COVID-19 Bulletin: June 2

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- The OPEC+ coalition will meet next week to discuss extending its production-cut agreement another one-to-three months. The cuts have helped drive a tripling of the WTI price over the past six weeks.

- The news helped boost oil prices in mid-day trading today, with the WTI price up 3.0% to $36.49/bbl and Brent up 2.4% to $39.25/bbl.

- Low gasoline prices and a reopening of the economy have sparked a moderate uptick in driving, pushing average gas prices near $2.00/gal and providing encouragement about an economic recovery.

- LNG demand will experience its first contraction in eight years as summer seasonal demand aggravates weakness from COVID-19 shutdowns.

Supply Chain

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

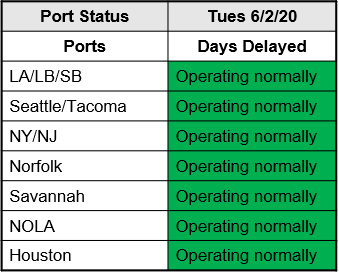

- Ports are operating normally:

Markets

- The Congressional Budget Office revised its 2020-2030 economic outlook, predicting it could take a decade or longer for the U.S. economy to overcome the economic effects of the COVID-19 pandemic.

- Protests across the country have set back reopening efforts by businesses of all stripes, forcing an examination of their safety and security protocols as well as their diversity postures.

- Ford and GM will operate many plants through the normal summer break around July 4 to make up for lost production during the COVID-19 shutdowns.

- As non-essential retailers reopen, they are bracing for a surge in product returns that will aggravate their already overstocked inventories. More than one in three consumers said they have items to return, according to a recent survey.

- Starbucks is further cutting hours and encouraging workers to take unpaid leave until September on expectations that demand will remain diminished until the fall.

- Consumer electronics sales rose by more than 20% the week ended May 23, the sixth consecutive week of 20%+ revenue growth.

- More than 94 million Americans have postponed elective surgeries since COVID-19 emerged, creating a financial crisis for many hospitals, a third of which were losing money on patient care before the pandemic.

- Forty-six percent of Americans have used telehealth services during the COVID-19 crisis, a four-fold increase, according to McKinsey & Company, which estimates that telehealth could grow from a $3 billion segment to more than $250 billion occupying 20% of the healthcare market.

- Prescriptions for sleep medication jumped nearly 15% in February and March, with 46% of respondents to a recent survey reporting sleeping problems due to stress from the COVID-19 crisis.

- A coalition of more than 100 recyclers and environmental groups is urging that any further economic relief legislation prioritize recycling, which has been disrupted by quarantines, recessionary pressures and low prime resin pricing.

International

- Central banks in emerging markets, after making significant interest rate cuts, are now considering quantitative easing to their arsenal in their fight against the COVID-19 downturn.

- Mexico’s automotive manufacturers face challenging obstacles in satisfying U.S. supply needs, including rising COVID-19 infections, a deteriorating economy and liquidity issues.

- The French economy will contract by 11% this year, says the government, higher than its previous forecast and more than forecasts of other major European Union countries.

- Starting Monday, anyone entering the U.K. will be required to quarantine for 14 days or face heavy fines, a further blow to the nation’s important tourism industry, which employs 3.1 million and comprises 6.5% of GDP.

- Thailand plans to employ “travel bubbles,” bilateral travel agreements with nations with low COVID-19 rates, to control cross-border travel when borders are reopened at the end of the month.

- Just one week after lifting stay-at-home restrictions, Tokyo issued alerts after new COVID-19 cases spiked at the highest rate since early May.

Our Operations

- Our Healthcare team, in collaboration with Plastics News, will host a webinar on materials selection for medical applications on June 11. Click here to register.

- Our Healthcare team is also offering videoconferences for clients seeking advice on medical material selection, manufacturing and regulations. To schedule a meeting, contact Healthcare Market Manager Josh Blackmore.

- Our 3D Printing team is offering videoconferences for clients seeking advice on part design, equipment selection, material selection and all aspects of 3D printing. To schedule a meeting, contact 3D Printing Market Manager Haleyanne Freedman.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.