strain, however, may have already been present in several other countries by the time it was discovered in the U.K., including Demark, the Netherlands, Australia, Italy, Gibraltar, France, South Africa and Belgium.

- Ontario, Canada’s largest province, will impose regional lockdowns starting the day after Christmas, with officials saying COVID-19 transmissions are moving toward dangerous territory.

- Australian officials are working to contain a cluster of 83 COVID-19 cases in Greater Sydney with bans on travel outside the region and increased restrictions posed on residents yesterday. Contact tracing used to isolate the cases appears to be working, as the region reported only eight new cases of locally acquired COVID-19 in the past 24 hours, down from 15 the prior day.

- South African officials are warning that rising COVID-19 rates are putting the nation’s hospital resources and available beds under increasing strain.

- Japan’s prime minister will not declare a state of emergency, though COVID-19 hospitalizations above 2,000 on Monday set a record for the nation.

- The European Union came one step closer to approving Pfizer/BioNTech’s COVID-19 vaccine, with final authorization expected to come from regulators later this week. Pfizer/BioNTech are already beginning to ship out refrigerated cargo trucks carrying hundreds of thousands of vaccine doses to the bloc’s 27 nations.

- Pfizer and German partner BioNTech are rapidly exploring ways to produce more than the 1.3 billion COVID-19 vaccines promised to countries in 2021.

- Brazil became the first country to complete Phase 3 trials of China-developed Sinovac Biotech’s COVID-19 vaccine, reporting a greater than 50% efficacy rate, enough for Brazilian regulators to approve the drug for use.

- Honda is cutting vehicle production in India by 40% through plans to close one of its two manufacturing plants in the country, a result of depressed sales during the pandemic.

Our Operations

- M. Holland will be closed on Thursday and Friday, December 24 and 25, for the Christmas holiday. We will be closed Friday, January 1, for New Year’s Day.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.