COVID-19 Bulletin: January 18

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices were softer in early trading today with the WTI down 0.2% at $52.26/bbl and Brent off 0.4% at $54.899/bbl. Natural gas was 5.5% lower at $2.59/MMBtu.

- Global oil demand took a 10% hit in 2020, with OPEC predicting that demand levels in 2021 will still fall 4% short of 2019 levels.

- Global spending on oil and gas production is expected to remain below pre-pandemic levels through at least 2025, as depressed oil prices remain too low to support attractive returns.

- OPEC’s crude oil export revenues likely declined by $323 billion in 2020, according to the U.S. Energy Information Administration, the lowest in 18 years.

- The U.S. rig count increased for the eighth consecutive week, rising by 13 to a total of 373, according to Baker Hughes.

- Venezuela is opening its oil industry to foreign investment as the nation aims to pump 1.5 million bpd in 2021, a bid to reverse the economic impact of U.S. sanctions.

- U.S. jet fuel prices slumped again as a new wave of global lockdowns grounded flights and extended passenger uneasiness.

- Gas station convenience stores played a large part in making up for weak fuel demand for oil majors such as BP and Shell in 2020, which both plan to add thousands of new retail locations in the next several years to offset a continued oil price slump.

- A cold snap in Asia and the return of Korean plastic production facilities is squeezing naphtha supplies in the region.

- Total is exiting the American Petroleum Institute over differences with the trade association’s climate policies.

- Global methane emissions fell an estimated 10% last year due to oil and gas production cuts and new regulations.

Supply Chain

- California utilities are warning they may need to cut power to 300,000 homes and businesses due to the wildfire risks from high winds, an unprecedented measure for January.

- Frontline e-commerce workers were the top job on LinkedIn’s jobs website for much of 2020, with available roles growing 73% year over year between April and October, higher than any other position.

- Union Pacific Railroad rescinded record-breaking surcharges on the West Coast Sunday, lowering prices for importers moving cargo through Los Angeles.

- American regulators have approved the first fully automated commercial drone flights to rural areas at altitudes below 400 feet, a significant step in expanding the commercial application of drones for deliveries.

- Hapag-Lloyd is dropping one of its calls to the port of Long Beach due to increasing levels of congestion at West Coast ports.

- Carriers will likely have to increase driver pay to attract more good drivers as the trucking industry meets continued growth expectations in 2021.

- Trucking companies are increasingly turning to time-based measurements to determine driver pay and salaries, a possibility with the adoption of new electronic logging device technology.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- U.S. COVID-19 infections, fatalities and hospitalizations were down yesterday, suggesting a possible peaking of the recent spike. New infections numbered 177,918, and there were 1,749 fatalities.

- The U.S. death toll from COVID-19, now just shy of 400,000, have risen by 100,000 in just five weeks; it took 12 weeks to rise from 200,000 to 300,000.

- Greater Los Angeles has surpassed 1 million COVID-19 cases, as health experts predict anywhere from 1 in 10 to 1 in 3 people have contracted the virus there. The state is approaching 3 million total infections, more than all but five nations worldwide.

- Alongside California, Arizona has become America’s hotspot for the COVID-19 crisis, with the highest infection rate in the nation crowding the state’s hospitals after a record number of cases last week.

- The U.S. South accounts for 42% of the nation’s new COVID-19 infections, leading every other region.

- COVID-19 cases are on the rise in Virginia as the state set a one-day record of more than 6,700 new infections.

- Planned COVID-19 vaccination clinics in more New York counties were canceled due to a dramatically reduced supply of available doses from the federal government, officials say.

- More than 12 million Americans were vaccinated against COVID-19 by the end of last week.

- The incoming U.S. administration is set to play a bigger role in getting Americans vaccinated, with plans to open federally supported community vaccination sites along with mobile inoculation clinics.

- Moderna is researching whether giving a third dose in addition to its two-dose COVID-19 vaccine regimen would prolong protection against the disease.

- A convalescent plasma therapy touted by the U.S. president and other health officials has shown no sign of improving COVID-19 symptoms, according to a large study in the U.K.

- The highly infectious “U.K. variant” will likely be the dominant strain of COVID-19 infecting Americans by March, officials predict, with Louisiana and Illinois becoming the latest states to discover a case of the strain, along with 13 other states so far.

- Restaurants in several of the six states that currently ban indoor dining are increasingly flouting restrictions, arguing the choice has come down to serving customers in defiance of government orders or shutting down completely.

- Trader Joe’s and Instacart joined Dollar General in announcing bonus pay for workers who get vaccinated.

- Three major U.S. banks cut their reserves by $5 billion last week, a sign of optimism after banks stashed away more than $35 billion in reserves for expected loan losses due to the pandemic.

- JPMorgan Chase has the lowest ratio among U.S. banks of available deposits to actual loans, a sign of the bank’s hesitancy to extend credit.

- Led by drops at restaurants and bars, U.S. retail sales fell slightly for a third straight month in December. In contrast, manufacturing production rose 0.9%, bringing the sector’s fourth quarter gain to 11.2%.

- The top 20% of earners in the U.S. are gaining wealth at historic rates due to a mixture of remote work possibilities, favorable interest rates and record-setting investment valuations.

- The rate of absenteeism — employees calling in sick or taking leaves of absence — has remained high throughout the pandemic, an overlooked aspect of the virus’ effect on workplaces and the economy.

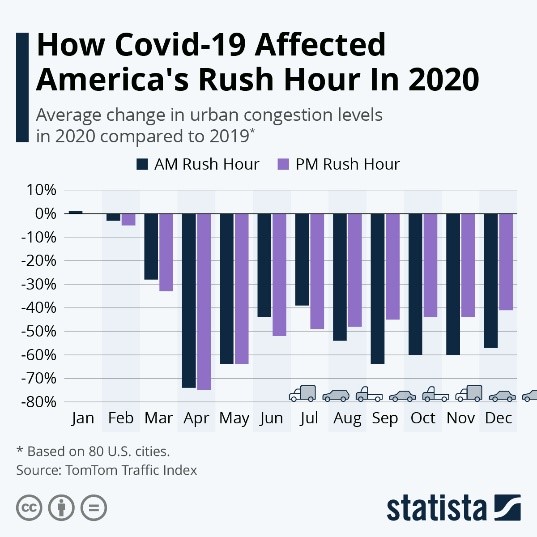

- Traffic levels fell 15% in Los Angeles and 11% in New York City in 2020:

- New York City property values are expected to decline 5.2% for tax purposes from the current fiscal year, the largest drop since the 1990s led by more than 20% value declines on retail and hotel establishments.

- San Francisco reported a budget shortfall of half a billion dollars, largely due to tax revenue lost from high-paid workers who left the city during the pandemic.

- Domestic and international business travelers supported 2.5 million jobs in 2019, a number expected to sharply decrease due to pandemic-induced drops in business travel.

- Fiat Chrysler and Peugeot-maker PSA Group completed their merger on Saturday, creating renamed Stellantis NV, the third-largest car maker in the world.

- U.S automakers are seeking help from the Commerce Department to ease a computer chip shortage that is impacting production around the globe.

- Kia is rebranding, including dropping the word Motors from its name, to signify its commitment to electric vehicles.

- Some companies and utilities are exploring dynamic charging for electric vehicles, wireless charging technology that would charge a vehicle as it drives.

International

- The global fatality toll from COVID-19 topped 2 million Friday.

- Germany recorded a record number of one-day COVID-19 fatalities late last week, prompting some to call for a tightened national lockdown.

- Global poverty is expected to stay flat or rise in 2021 after 90 million people joined the poverty rolls last year, erasing four years of progress, according to the World Bank.

- Moscow reported 81 COVID-19 fatalities Friday, a record.

- Mexico confirmed 21,366 new COVID-19 infections Friday, a record, followed by 20,523 new cases Saturday.

- China reported 96 new COVID-19 infections on Sunday after four days of triple-digit increases, as the nation warns of a potentially spreading outbreak that originated near the border with North Korea. Construction workers erected a 1,500-room hospital in just five days in Beijing to take in potential virus patients.

- Austria is extending a national lockdown until Feb. 7, along with requiring the use of full protective face masks on public transport and in shops, rather than just fabric face coverings.

- Portugal’s healthcare system is strained to capacity, with 647 of 672 available ICU beds taken by COVID-19 patients.

- A surge of COVID-19 infections in Brazil’s largest city in the Amazon rainforest, Manaus, is likely due to a new virus mutation recently found in four Brazilian air passengers arriving in Japan.

- Several European countries, including the U.K., Germany, Ireland, Austria, Denmark and the Netherlands, are closing schools over fears that school children are contributing to high COVID-19 transmission rates.

- The U.K. does not expect to ease lockdowns until early to mid-March as it accelerates COVID-19 inoculations.

- Malaysia’s Top Glove Corp., the world’s largest rubber glove manufacturer, reported COVID-19 outbreaks among employees at four factories.

- Singapore will require all inbound air travelers to take a COVID-19 test.

- India began the world’s largest COVID-19 vaccination campaign on Saturday, with authorities planning to inoculate more than 300 million people. More than 165,000 people were vaccinated the first day.

- Brazil authorized both China’s Sinovac vaccine and AstraZeneca/Oxford’s vaccine for emergency use Sunday and began rolling out mass vaccinations.

- Pakistan authorized emergency use of AstraZeneca/Oxford’s COVID-19 vaccine.

- Norway health officials are expressing concern over the effect of Pfizer/BioNTech’s COVID-19 vaccine on elderly people with serious underlying health conditions, citing 29 deaths in such people after receiving doses.

- GDP in China rose a better-than-expected 6.5% in the fourth quarter, raising growth for the year to 2.3%. Though the growth rate has returned to pre-pandemic levels, the numbers mask a growing disparity between the wealthy and the poor caused by the pandemic.

- Canada’s housing market pushed further past record levels in the final month of 2020, with home sales rising 7.2% as consumers rushed to take advantage of low mortgage rates to buy bigger homes.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.