COVID-19 Bulletin: December 7

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were higher in mid-day trading today, with the WTI up 0.4% at $46.46/bbl and Brent up 0.2% at $49.36/bbl. Natural gas was 5.9% lower at $2.42/MMBtu.

- The global energy industry is undergoing a large shift in fuel-making power, with more than 1.7 million bpd of refining capacity in Western countries (and Japan) shutting down in 2020 while more than 2.2 million bpd of capacity opens in China, India and the Middle East. From the U.S. to Japan, 11 refineries have announced closures this year, while eight more are on the chopping block or in partial shutdowns already.

- French supermajor Total is in talks to sell its 18% stake in an Iraqi-Kurdistan oilfield in a bid to curb debt as plunging oil and gas prices lower earnings.

- Iran is preparing to raise oil exports by a yet unspecified amount within the next three months, boosted by an expected lift on some U.S. sanctions in January.

- The Baker Hughes count of active oil and gas rigs in the U.S. rose by 3 last week to 323, 32% above the pandemic low but still 60% below a year ago.

- Baker Hughes is utilizing 3D printing to produce more than 450 parts for downhole and machinery applications.

- Braskem Idesa declared force majeure after Mexico’s National Centre for Control of Natural Gas cut off natural gas supply to the site.

Supply Chain

- Winter’s first major snowstorm hit the Northeast on Saturday, bringing more than a foot of snow alongside 50-mph wind gusts and leaving more than 200,000 without power.

- November saw a 1% year-over-year decline in airfreight demand, the sector’s first drop in six months, which is attributed to the impact of global lockdowns and restrictions.

- Delivery, warehousing and trucking operators added 131,400 jobs in November as logistics hiring skyrocketed ahead of the holiday-season rush.

- Autonomous vehicle company Waymo will open a testing site near Columbus, Ohio, the firm’s first venture into heavy-duty truck testing in a dense, urban area.

- We are seeing congested trucking and shipping conditions, backlogs at warehousing and packaging facilities, and tight packaging supplies. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- After four consecutive days of more than 200,000 new COVID-19 cases through Saturday, the U.S. has topped 1 million new infections in just five days, a number it took almost 100 days to surpass early in the pandemic.

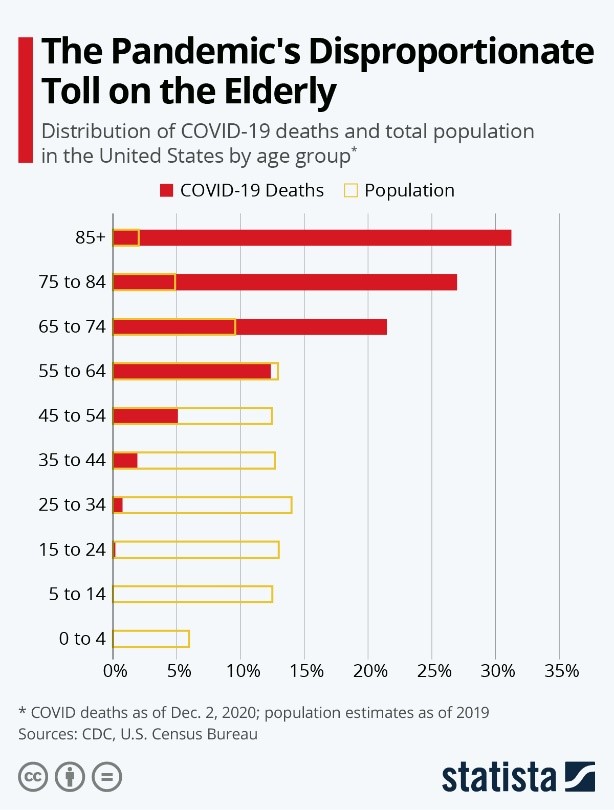

- Every key metric of COVID-19 in the U.S. rose to record numbers last week, including cases, fatalities, hospitalizations, individual state records and seven-day and 14-day averages. Death rates are disproportionately impacting older victims:

- Oregon, New Jersey, Pennsylvania, North Carolina, Virginia, South Carolina and California all reported record numbers of new COVID-19 cases over the weekend, with several states reporting consecutive days of records.

- Tens of millions of Californians were placed under new stay-at-home orders yesterday, with many of the state’s regions hitting the threshold trigger of sub-15% hospital bed capacity. Lockdowns in the Bay Area are some of the harshest of any U.S. city, with personal services, outdoor dining and most public gatherings all closed.

- Alabama reported nearly a week of consecutive record hospitalizations.

- All Americans who want a COVID-19 vaccine should be able to get one by the second quarter of next year, the White House’s Health and Human Services chief said Sunday, with potential vaccine authorization coming as soon as Thursday, and potential shots being distributed as soon as Friday.

- Hospitals must carefully balance COVID-19 vaccine distributions to their prioritized employees, as the side effects risk sidelining essential health care workers at a time of record hospitalizations.

- The CDC upped its mask-wearing recommendations, urging Americans to wear one indoors whenever they’re outside their own home.

- Public health experts are urging the medical profession to adopt a specific syndrome related to “long-hauler” COVID-19 effects, which could lead to lingering health problems that impede a person’s ability to work and function normally.

- U.S. exports and imports rose for a fifth straight month in October amid a continued recovery in global commerce led primarily by China.

- America’s largest companies are holding onto record cash stockpiles of nearly $2.1 trillion after issuing large amounts of debt to ward off COVID-19 disruptions earlier this year.

- Many firms that got rid of 401(k) retirement contributions earlier this year are now bringing them back, as positive vaccine news brings hope of sustained economic recovery.

- Goldman Sachs is considering moving a key financial division to Florida, a possible effect of the bank’s success in operating remotely during the pandemic and a worrying sign for New York, long considered the de facto financial hub of the U.S.

- Mercedes-Benz is the latest company to target the U.S. electric van market with plans to introduce its eSprinter cargo van in 2023.

- Nearly 17% of Cadillac dealers are ending their franchise agreements with parent General Motors as the car maker pushes for costly electric vehicle upgrades to dealerships.

- Volkswagen’s CEO expects to see fully autonomous vehicles on the market between 2025 and 2030, citing a boosted timeline from improvements in computer chips and artificial intelligence.

- Dollar General saw a 17.3% third-quarter increase in sales from the year-ago period, as the company works to bring frozen and refrigerated food distribution in-house and increase its locations nationwide.

International

- Germany is considering tougher restrictions after current measures have failed to contain the country’s COVID-19 spike, while the state of Bavaria imposed a stay-at-home mandate starting this week to address a “disaster situation.”

- Denmark is imposing partial lockdowns of major cities after the nation suffered record COVID-19 infections on Saturday.

- Turkey is approaching its highest daily levels of new COVID-19 infections, reporting 30,402 on Sunday.

- New COVID-19 cases in Seoul, South Korea, hit a nine-month high as officials imposed heightened social distancing rules.

- Italy became the world’s sixth country to surpass 60,000 COVID-19 fatalities, while new infections in the country gradually slowed last week.

- The U.K. will start giving out COVID-19 vaccine shots Tuesday, the first Western country to both approve and begin vaccine distribution to the public.

- Chinese provinces are placing massive orders for an experimental vaccine that is yet to release late-stage testing results. More than 1 million people have already received doses as some developing countries run their own tests on the drug, which is cheaper than its Western counterparts.

- China’s exports rose 21.1% in November year-over-year, driving the nation’s trade surplus to the highest level in nearly 20 years. The country’s foreign currency reserves rose to the highest level in more than 4 years.

- Taiwan’s exports rose a higher-than-expected 12% last month versus the prior-year period, the fastest pace since February, on strong shipments of high-tech products.

- German industrial production, fueled by the automotive sector, rose 3.2% in October from September, the sixth consecutive monthly increase and double the growth rate expected by analysts.

- The British pound is falling in value as analysts question exactly how close the country is to a final agreement in Brexit trade talks, with many critical final deadlines less than four weeks away.

- More than 80% of global firms and 90% of North American firms now provide reports on sustainability, a broad environmental movement that is making deep inroads into company practices.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.