COVID-19 Bulletin: July 21

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Crude prices were higher in early trading with the WTI price up 2.5% at $41.82/bbl and Brent up 2.5% at $44.34/bbl.

- The natural gas price fell nearly 5% yesterday to $1.64/MMBtu on a drop in export demand.

- The oil industry in Canada, the world’s fourth largest oil producer, appears early in recovery with falling inventories and rising gasoline consumption in the U.S. Midwest, a major market.

Supply Chain

- Japan is incentivizing 87 companies to return production from China after experiencing supply chain disruptions early in the pandemic.

- The Congressional Oversight Commission is scrutinizing the national security justification for the government’s $700 million loan to trucking giant YRC.

- Apple is expanding its sustainability initiative through its supply chain, seeking carbon neutrality by 2030.

- As businesses adjust to the pandemic era, the June Logistics Managers’ Index revealed a rapid expansion of inventories and a contraction of trucking capacity.

- We continue to experience challenges with truck deliveries, particularly LTL shipments, due to labor shortages and operational delays caused by COVID-19 protocols. Clients are advised to provide expanded lead times on orders to help assure delivery dates will be met.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- Oxford University’s experimental vaccine for COVID-19 has prompted an immune response in early testing, providing hope for an approval late this year as the drug enters late-stage trials in Brazil, South Africa and the U.S.

- A trio of experimental vaccines are entering large-scale testing and leading the race among about 160 vaccines in various stages of development, of which 20 are in human testing.

- Recent research suggests that the fatality rate for COVID-19 is between 0.3% and 1.5% of those infected, slightly higher than the flu, but the virus can have debilitating long-term effects on survivors.

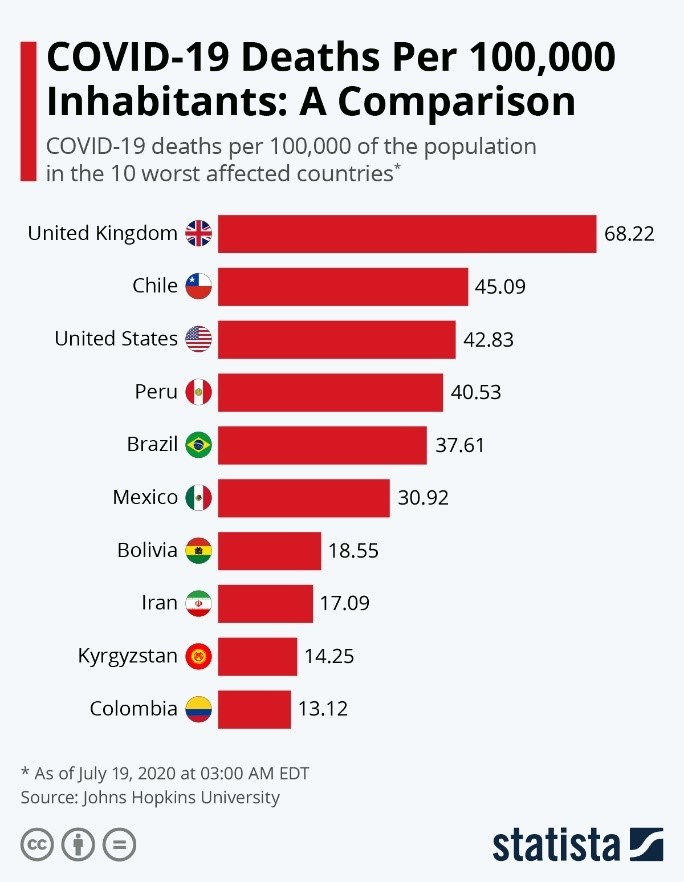

- The U.S. ranks third among nations for the severity of COVID-19 infections:

- Lawmakers, in designing the next tranche of economic relief, are considering accelerating the use of tax credits, which could free up billions in cash for corporations.

- Some business leaders and economists are urging the inclusion of healthcare price transparency provisions in the next relief package.

- Mounting economic uncertainty has driven silver futures to their highest close since 2016 and sent gold higher for six straight weeks.

- LinkedIn is cutting 6% of its workforce due to a drop in demand for its recruiting services because of the pandemic.

- Companies are delaying reopening and reviewing return-to-work protocols after the World Health Organization raised concerns about the possible aerosol spread of COVID-19, in which respiratory droplets can remain airborne for hours.

- Twenty-eight states now have face mask mandates, but the lack of a unified governmental policy regarding face coverings has many companies imposing their own mandates:

- Hotel chains Hilton, Hyatt, IHG, Loews Hotels, Marriott, Radisson and Wyndham will mandate masks and social distancing.

- Delta Air Lines will require passengers with medical conditions preventing them from wearing masks to obtain a formal exemption in the airlines new Clearance to Fly process.

- Winn-Dixie reversed course and announced yesterday that it will join other major grocery chains in requiring face masks.

- The Gap, Old Navy and Banana Republic will require face masks beginning August 1.

- In Canada, anti-mask groups are distributing fraudulent permits declaring that bearers are exempt from face mask mandates.

- A wave of consolidation continues in the Color & Compounding space during the pandemic:

- Private equity firm SK Partners, which owns several polymer-related businesses, yesterday announced that it has purchased a majority stake in leading compounder Techmer PM.

- On July 1, Avient (formerly PolyOne) completed its $1.4 billion purchase of Clariant’s color masterbatch business.

- Chroma Color, owned by private equity firm Arsenal Capital, acquired Epolin Chemicals, a maker of dyes and compounds, in June after acquiring Plastics Color Corporation in February.

- In May, Israeli materials company Tosaf acquired Vision Color.

- Volvo is weeks away from opening its Ridgeville, South Carolina, plant due to part shortages from Mexico and lackluster demand for sedans. The plant initially closed in late March, reopened May 11 and closed again three weeks later.

- Demand for electrical distributors fell a higher-than-expected 15.7% in the second quarter, while Datacom distribution was off 14.8%.

- As with historic pandemics, COVID-19 is likely to prompt changes in architecture and civil engineering, including a shift to streamlined and aerodynamic designs of the 1920s and 1930s.

- Researchers in the U.K. and Europe have developed a ceramic reinforced aluminum called Proteus that is 15% the density of steel but cannot be cut.

- COVID-19 deaths in the U.S. topped 140,000 yesterday.

International

- The European Union reached a deal on a 750 billion euro economic recovery package after four days of negotiations.

- China has successfully tamped down the cluster that emerged in Beijing last month, with mainland infections down to just 21 yesterday.

- The Bahamas has banned American tourists because of high U.S. infection rates.

- Real wages in the U.K. have fallen 4.5% during the pandemic, the biggest decline in buying power since the oil crisis sent inflation soaring during the 1970s.

- COVID-19’s economic impact reached the Beefeaters corps that has guarded the Tower of London for 535 years as it faces its first job cuts in history due to the collapse of U.K. tourism.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.