COVID-19 Bulletin: July 9

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices were down in mid-day trading today, with the WTI crude price off 2.9% at $38.73/bbl and Brent 1.9% lower at $42.47/bbl.

- Gasoline consumption is flagging in COVID-19 hot spots around the country, threatening to disrupt the oil recovery.

- With crude prices up from historic lows, Canada has restored about 20% of idled production.

- Biofuels have lagged other alternative energy sources due to their high investment costs, vulnerability to fossil fuel price swings and inconsistent government policy.

Supply Chain

- Trucking giant YRC Worldwide received a three-and-a-half-year reprieve on some of its debt from lenders as it negotiates a $700 million federal bailout package.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

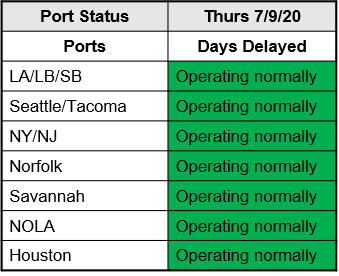

- Ports are operating normally:

Markets

- Another 1.3 million people filed first-time unemployment claims last week, slightly lower than expected.

- The U.S. budget deficit in June hit $863 billion, nearly as much as the entire deficit for fiscal 2019. The budget gap for the first nine months of 2020 was $2.7 trillion.

- The U.S. recorded more than 62,000 COVID-19 infections yesterday, a daily record for the second day in a row.

- Twenty-six state legislators in Mississippi, one sixth of the legislature, have tested positive for COVID-19, shutting down the state house.

- Texas recorded 98 COVID-19 fatalities yesterday, a daily record.

- Arizona and West Virginia delayed reopening schools for the 2020-2021 school year, despite federal government pressure for all schools to reopen on time.

- The national spike in COVID-19 infections is overwhelming testing capabilities, stranding some with hours-long waits to get tests and delays of a week or longer to get results.

- After a political stalemate on further economic stimulus, consensus is building in Washington for a fourth round of federal aid as prior stimulus programs expire.

- The Federal Reserve’s Main Street Lending Program aimed at midsized businesses is getting unenthusiastic support from banks, with major banks most noticeably hesitant.

- Automaker Daimler said that further cost cuts are on the way and telegraphed that second-quarter sales will be down significantly when it reports on July 23, despite strong sales in China.

- The pandemic is forcing changes in climate control systems for buildings, with equipment makers adding filtering, increasing outside air intake and deploying UV light to sanitize the air.

- Brooks Brothers filed for bankruptcy, and Bed Bath & Beyond announced the closure of 200 stores, the latest iconic retailers to be hobbled by the pandemic.

- At least 110 companies have filed for bankruptcy since March, citing the pandemic as the catalyst.

- With the airline industry in distress, Dallas-Fort Worth International has emerged as the world’s busiest airport, even though it’s running at only half capacity.

- Plastics Industry Association President & CEO Tony Radoszewski testified to Congress this week about the important role of plastics during the pandemic.

- COVID-19 cases globally topped 12 million today, a doubling in the past six weeks.

International

- The U.K. will initiate a second round of economic stimulus with a $38 billion spending package.

- Hong Kong and Tokyo experienced record COVID-19 infections yesterday, raising concerns about further flare-ups in Asia.

- Brazil and other Latin American countries are launching investigations of dozens of officials for corruption in attempting to siphon funds intended to fight the COVID-19 crisis.

Our Operations

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.