COVID-19 Bulletin: July 2

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The WTI crude price was back above $40 in early trading today, up 1.7% to $40.51/bbl, while Brent was up 1.9% to $42.81/bbl.

- Saudi Arabia, frustrated by quota cheating by Angola and Nigeria, threatened to reignite an oil price war if the wayward nations don’t fall in line.

- OPEC oil output fell in June to its lowest level since the Gulf War in May 1991.

- Forty-dollar oil will not be sufficient to stem the rising bankruptcy rate in the stressed U.S. shale industry, where 20 companies have filed in the first half, the highest failure pace since 2016.

Supply Chain

- The government will inject $700 million under the CARES Act into trucking giant YRC in exchange for a 29.6% ownership stake in the company.

- The shipping industry is struggling to rotate and relieve crews because of complications with testing requirements, exit and entry visas, and other pandemic-related disruptions.

- A weekly pandemic index of industrial distributors showed an 11.4% decline in revenues for the week ended June 26 when compared with the prior-year period.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

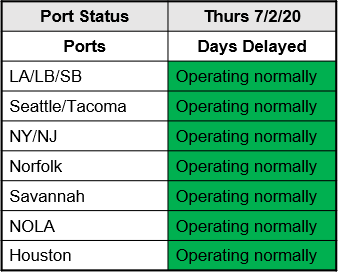

- Ports are operating normally:

Markets

- The U.S. unemployment rate fell to 11.1%, with employers adding a higher-than-expected 4.8 million jobs in June.

- More than 1.4 million people filed new jobless claims last week.

- The Treasury Department spent more than $100 billion in unemployment payments in June, a record.

- U.S. infections exceeded 50,000 yesterday, a new record, with 37 states experiencing rising levels.

- Florida’s daily infection rate surpassed 10,000 yesterday. Miami-Dade County, which has the highest infection rate in the state, issued an emergency order mandating masks in all public spaces, including outdoors. Area beaches are closed for the July Fourth holiday.

- North Carolina, Tennessee and Texas also set single-day infection highs yesterday.

- California, which saw COVID-19 infections surge 72% in the past two weeks, imposed strict lockdown restrictions on businesses in 19 counties.

- McDonald’s is pausing the resumption of in-store dining for 21 days in the U.S. due to rising infection rates.

- Apple is re-closing 30 stores in seven additional states on top of more than a dozen stores in five high-infection states it shuttered in late June.

- The House of Representatives unanimously passed an extension of the Paycheck Protection Program until August 8. The Senate already passed the bill.

- The second quarter saw 75 bankruptcy filings among companies with more than $50 million in liabilities, the highest level since 2009. Retailers led the grim list with energy companies in second place.

- The FDA’s just-announced standards for approval of a COVID-19 vaccine will require stricter testing than many expected, making approval unlikely this year even if a successful candidate is found.

- The Federal Reserve is rationing the distribution of coins due to a shortage caused by COVID-19 production interruptions and lower circulation, forcing some retailers to curtail cash transactions.

- Second-quarter auto sales fell 34% as expected:

- BMW down 39.5%

- Fiat Chrysler down 38.7%

- GM down 34.0%

- Honda down 27.9%

- Hyundai/Kia down 24.8%

- Mazda down 9.6%

- Mitsubishi down 58.0%

- Nissan down 49.5%

- Toyota down 34.6%

- VW down 30.2%

- Lincoln Motor is retiring its iconic Continental model, its last sedan, which first appeared in 1939 and was revived in 2017. The company will focus on SUVs going forward.

- Coke is killing its Odwalla juice brand in another example of consumer product companies paring their brand offerings during the pandemic.

- Companies are encouraging reluctant employees to take vacation both to relieve stress and avoid a year-end crunch of time offs.

- The global Plastic Free July movement, which involves millions of people in 177 countries, this year is encountering pandemic pressures that have increased the use of single-use plastics to further health and safety.

- Global COVID-19 infections approached 10.8 million today.

International

- Brazil’s manufacturing sector expanded in June for the first time in four months, according to the IHS Purchasing Managers Index (PMI), which registered 51.6. Readings above 50 signal expansion.

- The U.K.’s manufacturing sector also inched into expansion territory in June, with a 50.1 PMI rating.

- Germany’s manufacturing sector improved in June with a PMI ranking of 45.2, a three-month high, but remained in contraction.

- Motorcycle sales are rising in Asia and Europe as commuters seek alternatives to public transportation.

Our Operations

- M. Holland will be closed tomorrow, July 3, for the July Fourth holiday.

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.