COVID-19 Bulletin: January 6

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Special notice:

In-person components of NPE2021, scheduled for May 17-21, 2021, have been canceled due to risks associated with COVID-19 transmissions, the Plastics Industry Association announced Tuesday.

Supply

- Oil prices surged to a 10-month high above $50 per barrel yesterday after Saudi Arabia announced it will cut 1 million bpd of crude output in February, a move announced shortly after the kingdom struck a deal with other OPEC+ member nations to keep crude production constrained next month in the wake of rising COVID-19 infections across the globe.

- Oil prices were higher in mid-day trading today, with the WTI up 1.6% at $50.71/bbl and Brent up 1.7% at $54.53/bbl. Natural gas was 2.2% lower at $2.76/MMBtu.

- The announcement of larger-than-expected draws in crude oil inventories for the week ending Jan. 1 had little further effect on oil’s rally following OPEC’s Tuesday news.

- Saudi Arabia’s announcement caught its oil-refining customers in Asia off guard and challenged to procure supply on spot markets.

- The U.S. administration will open vast areas of once-protected Arctic Alaska territory to oil development.

- Venezuelan crude oil and refined product exports in 2020 plunged to their lowest level in 77 years due to the pandemic and increased U.S. sanctions.

- Investment in Canada’s oil industry is expected to grow 12% in 2021 from the prior year, a signal of optimism about stability and recovery in energy markets.

- Russia’s annual oil production dropped in 2020, the first decrease since the financial crisis of 2008.

- ExxonMobil is expected to report a fourth consecutive loss in the final quarter of 2020, with earnings dented by nearly $20 billion in write-downs during the period.

- The Baker Hughes count of active oil and gas rigs in the U.S. rose by three last week to 351, the sixth consecutive weekly gain. There were 796 active rigs in the comparative period a year ago.

Supply Chain

- Container ships are waiting for terminal berths up to two weeks at the ports of Los Angeles and Long Beach as high volumes continue to cause backlogs.

- Incidents of scammers offering fake containers to small businesses are on the rise in Canada.

- The pandemic-induced drop in passenger flights, which normally carry about half of air cargo, is causing delays of cancer-fighting medical deliveries in Canada.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

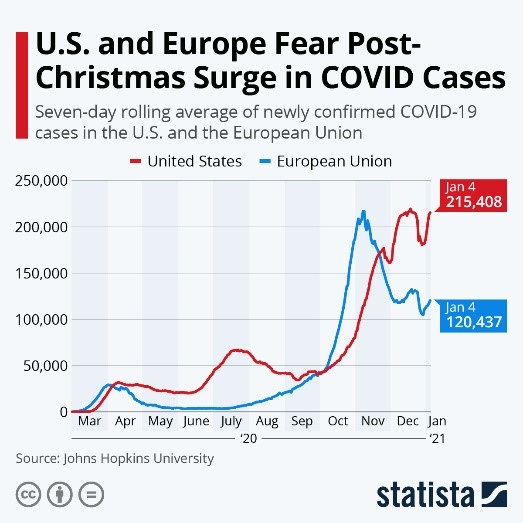

- There were 229,055 new COVID-19 cases in the U.S. yesterday, bringing total cases above 21 million. Tuesday’s 3,775 fatalities set a new daily record.

- The U.S. South is experiencing the worst rates of new COVID-19 infections over the past seven days, along with accounting for 41% of the nation’s hospitalized patients.

- Several states, including California, Oregon, North Carolina, Arizona and New Jersey, are falling woefully short of initial vaccination targets.

- Los Angeles County’s average daily COVID-19 death rate (186) now exceeds the death rate of all other causes combined (170).

- Arizona recorded 253 COVID-19 fatalities Tuesday, a record. The state is averaging over 8,000 new infections a day, more than double the daily rate of the summer peak.

- New Jersey reported its highest number of COVID-19 fatalities since May.

- Georgia recorded its first COVID-19 patient infected with a highly contagious strain discovered in England.

- Senior citizens in Daytona Beach, Florida, camped overnight to receive early morning COVID-19 shots as the state’s uneven vaccine rollout hits some counties harder than others.

- New York is asking the federal government to increase its weekly COVID-19 vaccine supply by 300,000 doses, alongside recruiting firefighters, police officers and teachers to help administer vaccines.

- Local governments are increasingly relying on party-planning web apps such as Eventbrite to schedule vaccinations at appointed sites.

- American universities are hastily changing spring education plans on expectations that the next several weeks will be among the worst for the U.S. during the pandemic.

- The U.S. Treasury Department has sent out about $112 billion of the estimated $164 billion in $600 direct payments to Americans.

- Private payrolls in the U.S. fell last month for the first time since April, suffering a drop of 123,000 jobs from the prior month.

- A dive in personal bankruptcy filings last year held overall U.S. filings to their lowest level since 1986, outweighing a 29% increase in commercial bankruptcy filings.

- Both divorce and marriage rates in the U.S. declined precipitously in 2020, contradicting at least one early prediction that the stresses of quarantine would cause a surge in divorces.

- Manhattan office vacancies rose to 15.1% in 2020, up from 11.1% in 2019 and the highest since 1999.

- Goldman Sachs expects all employees to return to offices by year’s end.

- Rolls-Royce is pausing development of a jet engine for narrow-body commercial jets after investing $680 million into the project the past seven years.

- General Motors reported a 4.8% rise in U.S. sales in the fourth quarter, with the average transaction price reaching a record $39,229.

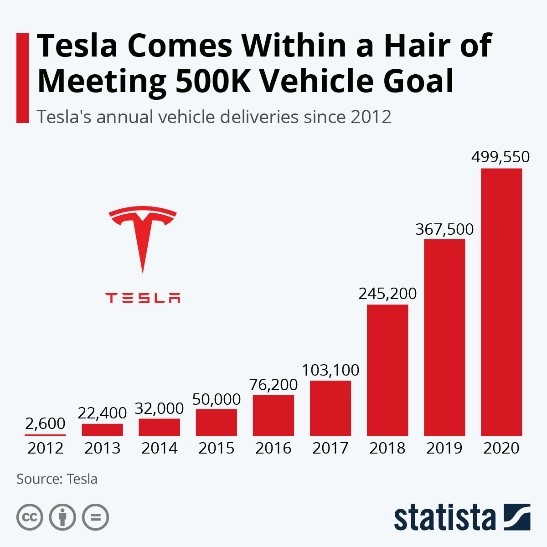

- Electric vehicle startup Rivian, backed by Amazon and Ford, is closing in on a new round of funding valuing the company at $25 billion, as the carmaker races against Tesla to deliver an electric-powered truck.

- After an impressive performance in 2020, Tesla’s 2021 plans include expanding in the Chinese market and opening new factories in Texas and Germany.

- Prices for lithium-ion battery packs used in electric vehicles have declined almost 90% in the past decade, spurring increased production of higher-powered vehicles.

- Demand increased for higher-priced vehicles at the end of 2020, helping lift automakers out of spring declines alongside stronger retail sales in the third and fourth quarters.

- The Grammy Awards will be delayed until March due to surging COVID-19 cases in Los Angeles, while Hollywood TV-show and movie sets debate whether to continue production after the holiday break.

- After making the playoffs for the first time in almost 20 years, four Cleveland Browns players along with the team’s head coach tested positive for COVID-19.

International

- One in every 50 Britons has COVID-19 as the nation enters a third national lockdown expected to last until mid-February. Overseas travelers entering the U.K. will soon be required to take a COVID-19 test, while the government offered $6.2 billion in further economic stimulus to businesses.

- Germany is extending a nationwide lockdown until the end of the month, a plan that includes the first non-essential travel ban for residents of hard-hit regions. Essential travelers will be tested twice for COVID-19.

- France reported at least 10 cases of a highly contagious virus strain first discovered in England. French restaurant and café closures will be extended past Jan. 20 as the nation reports double the threshold of daily COVID-19 cases required to ease restrictions.

- Italy reported 15,378 new COVID-19 cases and 649 virus fatalities Tuesday.

- With hospitals overrun in the country’s worst-hit region, new rules will prevent many Slovakians from going to work unless they test negative for COVID-19.

- Puerto Rico will reopen beaches and shorten curfews as part of wider easing of social restrictions.

- The European Union’s drug regulator approved Moderna’s COVID-19 vaccine, paving the way for its use.

- Mexico aims to vaccinate all senior citizens by the end of March thanks in part to the expected delivery of 35 million doses of a China-made vaccine that is easier to ship and store than Pfizer/BioNTech’s.

- A highly contagious COVID-19 variant discovered in South Africa is unlikely to disrupt a vaccine’s success, a researcher says.

- Denmark imposed new virus restrictions, with officials expecting a highly contagious variant discovered in the U.K. to be the dominant strain in the country by mid-February. In another pandemic-induced policy, Danish homeowners will be able to receive 20-year mortgage loans at a fixed rate of zero.

- Russia is struggling to accelerate its homegrown COVID-19 vaccine rollout after manufacturers found problems with scaling output and sourcing materials.

- Canada is falling behind on a plan to vaccinate 60% of its population by fall.

- The European Union is looking to double its supply of COVID-19 vaccines, asking for up to 300 million more doses from Pfizer/BioNTech.

- Indonesia’s vaccination campaign will begin Jan. 13 with a shot given to the president.

- The World Health Organization and Pfizer/BioNTech recommend the second required dose of Pfizer/BioNTech’s COVID-19 vaccine be taken within 21 to 28 days of the first, contradicting the U.K.’s recent decision to space out doses of the inoculation to accelerate distribution efforts.

- South American grains powerhouse Argentina is suspending corn exports until Feb. 28 to ensure domestic food supplies during the pandemic.

- The World Bank is signaling disappointing global economic growth for nearly a decade, a result of lower trade and investment caused by pandemic-induced uncertainty alongside education disruptions that will hamper labor productivity. The bank is working to provide 100 lower-income countries with low-interest loans and funding to purchase COVID-19 vaccines, and warning that several such countries will be in “deep debt distress” in 2021, requiring intervention.

- The International Monetary Fund said the global economy is starting 2021 in a better position than expected, with global GDP growth potentially rising up to 5.2% in the year ahead, compared to the World Bank’s forecast of up to 4%.

- Singapore’s GDP shrank a lower-than-expected 5.8% in 2020.

- iPhone assembler Foxconn has placed bets in the electric vehicle industry by partnering with Chinese EV startup Byton to help mass produce new vehicles in 2022.

- British retailer Marks & Spencer is citing new post-Brexit trade rules as the reason for delayed deliveries of fresh food to its locations in France.

Our Operations

- As we enter a new year, our President and CEO shared this message and video with our Mployees and business partners.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.