COVID-19 Bulletin: June 10

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices eased in early trading today, with the WTI at $38.61/bbl and Brent at $40.95/bbl.

- Design changes to the Federal Reserve’s Main Street Lending Program could provide a lifeline to many struggling oil companies.

- Coal is staging a comeback in Asia, which now accounts for three-fourths of global coal production, as the pandemic accelerates the shift by Western nations to cleaner fuel sources.

Supply Chain

- Railcars in storage spiked 20% in May with nearly one-third of railcars idle.

- Same-day delivery services are expanding beyond food deliveries to other products as cities reopen.

- Food prices have risen at their fastest pace in decades due to disruptions and higher costs throughout the value chain.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

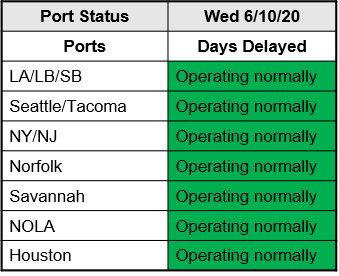

- Ports are operating normally:

Markets

- The Federal Reserve left the fed funds rate unchanged at 0%-0.25% and said it expects no rate hikes through 2022.

- The White House voiced support for a fourth round of economic stimulus on top of the $3.3 trillion already extended.

- Layoffs in April fell to 7.7 million from 11.5 million in March, the two worst months on record, with the most affected industries shifting from leisure, retail and travel in April to construction, mining and real estate in May.

- Citing May’s jobs gains, the Secretary of Labor voiced opposition to extending the $600 unemployment benefits enhancement scheduled to expire at the end of July.

- Black unemployment tripled to 16.8% between February and May as COVID-19 reversed job gains made by African Americans during the record economic expansion.

- Twelve percent of companies in a recent survey have cut or eliminated 401(k) matches to preserve cash and mitigate staff reductions with another 23% of respondents considering cuts.

- The International Air Transport Association forecasts that the global airline industry will lose $84 billion this year on a 50% revenue drop. Losses in 2021 could approach $100 billion as airlines fight for slowly returning passengers.

- Nikola, a startup focused on developing electric and fuel-cell-powered trucks that went public last week, saw its market value surpass Fiat Chrysler’s and Ford’s as parcel delivery demand soars and shippers seek more environmentally friendly fleets.

- COVID-19 hospitalizations have been rising sharply in nine Western and Southern states since Memorial Day.

- Global infections are rising at the fastest pace yet and are approaching 7.3 million.

International

- Germany began eliminating checks at its land borders, but extended warnings about travel outside the European Community and urged Germans to avoid travel to the U.K. specifically because of its high infection rates.

- Controversy continues in Sweden, where COVID-19 briefings are being reduced from daily to twice a week because of aggressive questioning about the country’s lax response strategy, which has resulted in one of the highest per capita death rates in the world.

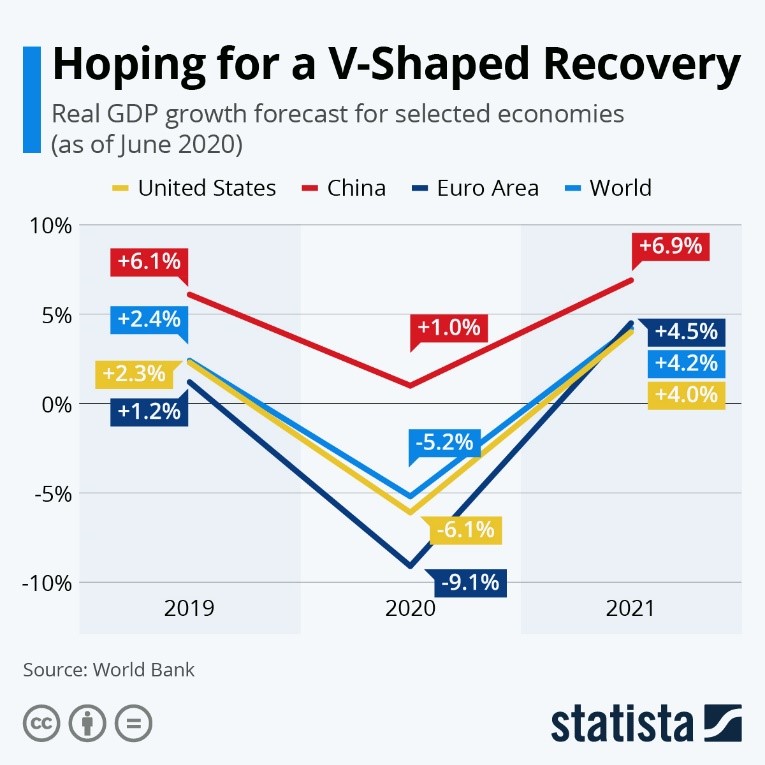

- In projecting a 5.2% global economic contraction this week, the World Bank forecasted a “V” shaped recovery:

- The Organization for Economic Cooperation and Development (OECD) forecasted a 6% contraction of the global economy this year, a grimmer outlook than the World Bank’s 5.2% estimate. The OECD urged diligence in fighting the virus and associated economic disruption, projecting that a second COVID-19 wave could result in a 7.6% contraction.

- Informal economies in many developing countries will exacerbate the economic distress of the pandemic, making it hard to deliver economic relief to those most affected, according to the OECD.

- India’s major cities are growing overwhelmed by rising infection and death rates after easing restrictions.

- Moscow, which accounts for 40% of Russia’s COVID-19 infections, abruptly lifted restrictions on its 12 million residents ahead of an upcoming WWII victory parade and elections to modify its constitution, despite still suffering 2,000 new infections a day.

Our Operations

- Our Healthcare team, in collaboration with Plastics News, will host a webinar on materials selection for medical applications tomorrow. Click here to register.

- Our Global Healthcare Manager Josh Blackmore was featured in an article in Medical Plastics News.

- Our Business Development Market Managers are available for videoconferences with clients seeking advice on material selection, manufacturing, regulations and other aspects of specialty markets:

- To schedule a meeting regarding Automotive, contact Market Manager Matt Zessin.

- For Color & Compounding, contact Market Manager Scott Arnold.

- For Electrical & Electronics, contact Market Manager Carlos Aponte.

- For Flexible Packaging, contact Senior Technical Development Engineer Todd Stevens.

- For Healthcare, contact Global Healthcare Manager Josh Blackmore.

- For Rotational Molding, contact Product Manager Pete Nutley.

- For Wire & Cable, contact Director Todd Waddle.

- For 3D Printing, contact Market Manager Haleyanne Freedman.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.