COVID-19 Bulletin: January 20

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose yesterday on hopes for more economic stimulus from Washington D.C. Prices resumed their climb in early trading today, with the WTI up 1.0% at $53.51/bbl and Brent up 0.75% at $56.32/bbl. Natural gas was down 3.0% at $2.47/MMBtu.

- Citing environmental concerns, Michigan officials ordered the shutdown of Enbridge’s Line 5 500,000-bpd pipeline that conveys oil and natural gas liquids from Alberta to refineries in Michigan, Ohio, Pennsylvania, Ontario and Quebec.

- A panel of federal judges vacated the White House’s recent rules that eased emissions standards for power plants.

- High gas prices and growing confidence in the European Union’s Emissions Trading System prompted analysts to raise price estimates for the bloc’s carbon market in 2021 and 2022.

- France’s central bank is pulling back on oil and gas investments over the next four years in a bid to redirect resources to more renewable energy projects.

- China added a record 133 gigawatts of clean energy installations in 2020, led by 72 gigawatts of wind power installations.

- The growth in renewable energy is spawning a fleet of ships dedicated to supporting offshore wind farms.

Supply Chain

- Port Houston’s December container activity rose 4% compared to the year-ago period, matching levels in record-setting 2019.

- Some 65 vessels continue to be stranded off the Chinese coast, a result of a months-long disruption caused by Beijing’s bar against Australian coal imports.

- Low U.S. demand for refined oil products is causing higher levels of transatlantic tanker diversions, with U.S. East Coast gas inventories reaching their highest levels since August.

- Soaring liquified petroleum gas vessel rates are expected to slide after reaching record-high prices of $110,000 per day in last week’s spot market.

- FedEx announced new surcharges on Ground and Express services beginning in February, citing continued high volumes of shipments.

- A shortage of transit guarantees is increasing post-Brexit shipping congestion, as U.K. customs agencies struggle to keep up with overwhelming new regulations.

- U.K. courier DPD continued a suspension of parcel deliveries to Europe and Ireland, citing burdensome post-Brexit customs requirements.

- Air cargo demand between Europe and the U.K. is picking up with freight carriers increasingly reporting holdups caused by post-Brexit red tape.

- High container prices in late 2020 were boosted by millions of delayed shipments from the first half of the year.

- Singapore will become one of the first countries to vaccinate its maritime workforce, with plans to provide 10,000 initial vaccinations by the end of January.

- Samsung Heavy Industries is competing with Japan, China and South Korea — the three countries responsible for 90% of world shipbuilding — to bring crewless, autonomous ships to market next year, successfully completing a 10km sea trial in October.

- Truck maker Paccar is working with driverless vehicle startup Aurora Innovation to create self-driving heavy-duty trucks, potentially bringing vehicles to market in the next several years.

- The fourth quarter was the strongest ever for leased logistics space as companies accommodated surging demand for e-commerce.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

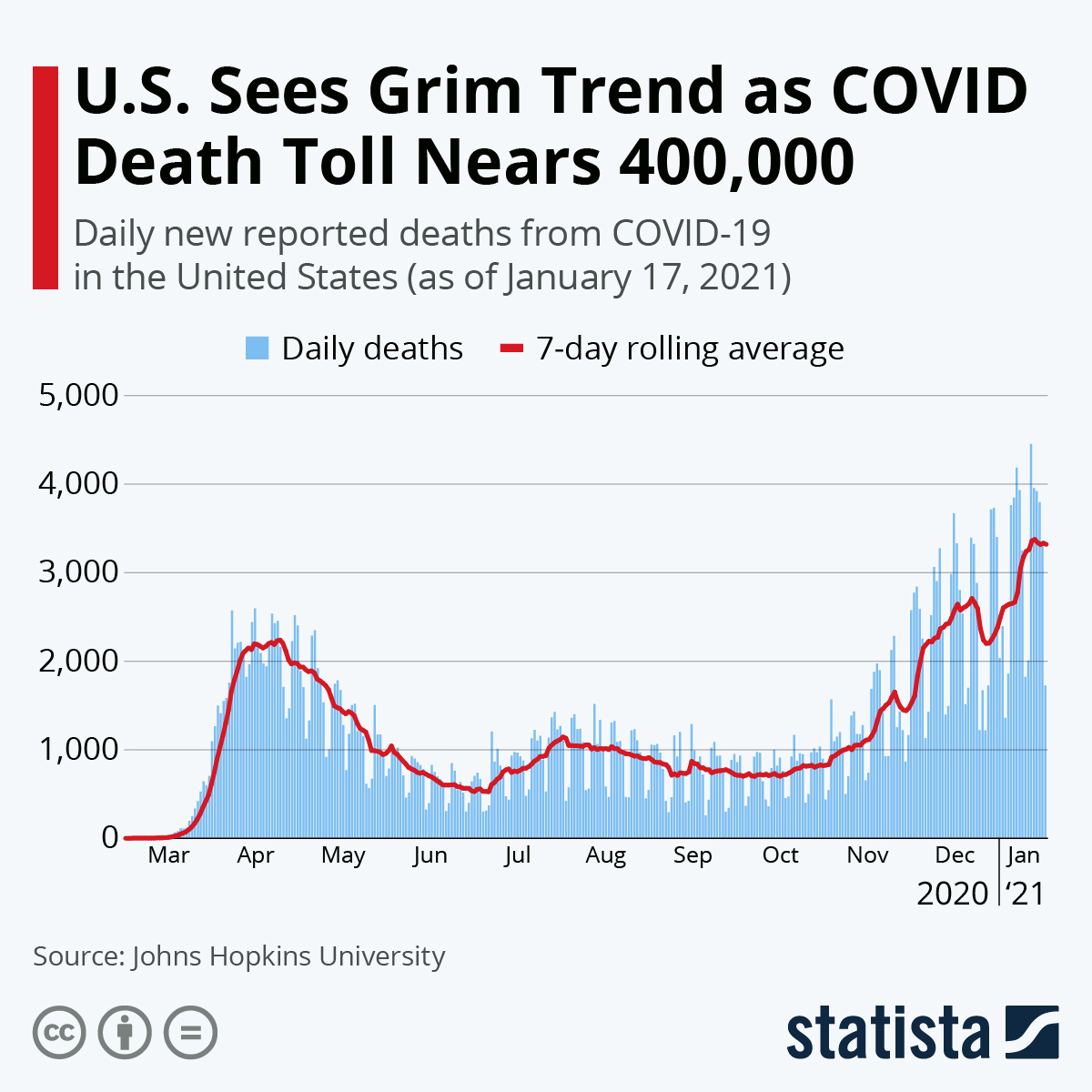

- The U.S. passed another grim COVID-19 milestone Tuesday, topping 400,000 fatalities attributed to the virus in the past year — roughly equal to American deaths in the four years of WWII. For the day, new infections totaled 177,256, and there were 2,769 fatalities.

- The latest seven-day average for new COVID-19 infections fell 16% from the previous week, with weekly averages falling or flat in 46 states.

- COVID-19 continues to rage in Texas, forcing Laredo to issue a second cell-phone alert to citizens that hospitals are at capacity. Average daily infections in the state have increased five-fold since October. Apple is temporarily closing stores in the state due to high infection rates in several regions.

- More than a quarter of New Yorkers don’t plan to get vaccinated against COVID-19, polls show. New York City, meanwhile, will begin closing vaccine sites Thursday due to lower-than-expected federal shipments.

- All major Western COVID-19 vaccine manufacturers have begun testing shots in children, a potential key to herd immunity.

- Moderna will deliver 100 million doses of its COVID-19 vaccine to the U.S. by the end of March, on track with the new administration’s plan to provide 100 million doses in the first 100 days.

- Abbott’s 15-minute COVID-19 rapid test may miss two-thirds of infections in asymptomatic people, the CDC says.

- During Senate confirmation hearings, the Treasury Secretary nominee endorsed aggressive new stimulus measures to bolster the economy.

- The number of U.S. households unlikely to maintain their standard of living in retirement increased from 49% to 51% last year.

- The Cedar Rapids, Iowa, airport will become the first in the country to conduct COVID-19 screening of passengers before they enter security screening.

- Bank of America’s Q4 earnings fell 22%, the worst of any major U.S. bank so far led primarily by drops in interest income due to low rates.

- Office Depot rejected an unsolicited takeover offer from Staples, keeping the door open for nontraditional deals to fend off the regulatory scrutiny that has blocked previous takeover attempts by Staples.

- Average U.S. airfare prices in the three months ending September fell to their lowest inflation-adjusted levels since 1995, the first year of available data.

- San Francisco’s office vacancy rate hit 16.7% at the end of 2020, higher than the aftermath of the 2008 recession as companies reevaluate office needs after months of shutdowns and remote work.

- Retail rents in Manhattan’s Soho district fell 22% in the fourth quarter, the worst of a citywide trend of declining asking prices.

- Supermarket chain Aldi is the latest company to offer bonus pay to employees who receive COVID-19 vaccines.

- The personal fitness sector faces broad changes in the coming years as most people plan to retain virtual and at-home components to exercise and gym routines beyond the pandemic.

- Microsoft announced investments in General Motors’ driverless-car startup Cruise.

- An Israeli company is starting to manufacture a battery for electric vehicles that can be charged in just five minutes, a significant step toward matching refueling of gas-powered vehicles.

- Amazon-backed electric truck startup Rivian, backed by a recent $2.65 billion investment from T. Rowe Price, plans to put vehicles in production this year.

International

- One in eight people in England tested positive for COVID-19 antibodies, new data shows. The country registered 1,610 virus fatalities yesterday, a record.

- Peru became the 18th country to log more than 1 million COVID-19 infections.

- Germany extended a national lockdown until Feb. 14, with new rules requiring people to wear medical masks in shops and on public transport.

- Scotland is extending a national COVID-19 lockdown until at least mid-February.

- COVID-19 fatalities in Portugal set a record.

- Israel, with the world’s most successful vaccination campaign, extended national lockdowns to the end of the month after a spike in COVID-19 infections.

- Reporting 107 new COVID-19 infections Monday, Hong Kong will extend social-distancing measures, expand mandatory testing and introduce tighter restrictions in certain neighborhoods.

- Indonesia reported 308 COVID-19 fatalities Tuesday, a record.

- A South African variant of COVID-19 was found to be 50% more infectious than previous strains, scientists say.

- Irish COVID-19 hospitalizations fell yesterday from a record high on Monday, a welcome change for the nation’s overburdened health system.

- New COVID-19 cases in the Netherlands fell 10,000 last week from the week prior, as hospitalizations remain high.

- Touted as the world’s largest COVID-19 immunization campaign, almost all Indian states failed to meet initial vaccination targets as leaders urge frontline workers not to refuse getting shots.

- Cambodia, Thailand and the Philippines have signed up to purchase China’s Sinovac COVID-19 vaccine as Western vaccine manufacturers limited their efforts to get regulatory approval from low- and middle-income countries.

- Denmark has added homeless people to its list of early recipients of COVID-19 vaccines.

- The COVID-19 pandemic will likely be the source of significant economic volatility, such as asset bubbles and price instability, for the next three to five years.

- Global investments in renewable power, electric vehicles and other green technologies reached a record $501.3 billion in 2020, a 9% increase over the previous year.

- Taiwan’s export orders surged 38.3% year-over-year in December to a record level on strong global demand for technology products.

- Toyota and Honda restarted their Malaysian plants on Monday after government leaders lifted a restriction on all nonessential industries.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.