COVID-19 Bulletin: December 9

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were mixed in mid-day trading today, with the WTI down 0.2% at $45.5/bbl and Brent flat 1.0% at $48.85/bbl. Natural gas was 4.0% higher at $2.50/MMBtu.

- The American Petroleum Institute reported a 1.1-million-barrel increase in crude inventories last week, versus an expected draw of 1.5 million barrels.

- The Energy Information Agency raised its forecast for oil prices in 2021, now expecting WTI to average $45.78/bbl and Brent to average $48.52/bbl; it lowered its estimate for natural gas prices next year to an average of $3.01/MMBtu.

- The Baker Hughes count of active oil and gas rigs in the U.S. inched higher last week for the 11th week in the past 12, up by 3 to 323 but well below the year-ago level of 799.

- The U.S. oil patch added 2,665 jobs in November, the third consecutive monthly increase, but industry employment remains nearly 11% below the year-ago level.

- Oil demand in Latin America has rebounded above pre-pandemic levels, providing a boost to Brazil’s petrochemicals industry.

- Chevron’s CEO expects fossil fuels to be an important part of the economy for the foreseeable future but said the industry must invest in green energy and new technologies to help address the climate crisis.

- Braskem America and Encina announced a collaboration to develop feedstocks for recycled polypropylene.

Supply Chain

- Major retailers including Amazon are urging customers to choose nontraditional shipping options during the holidays, a bid to save costs on record freight prices if customers opt for slower deliveries.

- Walmart is utilizing artificial intelligence to contact suppliers and carry out negotiations via chatbot, a move to ensure the latest business conditions are reflected in the company’s thousands of small-scale supplier contracts which, left untended, can result in significant losses on a contract’s value.

- Vaccine transporters are like a “factory running at 80% of capacity…with 150% demand,” a logistics industry leader said Tuesday.

- Dozens of truck drivers in Cleveland waited up to 15 hours for dropping off and picking up shipments over the weekend, a result of unprecedented volumes and backlog.

- Despite reports of little or dangerous parking situations, most truck stop owners did not have plans to add more parking in a survey from the National Truck Parking Coalition.

- Hundreds of thousands of seafarers remain stranded at sea, some for as long as 17 months, as pandemic border restrictions have prevented shipping companies from rotating crews.

- We are seeing congested trucking and shipping conditions, backlogs at warehousing and packaging facilities, and tight packaging supplies. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. recorded 215,724 new COVID-19 infections yesterday and 2,546 deaths.

- The U.S.’s seven-day moving average of new COVID-19 cases topped 200,000 for the first time on Tuesday.

- Texas recorded more than 15,000 new COVID-19 cases Tuesday.

- Washington state and Massachusetts are imposing new COVID restrictions to forestall increased transmission during winter holidays.

- The U.S. is facing a national hospital crisis, with a third of Americans in areas where available ICU capacity is less than 15%. ICU beds in three California counties are completely full.

- Defying CDC warnings, more home-weary Americans traveled over the Thanksgiving weekend, with 80% of U.S. counties reporting increases.

- Early reports show the Pfizer/BioNTech COVID-19 vaccine meets the criteria for approval by the Food and Drug Administration, which could come as soon as this weekend.

- While considered safe, the Pfizer/BioNTech and Moderna vaccines can cause strong side effects.

- New data from AstraZeneca’s late-stage vaccine trials show the company’s vaccine is much more effective at preventing COVID-19 illness in individuals than preventing viral transmissions to others.

- U.S. officials say the country will have enough COVID-19 vaccine doses for most Americans to get inoculated by next summer.

- Disagreements over protection against virus-related lawsuits against businesses and state and local aid are stalling Congressional negotiations for a new $908 billion bipartisan relief package. Separately, the White House proposed an alternative $918 billion relief package late yesterday.

- Job openings edged down last week, a further sign of a softening labor market.

- About 1 in 3 workers suffered a pay cut during the pandemic.

- U.S. employers cut 128,000 IT jobs in November, largely erasing the sector’s hiring gains from October.

- Mortgage rates hit a record low last week for the 14th time this year.

- Median rental rates in San Francisco are down 35% as tech workers flee the city to work remotely.

- Third-party food deliverer DoorDash has both helped restaurants stay afloat during the pandemic and contributed to their shutting down, as the delivery costs are untenable for many conventional restaurants.

- United Airlines is the first airline to receive a new Boeing 737 MAX jet after the plane’s near two-year grounding was lifted in recent months.

International

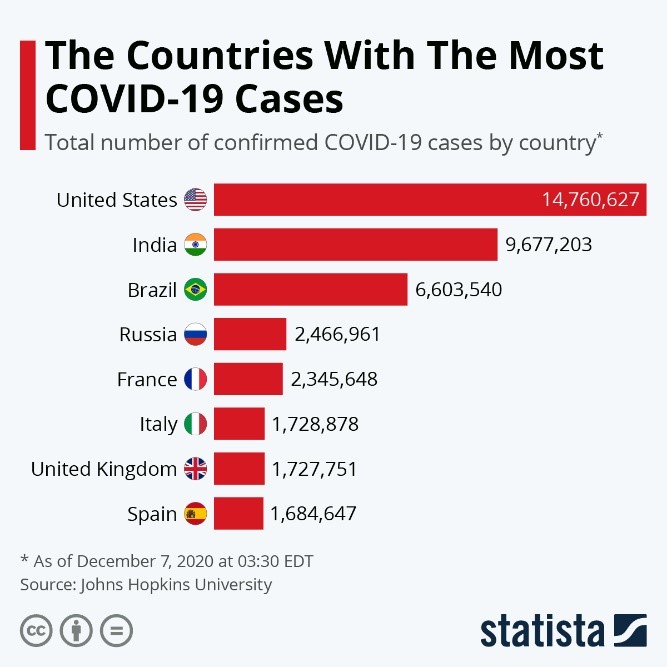

- Total global COVID-19 cases topped 68 million yesterday with the U.S., India and Brazil accounting for over 46% of infections.

- COVID-19 fatalities in Germany rose at the highest rate of the pandemic yesterday.

- Hong Kong is limiting dining and closing gyms and beauty salons to curb rising COVID-19 infections that have been appearing in a “more complicated and severe” wave than previously.

- Western Canada is taking some of the world’s harshest measures to contain COVID-19, imposing a month-long lockdown that prohibits all outdoor and indoor gatherings, compels mask wearing and forces hospitality businesses to temporarily close, along with a 15% capacity cap at retail stores and houses of worship.

- Latin America, with 8% of the world’s population yet 30% of global COVID-19 fatalities, will face significant challenges in the months ahead to boost public trust in vaccines.

- A Royal Caribbean cruise ship launching on a “cruise to nowhere” from Singapore was forced to turn around after a person tested positive for COVID-19, sending 2,000 guests into quarantine in the ship’s cabins.

- Holdouts Poland and Hungary agreed to a 750-billion-euro stimulus package for the European Union, paving the way for approval by the remaining 24 EU nations.

- China’s consumer prices fell for the first time in more than a decade, dropping 0.5% last month from the year-ago period.

- Machinery orders in Japan jumped by a record 17.1% in November from a 4.4% slump the prior month, a healthy sign for capital spending.

- The President of the World Bank is estimating it will take two to three years for global output to return to pre-pandemic levels, as developing nations climb slowly out of economic slumps with the help of vaccines.

- Quarterly revenues quadrupled for Malaysian-based Top Glove, the world’s leading producer of rubber gloves.

- Honda was forced to shut down its Civic plant in the U.K. due to port congestion as shippers scramble in anticipation of Brexit.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.