COVID-19 Bulletin: July 22

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The Energy Information Administration reported that U.S. oil inventories were 19% higher than their seasonal average last week, which halted an oil rally.

- Crude prices were lower in mid-day trading with the WTI price at $41.46/bbl and Brent at $43.88/bbl.

- North Dakota, which has the highest per capita production rate in the country, experienced a 40% drop in oil output between January and May, four times the drop nationally. Producers in the state’s Bakken shale basin need an oil price of $45 to cover production costs, and the threatened shutdown of the Dakota Access pipeline over environmental concerns could create an additional competitive hurdle.

- Baker Hughes reported a higher-than-expected second-quarter loss and said it is bracing for a second wave of COVID-19 infections and lockdowns.

- Aggressive “blanket testing” is helping Gulf states maintain low COVID-19 infection rates, with some nations testing over 40% of their citizens. In some countries, more than 70% of people with positive tests are asymptomatic.

Supply Chain

- Lockheed Martin, considered impervious to the pandemic along with much of the defense industry, reported delivery delays due to supply chain issues amid rising COVID-19 cases in Florida and Texas.

- So far, weak demand is more than offsetting reshoring efforts by U.S. factories, with factory jobs and direct foreign investment down.

- Ninety-one percent of respondents to a recent survey of medical device makers say they are double or triple sourcing their supply strategies, and 73% plan to minimize their reliance on China.

- We continue to experience challenges with truck deliveries, particularly LTL shipments, due to labor shortages and operational delays caused by COVID-19 protocols. Clients are advised to provide expanded lead times on orders to help assure delivery dates will be met.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- The U.S. suffered more than 1,000 COVID-19 fatalities yesterday, the highest level since early June. Nine states reported daily high death rates.

- With nearly 59,000 people now hospitalized due to COVID-19, the national hospitalization rate is approaching the record set in April.

- At his first coronavirus task force briefing since April, the president warned that the virus will likely “get worse before it gets better” and urged people to wear face masks.

- COVID-19 patients in many areas are waiting days and sometimes weeks for test results due to the surge in new cases, hampering the national response to the pandemic.

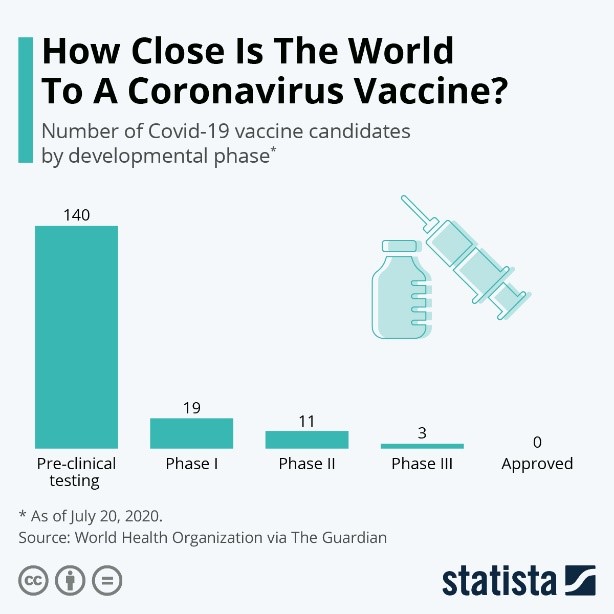

- The race is on for a COVID-19 vaccine, with more than 160 candidates in play:

- Lawmakers in Washington are scrambling to secure an additional $1 trillion economic rescue package before current aid programs expire in coming weeks, with divergent priorities emerging between the White House and the Senate.

- According to the Institute of Supply Chain Management’s most recent COVID-19 survey, 81% of respondents said demand for their products has been negatively impacted by the pandemic by an average of 15%. Only four sectors reported higher demand: Health Care & Social Assistance (+13%), Finance & Insurance (+7%), Food, Beverage & Tobacco Products (+5%), and Computer & Electronic Products (+3%).

- United Airlines, which saw revenue plunge 87% and lost $40 million a day in the second quarter, will operate at just a third of capacity in the third quarter, when it expects to lose $25 million a day. The company is slashing 6,000 more jobs.

- Boeing, which has suffered $18 billion in losses related to the grounding of its 737 Max airliners, probably won’t receive Federal Aviation Administration approval to return the jet to the skies until late this year.

- With Paycheck Protection Program funds expended and COVID-19 still spreading, retail sectors continue to adapt:

- Walmart will close on Thanksgiving Day, normally the start of its holiday shopping season, and pay $428 million in bonuses to U.S. employees as a thank you for their dedication during the pandemic.

- Tailored Brands, owner of Jos. A. Bank and Men’s Wearhouse, will shutter 500 of its 1,450 stores and cut 20% of its corporate staff.

- Ascena Retail, owner of Ann Taylor and Lane Bryant, is negotiating new financing as it prepares to file for bankruptcy. The firm has closed 1,200 of its 3,000 stores.

- Many restaurants are throwing in the towel, with 15,000 permanent closures so far during the pandemic, according to Yelp.

- Rising COVID-19 infections in key vacation states have set back the recovery for the lodging industry, where the weekly growth in occupancy fell below 3% in recent weeks, versus a weekly growth rate of over 8% between mid-April and mid-June.

- The CEO of truck-stop leader Pilot Co., the nation’s tenth largest privately owned company, is relinquishing the job to non-family leadership as the firm grapples with the recession and profound changes in the transportation sector.

- Global industrial giant Siemens is permanently adopting a “work from anywhere” approach, allowing employees to work remotely two to three days a week.

- Waymo, Alphabet’s self-driving technology division, is expanding its relationship with Fiat Chrysler to develop a self-driving van.

- Major retailers, including CVS, Target and Walmart, pledged $15 million toward a new “Beyond the Bag Initiative” intended to rethink sustainable alternatives to the single-use plastic bag.

- Brands leader L’Oréal is accelerating its sustainability initiatives and plans to eliminate non-recycled plastics by 2030.

- “Design for Recycling” guidelines for bioplastics have been published by three recycling organizations.

International

- Tensions between the U.S and China were heightened after the U.S. ordered the closure of China’s consulate in Houston over alleged violations of U.S. sovereignty. China threatened to retaliate.

- Hong Kong tightened social distancing restrictions and imposed a face mask mandate as new infections yesterday set a daily record.

- Brazil’s president, who has been dismissive of COVID-19, tested positive for the third time since falling ill on July 7.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.