COVID-19 Bulletin: January 8

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices ended on an 11-month high Thursday as markets ignored U.S. political turmoil in favor of optimism over Saudi Arabia’s unexpected February output cut. Prices were higher in early trading today, with the WTI up 1.4% at $51.56/bbl and Brent up 1.6% at $55.23/bbl. Natural gas was 2.9% lower at $2.65/MMBtu.

- Spot rates for liquefied natural gas have more than doubled from a year ago, a result of increasing Asian demand ahead of an expected cold winter.

- Traders are accelerating sales of floating-storage crude oil ahead of rising demand from Asian refineries as the region enters peak winter usage.

- Averaging $2.29 per gallon, U.S. retail gas prices are the highest since the pandemic began, aided by a pricing boost after Saudi Arabia’s recently announced output cut planned for February.

- In the five years since the U.S. began the rapid rise of shale crude exports, the nation’s presence in the global market has shifted geopolitical power around the world, with shipments now frequently surpassing any OPEC producer except Saudi Arabia.

- The federal government received bids for only half of the available acres for oil and gas development in the Arctic National Wildlife Refuge in Alaska.

- Polypropylene prices are soaring after a fire disrupted production at Total’s LaPorte, Texas, operation, aggravating an already tight supply situation for the material.

- Braskem Idesa has restored partial production at its polyethylene operation in Mexico, which shut down in December after gas supplier Cenagas cut off its natural gas supply, part of a broader dispute over ethane contracts with state-controlled oil and gas producer Pemex.

- Ineos Styrolution reported that new styrenic polymers it is developing for 3D printing have shown overall energy savings of up to 67% compared with traditional polyamide.

Supply Chain

- New tariffs and food origination rules are delaying or halting the shipments of goods from supermarkets and food companies between the U.K. and European trading partners.

- During the traditionally slack Chinese New Year, container carriers are expected to send out fewer blank sailings than ever before.

- UPS expects to handle nearly 9 million returns this week, blowing past the previous record and more than tripling return volumes since 2012.

- U.S. railroads originated 3.7% fewer carloads in December from the year-ago period, while container and trailer originations were up 12.2%.

- Israeli container shipper ZIM is banking on small-size flexibility as a competitive advantage to large megaship carriers that dominate global supply chains.

- Trans-Pacific air cargo rates continue to rise on growing global volumes, while prices on other east-west trades fell slightly.

- Supply chain transparency, biodiversity, clean energy jobs and climate change were among the driving themes of ESG attention in 2020.

- The global shortage of computer chips for automotive manufacturers is growing more acute, with Honda and Nissan reporting production cuts for lack of chips, joining other major global producers facing production impacts.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 274,703 new COVID-19 cases in the U.S. yesterday. Tuesday’s 4,085 fatalities set a daily record for the third consecutive day.

- Texas and Pennsylvania became the most recent states to detect patients with a highly contagious COVID-19 variant discovered several months ago in the U.K.

- Lack of federal guidance on a COVID-19 vaccine rollout has left states to come up with their own individual plans, complicating nationwide rollouts amid faulty coordination and messaging.

- Arizona recorded nearly 300 daily COVID-19 fatalities and more than 10,000 new cases for the second time this week.

- North Carolina’s governor extended the state’s partial stay-at-home order for an additional three weeks after more than 10,000 COVID-19 cases were recorded in one day, a record.

- Illinois became the fifth U.S. state to surpass 1 million COVID-19 infections.

- New York recorded a spike of 17,636 COVID-19 cases Wednesday, surpassing spring peaks as the governor expanded the list of essential workers who may receive vaccines.

- With record-high COVID-19 hospitalizations topping 13,500 in recent days, Texas ICU bed capacity is straining.

- More than half of COVID-19 transmissions are spread by people with no symptoms of the virus, research shows.

- Moderna’s president said the company’s COVID-19 vaccine will likely offer immunity to the disease for a couple of years, though more data is needed.

- Johnson & Johnson hopes to seek regulatory approval for its vaccine in February and plans to sell the drug, which can be administered in a single dose, at cost.

- The U.S. trade deficit reached a 14-year high in November with a 1.2% increase in exports outweighed by a 2.9% rise in imports, led by consumer and household goods. The data suggests an uneven economic rebound as American workers continue to apply for unemployment aid at historically elevated levels.

- Non-farm payrolls fell by 140,000 jobs in December, the first decline in eight months, leaving the unemployment rate at 6.7%.

- Chicago’s Federal Reserve president expects the central bank to hold interest rates near zero until 2024, giving inflation time to return to 2%.

- Thirty-year fixed mortgage rates have reached a record low of 2.65%, the 17th record low since the pandemic began.

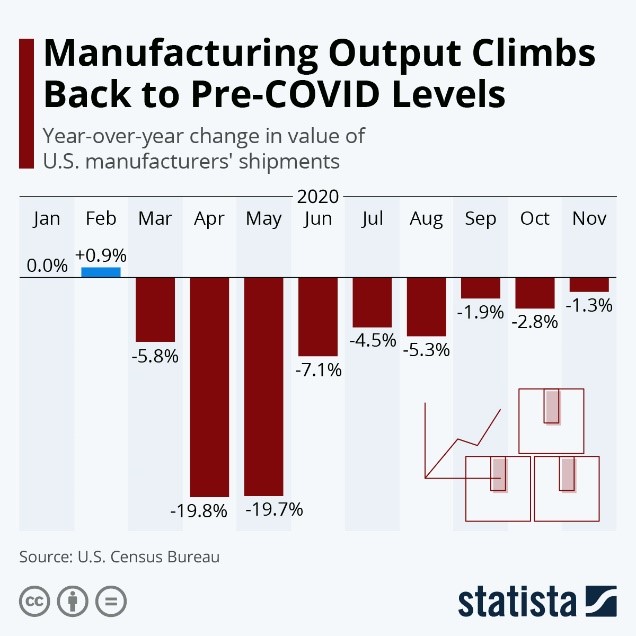

- U.S. manufacturing activity was nearly back to pre-COVID-19 levels by November:

- U.S. trade representatives delayed a 25% increase in tariffs on luxury goods from France, the planned result of a trade dispute over French digital services taxes imposed on U.S. big tech companies.

- Despite a 77% increase in digital sales, Bed Bath & Beyond’s revenue declined 5% in the quarter ended November on decreased in-store sales, store closures and divestiture of brands.

- Costco’s sales rose 12% in December boosted by frozen food and liquor sales, with an increase in the average transaction spend offsetting a drop in sales frequency as customers shift shopping habits during the pandemic.

- Packaged food company Conagra Brands predicts current-quarter profit above Wall Street estimates, indicating continued high demand for frozen dinners, cake mixes and snacks during the pandemic.

- Major development of an Apple-branded autonomous, electric vehicle is reported to be at least five years away.

- Tesla founder Elon Musk surpassed Amazon founder Jeff Bezos as the richest man in the world with a net worth of $181 billion.

- Chemicals company Albemarle will double production of lithium at its Nevada facility to support increased demand for electric vehicle batteries.

- California’s proposed economic stimulus plan includes a $1.5 billion financial infusion to help people and businesses purchase electric or hydrogen vehicles alongside investing in construction and maintenance of EV infrastructure.

- Cars featured more vibrant colors last year, according to BASF’s annual Color Report.

- Airlines are turning to ultra-cheap airfares to encourage passengers to fly again in 2021, a year that could also see the first commercial flights to near space.

International

- The greater Tokyo region is under a state of emergency with regional COVID-19 infections surging to 2,447 on Thursday, a record.

- Ireland is the latest European country to impose or extend lockdowns to stem rising COVID-19 infections, with a three-week closure of schools and construction sites announced yesterday.

- Germany reported a record 1,152 COVID-19 deaths yesterday, the third consecutive day of more than 1,000 fatalities.

- Spain became the fourth Western European country to surpass 2 million COVID-19 infections.

- Eleven million people are under strict lockdowns in China after the nation’s Shijiazhuang province reported more than 200 new COVID-19 cases.

- The United Arab Emirates reported a spike of almost 3,000 new COVID-19 cases as the nation enters late-stage trials of the Russia-developed Sputnik V vaccine.

- Colombia’s capital city is under strict quarantine after rising COVID-19 infections are leading some officials to believe a new strain of the virus is spreading.

- COVID-19 fatalities in Brazil surpassed 200,000 with yesterday’s 1,524 deaths, the highest daily death rate since July.

- Israel tightened its coronavirus lockdown Friday amid COVID-19 infection rates surpassing 8,000 per day. The nation plans to vaccinate all citizens by the end of March.

- The U.K. announced ambitious plans to vaccinate more than 100,000 people a day by mid-January. The nation is banning entry to the country from 11 African nations to prevent spread of a highly contagious COVID-19 variant discovered in South Africa.

- U.K. hospitals will begin using arthritis medication Actemra on COVID-19 patients, with the drug successfully reducing fatalities and time spent in ICUs in recent research.

- Saudi Arabia’s digital “health passport” will let people who have been vaccinated against COVID-19 prove their immunization status, potentially aiding travel and other activities.

- COVID-19 vaccine rollouts in several European countries, including France and the Netherlands, have fallen far short of similar campaigns in the U.S., U.K. and Germany, leading to widespread criticism of officials in charge of vaccine distribution. In response, France will speed up shots available to senior citizens and space doses of two-shot vaccines by six weeks against recommendations of drugmakers and the World Health Organization.

- South Africa will begin distributing COVID-19 shots without regulatory approval, a measure expected to be followed by low- and middle-income countries to speed inoculations once vaccines have been approved by other countries.

- A China-made COVID-19 vaccine developed by Sinovac is reported to be 78% effective against transmissions and 100% effective against severe cases of the disease, opening the door for widespread use of the inexpensive vaccine in developing nations.

- German drugmaker Bayer will support vaccine maker CureVac in the development of a new COVID-19 vaccine.

- The World Health Organization is sounding the alarm on the highly contagious COVID-19 strain discovered in England, urging European countries to do more to curb transmissions.

- India’s statistics ministry said GDP in the nation will be down 7.7% in 2020, the steepest drop in records going back to 1952.

- China’s auto market shrunk 1.9% last year, a better-than-expected outcome helped by government stimulus to the industry.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.