COVID-19 Bulletin: July 31

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The WTI crude price climbed back above $40 in early trading today at $40.24/bbl, while Brent rose to $43.27/bbl.

- Big oil companies are preparing for a prolonged pandemic after reporting disappointing second-quarter results.

- Royal Dutch Shell took a $16.8 billion impairment charge in the second quarter. Before the charge, adjusted net income slid 82% but beat analyst expectations of a loss for the period.

- Exxon and Chevron posted their worst quarterly losses in a generation as they confronted the oil and gas recession and lower demand across markets.

Supply Chain

- Walmart is melding its online and bricks-and-mortar businesses in the U.S. to create an omnichannel path to market.

- The growing integration of Internet of Things (IoT) components in supply chains is presenting new cyber risks for businesses.

- We’re seeing delivery challenges with LTL shipments caused by labor shortages and operational delays from COVID-19 protocols now spreading to truckload shipping. Clients are advised to provide expanded lead times on orders to help assure delivery dates will be met.

- Beyond the transportation challenges, our Gold Standard logistics partners and U.S. ports continue to operate without interruption.

Markets

- The U.S. reported 1,465 deaths yesterday, about one fatality per minute.

- Consumer spending rose 5.6% in June but appears to be slowing in the face of tightened lockdowns in high-infection areas.

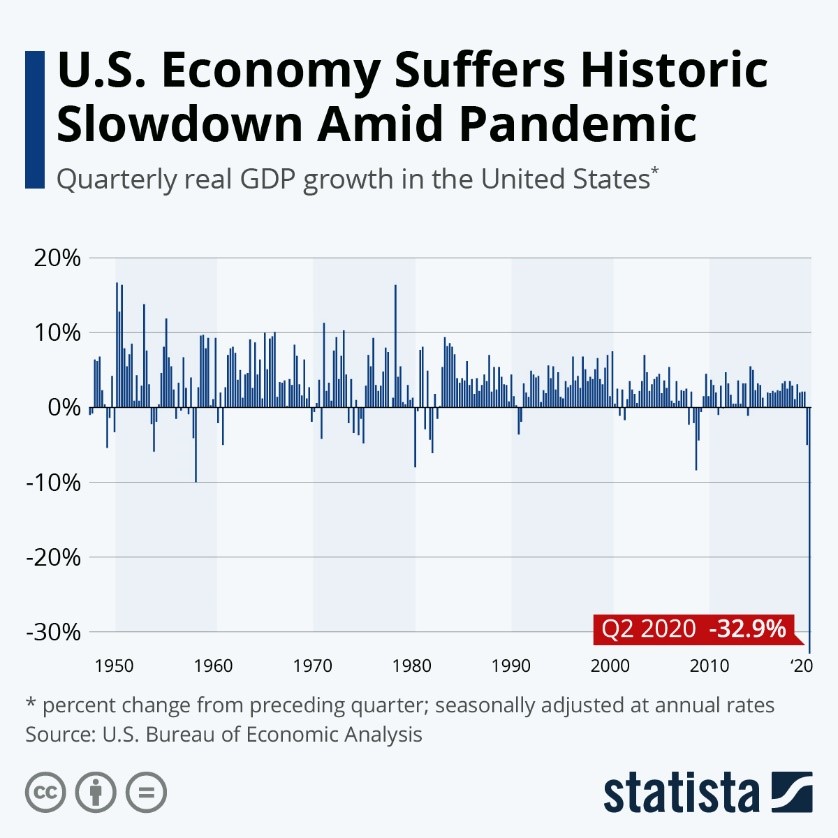

- The 32.9% plunge in year-over-year GDP in the U.S. was the steepest on record:

- Quarterly financial reports yesterday spotlighted some of the corporate winners during the pandemic:

- Amazon reported a 40% increase in second-quarter earnings and raised guidance for the third quarter.

- Apple overcame shutdowns of its retail stores and posted an 18% increase in quarterly earnings.

- Facebook’s earnings nearly doubled on a 2.6% increase in monthly average users.

- A 43% increase in cloud revenue could not offset a drop in ad revenue for Google parent Alphabet, which reported its first ever quarterly revenue decline and a 12.1% drop in earnings.

- P&G swung from a year-ago quarterly loss to a better-than-expected profit on 6% organic growth in revenue driven by high demand for household cleaning and personal healthcare products.

- Nestle registered higher earnings on organic revenue growth of nearly 3% in the second quarter driven by robust sales of pet care and household goods.

- Major corporations, flush with cash, have reduced bond sales by a third and are curtailing spending, blunting the effectiveness of the Federal Reserve’s efforts to stimulate the economy.

- The U.S. dollar lost ground to all major currencies in July, down 4.6%, its worst month in a decade.

- Boeing is planning more employment cuts and possible plant closures after reporting that deliveries are down 73% this year. The company reported a larger-than-expected second-quarter loss and does not expect passenger air traffic to return to 2019 levels for three years.

- Citing expectations for “a long, slow recovery,” Airbus said it is further cutting airliner production. The company, which has taken just 25 orders since January and saw second-quarter revenue fall 40%, said air traffic may not return to normal until 2023-2025.

- Ford’s adjusted net income swung to a loss in the second quarter on a 50% drop in revenue but beat analyst estimates. The company reported a profit after booking a gain on its investment in Argo Al, a self-driving technology company.

- Fiat Chrysler suffered a 56% drop in revenues and a $1.2 billion loss in the second quarter, but the company turned a small profit in North America on a 62% decline in shipments.

- Caterpillar, an economic bellwether, reported a 70% drop in earnings on a 31% slide in revenues in the second quarter and said it is cutting costs and prioritizing investments given the uncertain economic outlook.

- Walmart, Safeway and Tyson Foods are among a growing number of companies facing wrongful death lawsuits related to their actions during the pandemic, the beginning of what is expected to be a surge in negligence cases.

- Tyson Foods is adding a Chief Medical Officer and expanding its nursing staff to administer an ambitious COVID-19 testing program to protect workers.

- Isaias was upgraded from a tropical storm to a hurricane as it approached Puerto Rico. On Saturday it is expected to impact the east coast of Florida, which closed all COVID-19 testing sites.

- Oversized kitchens, heated balconies, private elevators and private entrances will be a legacy of COVID-19 on building design.

- Global COVID-19 cases have exceeded 17.4 million.

International

- The eurozone economy contracted 40.3% on an annualized basis in the second quarter, the steepest drop on record and a worse drop than the U.S. suffered.

- Germany’s economy shrank 10.1% in the second quarter when compared with the first, the steepest quarter-on-quarter drop in history, negating a decade of economic growth.

- Mexico’s GDP in the second quarter fell 18.9% from the prior-year period. Barring a second COVID-19 wave, the economy could recover to pre-pandemic levels in one-to-two years, according to a government official.

- Three million Chileans rushed to withdraw pension funds after the government lifted restrictions to ease the economic burden on citizens.

- South Africa’s economy is expected to shrink 7.5% this year, but a second COVID-19 wave could cloud the outlook.

Our Operations

- Join us for our next Fireside Chat on August 19. Panelists from M. Holland and Plante Moran will discuss the new USMCA and how it will impact businesses, the economy and the plastics industry. For more information and to register, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.