COVID-19 Bulletin: January 19

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The WTI price dipped to near $52/bbl Monday over fears that Asian COVID-19 hotspots will impact demand in the world’s biggest crude-importing region.

- Despite a cut in demand projections for 2021 by the International Energy Agency, a weaker dollar helped boost crude higher in early trading today, with the WTI up 0.2% at $52.55/bbl and Brent up 0.7% at $55.40/bbl. Natural gas was 3.5% lower at $2.64/MMBtu.

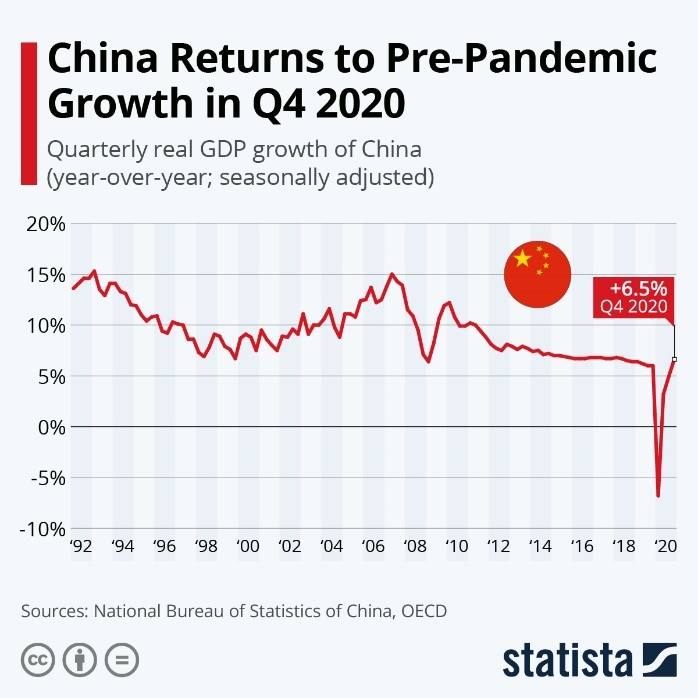

- Chinese refineries processed record volumes of crude oil in 2020, a 3.2% increase from the previous year at an average of 13.51 million bpd.

- The developer for the embattled Keystone XL pipeline pledged investments of $1.7 billion on solar, wind and battery power to operate the 2,000-mile, partially completed pipeline, along with eliminating greenhouse-gas emissions from operations by 2030.

- French oil major Total is investing $2.5 billion for a 20% stake in Adani Green Energy, the world’s largest solar developer. Separately, the company entered a joint venture with 174 Power Global, a subsidiary of South Korea’s Hanwha Group, to develop 12 solar and energy storage projects in the U.S., including five in Texas, as part of a plan to provide 35 gigawatts of renewables production capacity worldwide by 2025.

- Russian gas imports surged eight-fold in November from October after a four-month ban on refined oil products, including gas, diesel and jet fuel, was lifted.

- Abu Dhabi National Oil, the UAE’s government-run oil company, is partnering with two sovereign wealth funds to begin plans for future exports of green and blue hydrogen.

- Colombia, facing depletion of its oil reserves and public resistance to more hydroelectric dams, is focusing on wind and solar power to satisfy its future energy needs.

- Fossil fuels and plastics are underappreciated but vital elements to the development and rollout of COVID-19 vaccines.

Supply Chain

- Shipping costs from China to Europe have tripled in the past eight weeks, threatening to disrupt the global economic recovery. Higher shipping costs are driving up prices for imported products, including large toys, with trampoline prices in the U.K. spiking as much as 50%, for example.

- Cargo volumes at Dublin’s port have fallen 50% post-Brexit as truckers sidestep the U.K. to reach mainland Europe, a number boosted by retailer stockpiling prior to Brexit and British suppliers’ failing to prepare correct paperwork.

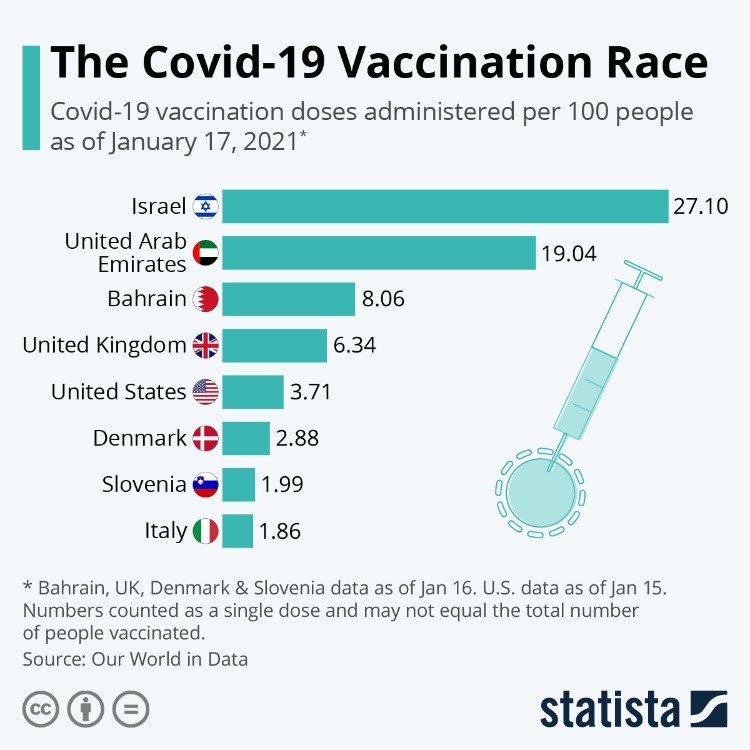

- The International Chamber of Shipping, which represents 80% of the world’s merchant shippers, urged that seafarers be prioritized for COVID-19 vaccinations to protect global supply chains.

- The Cass Freight Index, a barometer of freight volumes and market conditions, increased 6.7% from the year-ago period in December, with freight expenditures notching a 13% increase to their highest reading on record.

- The rail industry saw significant gains in intermodal container and trailer volumes in the week ended Jan. 9 compared with the previous two weeks and increased 10.4% over the year-ago period.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

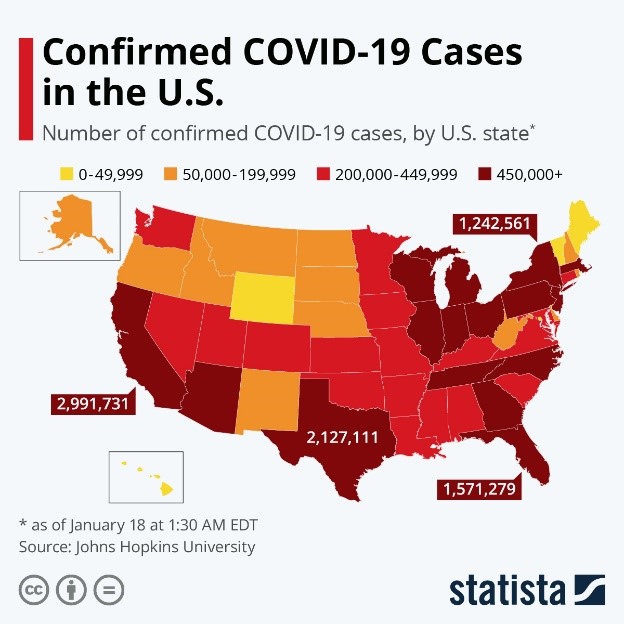

- COVID-19 fatalities are rising in 30 U.S. states, a combined result of winter surges and the introduction of highly infectious mutations of the virus from other countries.

- A variant of COVID-19 first identified in Denmark and separate from the virulent U.K. variant is spreading rapidly in Northern California.

- California health officials were asked to pause distribution of a batch of 330,000 Moderna COVID-19 doses after reporting a higher-than-usual number of potential allergic reactions. In Los Angeles, air quality regulators lifted limits on the number of cremations that can be performed, citing a death rate near double pre-pandemic levels.

- New York is asking to purchase vaccine doses directly from Pfizer/BioNTech, an unusual measure prompted by a shortfall of federally procured doses.

- The U.S. administration is lifting COVID-19 restrictions on incoming travelers from Europe, the U.K. and Brazil starting Jan. 26, the same day new testing requirements take effect for all international visitors, although the incoming administration said it will block the move.

- The difference in COVID-19 infection severity in a pair of identical twins offers clues to the virus’ genetic roots, including why healthier people can sometimes experience far worse symptoms than those with high-risk conditions.

- COVID-19 infections and exposure are exacerbating a nationwide teacher shortage and frustrating a return to classrooms for many school districts.

- A California man afraid to go home due to COVID-19 was arrested after spending three months undetected in the secured terminal area of Chicago O’Hare Airport.

International

- China reported more than 400 new COVID-19 cases over the weekend, half of which were asymptomatic, as the nation heads into the mid-February celebratory period of Lunar New Year.

- Japan found three cases of COVID-19 patients infected with the highly transmissible U.K. variant despite not having traveled to Britain.

- A triangle of regions in London working-class neighborhoods is experiencing unprecedented mortality rates, mostly due to the highly infectious U.K. variant spreading there.

- Portugal, a nation of 10 million that has recently become one of the hardest struck COVID-19 countries, reported a record number of virus fatalities Monday as the nation’s hospitals approach capacity.

- COVID-19 infections in Ireland have increased from 300 per day to more than 8,000 per day in just over a month, a result of relaxed holiday restrictions and spread of the highly infectious U.K. variant.

- Israel leads the world in vaccinating its citizens against COVID-19:

- French health officials continue to face vaccine distribution problems tied to the public’s distrust of vaccines, which ranks among the world’s highest.

- Health officials in Norway are working to allay vaccine fears after 33 elderly recipients of the Pfizer/BioNTech vaccine died after getting shots.

- The U.K. is opening vaccine eligibility in an effort to speed up mass inoculations this week, along with implementing a new, strict quarantine ban on any entering travelers who test positive for COVID-19.

- China’s Sinovac Biotech COVID-19 vaccine maker is defending conflicting data showing varying levels of efficacy in its shots, saying the required two doses are more effective when spread out over a longer period.

- While the U.S., U.K. and European Union have so far vaccinated more than 24 million people against COVID-19, many low- or middle-income countries haven’t begun rollouts, a disparity that risks fostering dangerous viral strains and economic inequality.

- The European Union is urging member nations to adopt a plan to vaccinate 70% of the bloc’s population by this summer.

- Long expected by analysts, data confirms China’s status as the only major world economy to record gains in 2020, with GDP rising 2.3%.

- The European Central Bank is preparing proposals to strengthen the euro as a global reserve currency and lessen its exposure on the U.S. dollar.

- After turning to bank loans and bond issuances to survive the pandemic, European businesses face an equity shortfall of as much as $724 billion as existing government programs and private funding will fall short of covering losses sustained during coronavirus restrictions.

- The average asking price for homes in the U.K. fell 0.9% last month as sellers tried to speed up discounted transactions ahead of a tax deadline, a reversed trend from the rapidly rising prices of homes in many other nations.

- Ford is closing a plant in Germany for a month due to a global shortage of computer chips.

- New vehicle registrations in Europe plunged 24% last year, the biggest drop on record.

- Electric vehicle maker Tesla began delivering Model Y crossover vehicles on Monday in China, a significant milestone for the company’s entrance into the world’s largest car market.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.