COVID-19 Bulletin: July 23

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices are facing the counter-forces of upward pressure from a weakening U.S. dollar and downward pressure due to rising inventories and economic uncertainty.

- Crude prices were lower in early trading with the WTI price at $41.55/bbl and Brent at $43.91/bbl.

- Alternative energy has captured record share of global electricity markets during the pandemic as its essentially free variable cost creates a preference over fossil fuel sources.

- Chevron is using solar power at an oil field in California, reducing production costs while generating low-carbon fuel standard credits worth $4 million annually.

Supply Chain

- Whirlpool, which reported better-than-expected second-quarter results on strong appliance sales from stay-at-home consumers, said supply chain constraints have stretched backlogs from weeks to as much as two quarters. Among the challenges is lower factory productivity due to social distancing requirements.

- We continue to experience challenges with truck deliveries, particularly LTL shipments, due to labor shortages and operational delays caused by COVID-19 protocols. Clients are advised to provide expanded lead times on orders to help assure delivery dates will be met.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- In a setback for the economy, new jobless claims rose more than expected to 1.4 million, the first increase since filings peaked in March.

- U.S. COVID-19 cases are on track to surpass 4 million today, and deaths exceeded 1,000 again yesterday, the second highest daily total.

- California had a record 12,000+ new infections yesterday, surpassing New York as the state with the most total infections.

- Texas recorded nearly 200 deaths yesterday, a state record.

- Missouri, North Dakota and West Virginia registered daily highs for infections yesterday.

- Florida recorded more than 10,000 new cases yesterday.

- Arizona is experiencing a big spike in new cases after the infection rate appeared to be leveling off over the weekend.

- Ohio mandated the use of face masks statewide starting today, and visitors from nine high-infection states must quarantine.

- Indiana and Minnesota also imposed statewide mask mandates.

- With hospitals near capacity, Miami has stiffened penalties for face mask violations, including higher fines and possible incarceration.

- Washington D.C. and Baltimore imposed face mask mandates, while two cafeterias in the White House complex were closed due to the infection of an employee.

- With the $600 unemployment supplement and restrictions on home evictions expiring tomorrow, the Senate and White House compromised on significant differences and agreed on a $1 trillion rescue package. Negotiations with the House of Representatives have yet to begin.

- Now that Paycheck Protection Program loans are spent, many small businesses are at a breaking point, with one-third lacking enough cash reserves to last more than a month.

- The federal government entered a $2 billion contract to produce 600 million doses of a COVID-19 vaccine under development with Pfizer and BioNTech, who are partnering in the vaccine project.

- There is growing anecdotal evidence but no scientific verification that it may be possible to catch COVID-19 more than once.

- The housing market, fueled by historic low interest rates, continued its rebound in June, as sales of existing homes jumped 20% month-over-month. With 47% of those sales in the southern U.S., the rebound could face an obstacle with rising COVID-19 infections in many Sunbelt states.

- Southwest Airlines and American Airlines joined other major carriers in scaling back flights as rising COVID-19 infection rates curtail summer travel.

- Amazon announced that it will delay its Prime Day, which normally takes place in July, without specifying a new date.

- The pandemic has disrupted the back-to-school shopping season, leaving parents uncertain about whether physical schools will reopen, or classes will be held online. Sales are expected to reach a record $102 billion with laptop sales expected to be a hot product.

- A Materials Recovery for the Future project to test new separation methods for flexible plastic packaging (FPP) from the waste stream was a success. FPP, a 12-billion-pound market in the U.S., is the fastest growing plastic packaging globally.

International

- The U.S. dollar is down 8% from this year’s highs relative to a basket of other currencies and at its weakest point since 2018 as the expanding pandemic and escalating trade tensions weigh on the currency.

- The euro has rallied 3% versus the dollar this month, fueled by optimism about this week’s bailout package and the dollar’s relative weakness.

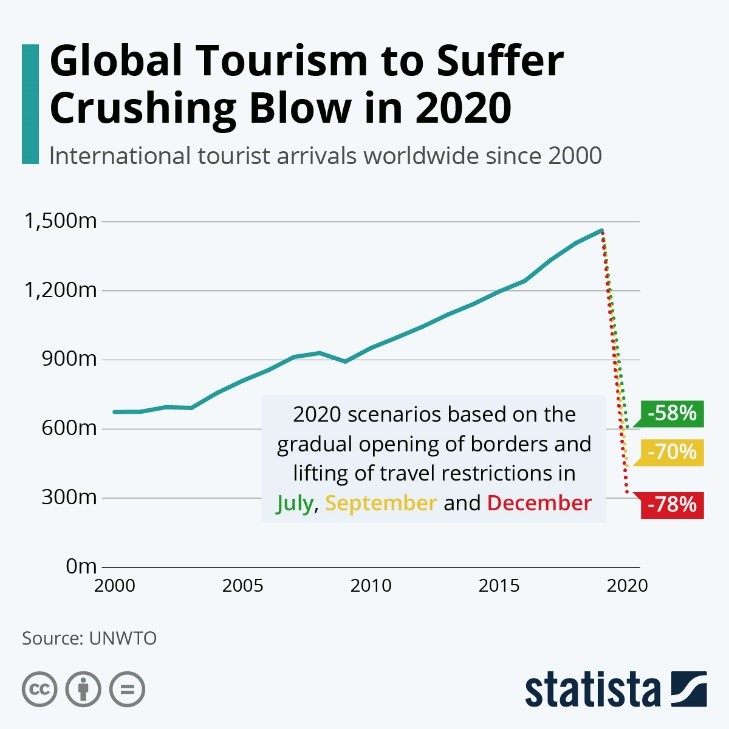

- Global tourism is suffering a devastating fall this year:

- A COVID-19 silver lining: prevention measures have resulted in a steep drop in cases of the flu and other seasonal viruses in the Southern Hemisphere.

- Brexit talks stalled between the European Union and the U.K. with a year-end deadline for the U.K.’s departure from the Union looming.

- U.K. manufacturing sentiment and industrial activity recovered more than expected in the second quarter.

- Sweden has paid a steep price for its “herd immunity” strategy to COVID-19, with a death count 4 ½ times higher than combined death toll of the other four Nordic countries.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.