COVID-19 Bulletin: July 6

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The WTI crude price stood at $40.43 in early trading today, while Brent was at $42.01/bbl.

- China is on pace to purchase less than 20% of the energy products it agreed to buy under this year’s Phase 1 trade agreement with the U.S.

- Dominion Energy and Duke Energy are abandoning their planned $8 billion Atlantic Coast Pipeline due to regulatory obstacles, sowing doubts about large-scale energy projects in the future. Dominion also is selling its gas transmission business. Duke Energy reaffirmed its commitment to invest in renewable energy.

- Germany passed legislation to phase out the use of coal as an energy source by 2038, the first major country to do so.

- Gasoline retailers are enjoying record margins with high July Fourth holiday demand coupled with low wholesale prices.

Supply Chain

- Dow has agreed to sell its rail logistics assets as part of a plan to focus on its product-producing assets.

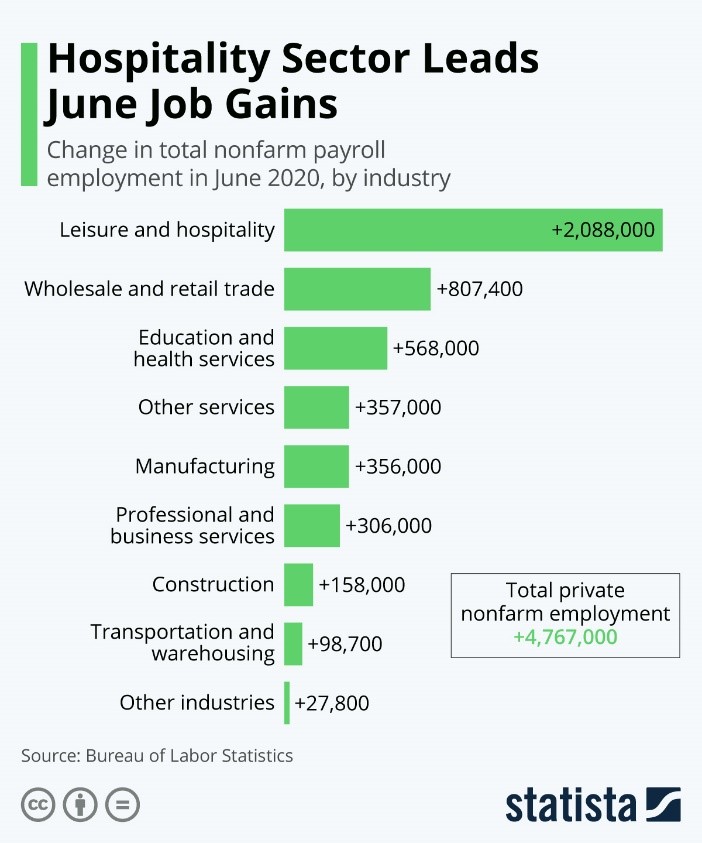

- The transportation and warehousing sector saw nearly 100,000 job gains in June:

- Amazon is delaying its Prime Day for a second time, from September to October, out of concerns about supply chain disruptions due to rising COVID-19 infection rates.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

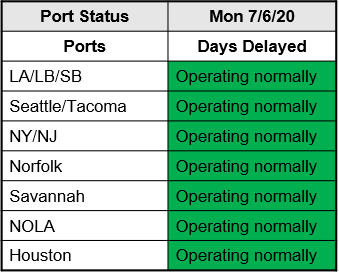

- Ports are operating normally:

Markets

- The rolling seven-day average of new COVID-19 cases exceeded 48,000 on Sunday, a record for the 27th consecutive day:

- Former epicenter New York, which has largely tamed the virus, has been replaced by four concerning hot spots: Arizona, California, Florida and Texas, all of which reported daily record infections over the holiday weekend.

- Florida, with more than 11,000 new COVID-19 cases reported on Saturday, and Texas, with more than 8,000, accounted for 40% of national infections over the holiday weekend.

- Arizona’s case count has risen at a 4.1% rate for the past seven days.

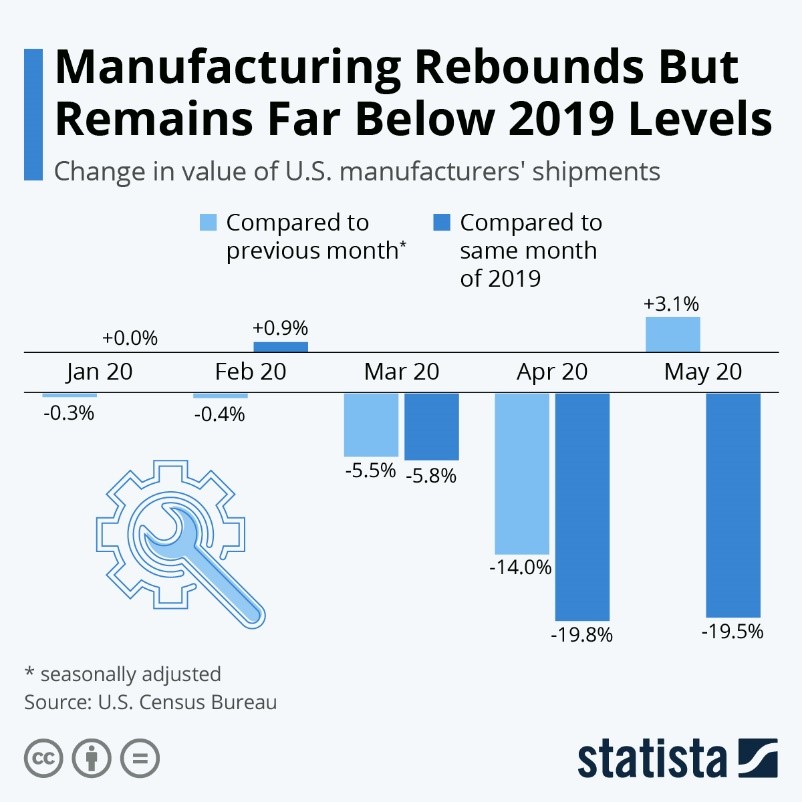

- U.S. manufacturing activity is rebounding but remains well below 2019 levels:

- Goldman Sachs lowered its outlook for the U.S. economy in 2020 from a 4.2% contraction to a 4.6% contraction in expectation of a smaller rebound in the third quarter as more states retrench in the face of accelerating COVID-19 spread.

- As the second-quarter reporting season for public companies begins, average revenues are expected to be down 11.1% and earnings down 43.8%.

- Used car sales and prices have rebounded strongly in June due to stimulus spending, low interest rates and shortages of new cars as automakers ramp up production.

- With consumers looking for off-road adventures during the pandemic, Ford is reviving its Bronco brand after 25 years in retirement.

- Testing is proving to be a difficult and expensive protocol to implement for companies reopening facilities and offices.

- Kroger has received FDA approval to provide at-home COVID-19 testing kits to all its frontline workers through an affiliation with a laboratory partner.

- The pandemic is accelerating a shift toward a cashless economy as consumers shop more online and turn to cards and cashless payments out of safety concerns.

- More than 200 medical experts from 32 countries are pressing the World Health Organization to definitively acknowledge the airborne transmission risk of COVID-19.

- U.S. COVID-19 infections are approaching 3 million today.

International

- India surpassed Russia with the third-highest COVID-19 infections in the world behind Brazil and the U.S.

- Tokyo, which has experienced triple digit new COVID-19 infections for five straight days, is preparing for a possible second wave.

- Israel’s cabinet will meet today to consider new restrictions and economic measures to address a renewed surge in infections.

- Unlike past recessions, the COVID-19 recession has impacted service sectors first and foremost, hitting Latino and Hispanic workers particularly hard since they constitute about half of service workers.

- Job losses among migrant workers around the world could reduce remittances by up to 20% this year, dealing a further economic blow to many developing countries.

- Plastimagen, Mexico’s largest plastics trade show, has been postponed from November to January 2021.

- Berlin’s public transportation company initiated an ad campaign urging riders to forego deodorant as a means of forcing others to properly wear face masks to cover their noses.

Our Operations

- Today we welcome Lindy Holland, Market Manager, Sustainability, back to work after a challenging bout with COVID-19.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.