COVID-19 Bulletin: July 7

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices were steady in early trading today, with the WTI crude price at $40.42 and Brent at $42.98/bbl.

- Weekly U.S. oil output has fallen from 13 million bb/d in March to 10.5 million bb/d in recent weeks, the steepest drop in history. The drop helped boost the WTI price above $40 but may not be enough to help many shale producers, who face $240 billion in debt maturations over the next five years.

- A federal judge shut down the Dakota Access Pipeline, which connects shale oil fields in North Dakota to Illinois, pending an environmental review. The pipeline has been operating since 2017.

- Royal Dutch Shell would consider moving its headquarters from the Netherlands to the U.K. to avoid the former’s dividend tax.

Supply Chain

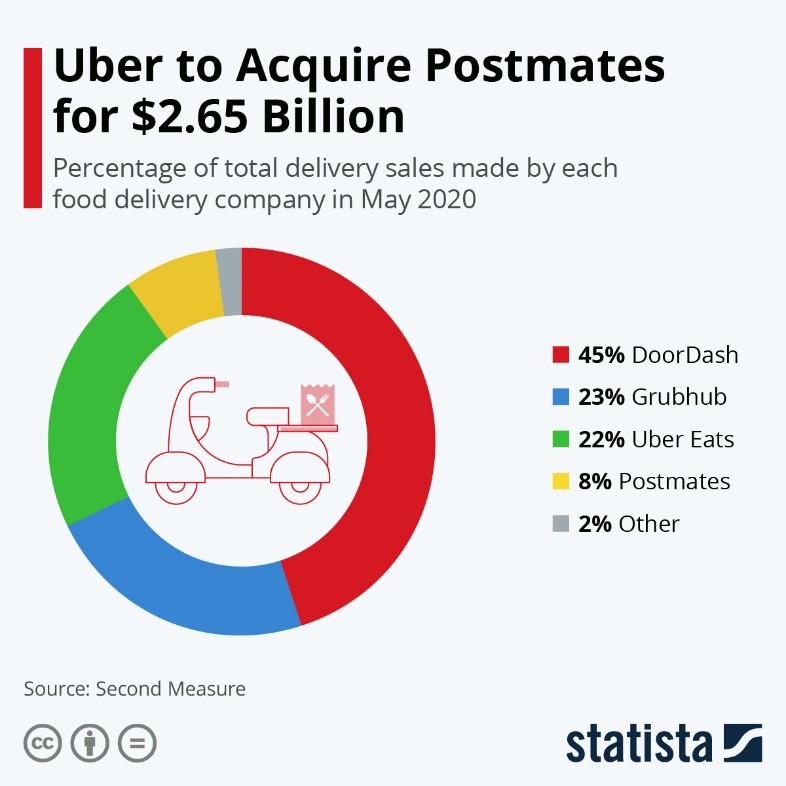

- Uber is broadening its delivery capabilities with its $2.65 billion acquisition of Postmates, which delivers prepared food as well as groceries and other goods. Business doubled in the second quarter for Uber Eats, the third-largest food delivery service, while Uber’s ride-hailing service was down 70%.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

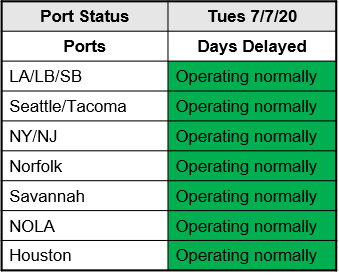

- Ports are operating normally:

Markets

- The seven-day average COVID-19 infection rate hit a new high in 12 states yesterday, with the biggest increases in Montana, Tennessee and West Virginia.

- COVID-19 infection rates are rising in more than 40 states, with Sunbelt states straining their hospital capacities. Hospitalizations are up 56% in California in the past two weeks, more than 40% in Florida in the past week, and fourfold in Texas in the past month.

- Miami-Dade County issued an emergency order closing bars, restaurants and many other businesses beginning Wednesday.

- West Virginia will mandate face masks indoors after experiencing a recent spike in COVID-19 infections.

- The head of the Federal Reserve Bank of Atlanta cited “troubling” signs that the economic recovery may be leveling off in the face of rising COVID-19 infection rates.

- The Organization for Economic Cooperation and Development predicted that global employment will not return to pre-pandemic levels until 2022 at the earliest.

- United Airlines warned of possible further furloughs as reservations soften due to new shutdowns and travel restrictions forced by rising COVID-19 infections.

- The FDA approved a hand-held testing device made by Becton Dickinson that can deliver results in 15 minutes.

- Hospitals, the front line for fighting COVID-19, are proving to be centers for cluster spread of the disease.

- Full-sized pickup trucks surpassed crossover vehicles to become the top selling category in the second quarter, with 1 in 4 vehicles sold a pickup truck.

- Demand for pneumatic conveying equipment is soaring as banks close lobbies and turn to drive-through banking to maintain personal service. Sales of plastic cylinders are up 300%.

- U.S. COVID-19 fatalities have surpassed 130,000.

International

- The U.S. Chamber of Commerce and more than 40 trade groups urged China to step up purchases of U.S. goods and services to comply with the Phase 1 trade agreement.

- The European Commission downgraded its projections for Europe’s economy, now projecting a contraction of 8.3% this year for the European Union versus its earlier forecast of a 7.4% contraction. Southern Europe is being hardest hit, with several nations expected to shrink by double-digit rates.

- The president of Brazil, which is reopening cities despite the second highest infection rate in the world, was tested for the second time after exhibiting symptoms of COVID-19.

- Australia, which has largely controlled the pandemic, will shut down Melbourne for six weeks after the country’s second largest city experienced record new infections.

- With its quarantine facilities overflowing, New Zealand is curtailing arrivals of citizens wishing to return to the zero-infection-rate country.

Our Operations

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.