COVID-19 Bulletin: July 28

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Crude prices were steady in early trading with the WTI price at $41.45/bbl and Brent at $43.51/bbl.

- Rising global COVID-19 infection rates and stagnating airline fuel consumption appear to have stalled the oil demand recovery.

- Permian Basin oil driller Rosehill Resources will restructure and go private under bankruptcy protection, wiping out common shareholders.

- Russia overtook the U.S. as the leading supplier of Liquified Natural Gas (LNG) to China, the world’s largest importer, with month-over-month growth of 20.7% versus U.S. growth of just 2.4%. China’s LNG imports were up 29% in June on a year-over-year basis.

- Forty publicly traded oil companies wrote down asset values by a combined $48 billion in the first quarter, with further impairment charges expected in the second quarter. Total impairment charges due to the pandemic and oil recession could top $300 billion, according to Deloitte.

Supply Chain

- Toy makers are being squeezed between high retail demand from homebound families and low wholesale restocking as bricks-and-mortar outlets close and online business models rely less on inventory.

- We continue to experience challenges with truck deliveries, particularly LTL shipments, due to labor shortages and operational delays caused by COVID-19 protocols. Clients are advised to provide expanded lead times on orders to help assure delivery dates will be met.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- Monday, Moderna began large-scale Phase 3 testing trials in the U.S., while Pfizer and German partner BioNTech began selecting volunteers for combined Phase 2/3 testing of their vaccine candidate.

- Senate leadership unveiled its $1 trillion rescue package amid rancor within the Republican party and between parties. It includes money for testing and schools, further funding for the Paycheck Protection Program, a liability shield for employers and scaled back extended unemployment benefits.

- With 55,000 new COVID-19 cases, yesterday marked the the lowest daily increase since July 7th as infection rates continue to decline. However, the total confirmed cases have risen by 69% in the past 30 days.

- U.S. industrial production rose 5.4% in June from May, while manufacturing activity rose 7.2%, a month-over-month record. Second-quarter industrial production was at the lowest quarterly rate since World War II.

- Tennessee, an emerging hotspot for COVID-19 with more than 2,500 new infections yesterday, is resisting CDC advice to impose social distancing restrictions.

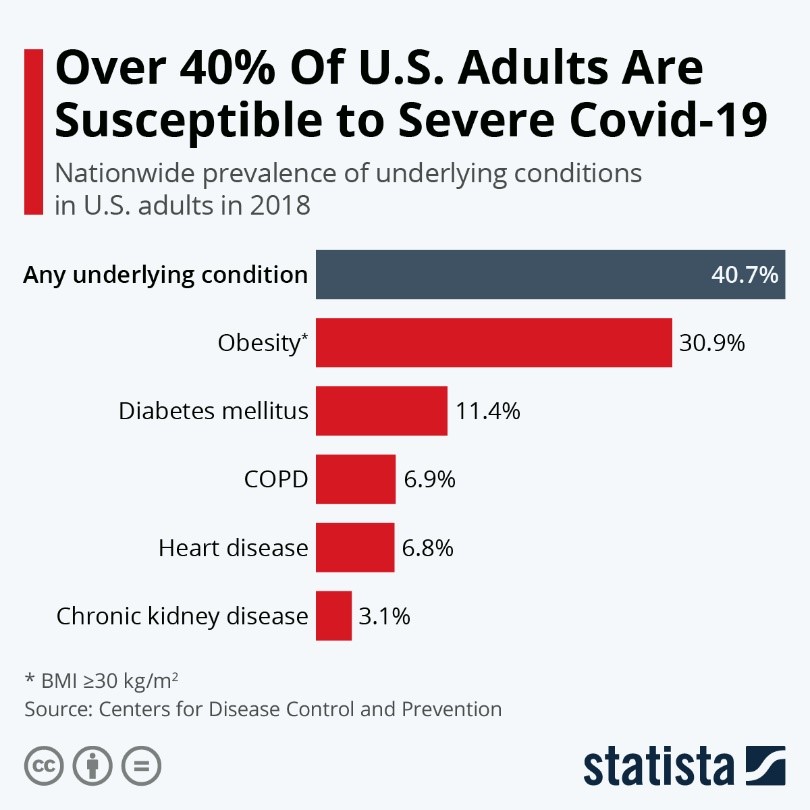

- Over 40% of U.S. adults have conditions that make them susceptible to severe consequences of COVID-19:

- Nissan said it expects to lose over $6 billion this year on a 21% fall in revenues as the company eliminated its dividend to preserve cash.

- Many companies are facing sticker shock over their rising cost of cloud computing in the work-at-home era.

- Target will join Walmart in closing stores on Thanksgiving in gratitude to its frontline workers.

- A medical paper suggests masks may protect wearers from COVID-19 and also mitigate the symptoms of those infected.

- Demand is surging for transparent masks.

- Eleven players and two coaches on the Miami Marlins baseball team tested positive for COVID-19, forcing cancellations of scheduled games and putting the MLB season in jeopardy.

- The price of gold, buoyed by economic uncertainty and a weakening U.S. dollar, eased in early trading today after hitting a record high of $1,974.40/ounce yesterday.

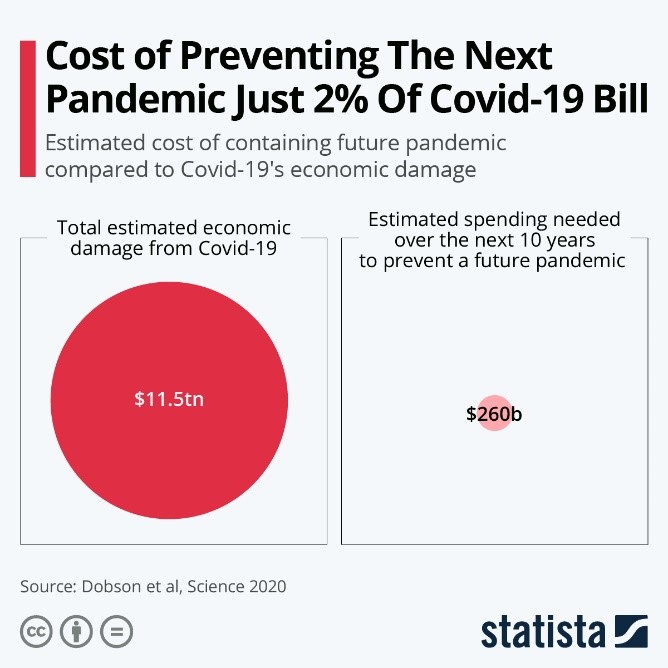

- Prevention will be paramount when it comes to preparing for the next pandemic:

- Global COVID-19 cases passed 16.5 million yesterday.

International

- Latin America surpassed North America for the region with the most COVID-19 infections, accounting for nearly 27% of the global total.

- Fitch Ratings projects that the growth rate of 10 industrialized nations will slow by an average of 0.6% through the middle of the decade due to subdued employment and lower capital accumulations caused by the pandemic.

- The European Union is close to extending its ban on travelers from high-infection nations, including the U.S., for two additional weeks.

- Germany will mandate testing of arriving travelers and is urging social distancing after a COVID-19 flare-up among migrant workers in Bavaria.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.