COVID-19 Bulletin: June 23

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices steadied yesterday after mixed signals from the White House about the China trade deal; prices in early trading today were the highest since March, with WTI up 1.0% to $41.15/bbl and Brent up 1.6% to $43.44/bbl.

- A lack of standards for estimating shale oil reserves has led to overestimates by many companies, creating concerns and caution among investors.

Supply Chain

- A successful pilot project employing blockchain in the drug supply chain demonstrated the technology can connect disparate computer systems to track and trace products while expediting communications. IBM, KPMG, Merck and Walmart participated in the pilot.

- U.S. exports of coal and farm goods as well as European automobile exports could be targets for retaliatory tariffs in a growing trade dispute between the U.S. and Europe.

- Industrial real estate activity rebounded over the past month, fueled by surging demand for warehouse space as retailers transition to e-commerce. Transactions are nearly 3% higher year to date, despite a steep drop in March and early April.

- Cruise lines will extend their suspension of departures from U.S. ports until September 15.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

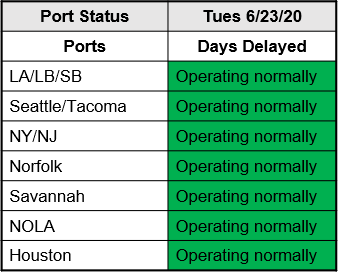

- Ports are operating normally:

Markets

- Citing the nation’s high unemployment rate, the White House issued an executive order freezing a range of visas for non-immigrant workers, including new H1-B and H-4 visas, used by technology workers, L visas for intracompany transfers, and J visas for work- and study-abroad programs until the end of the year.

- A rise in raw material prices is creating optimism about the global economic recovery but could be the result of production cutbacks as well.

- With stimulus checks largely spent by lower-income workers and subsidized unemployment payments due to expire at the end of July, Washington is wrestling with whether further federal aid is needed.

- Businesses and front-line workers are encouraging government-mandated masks as evidence mounts about their effectiveness in mitigating infection rates.

- Demand for plastic packaging is expected to be up 5.5% this year, boosted by growth in packaged consumer goods and medical supplies, the suspension of single-use plastic bans, and a challenged recycling sector.

- Amazon’s just-announced Climate Pledge Fund will invest $2 billion in businesses that help reduce climate change in its quest to achieve net zero emissions by 2040.

- There is growing concern among health experts about increases in infections among young people; 44% of those recently infected in California were below 35 years old.

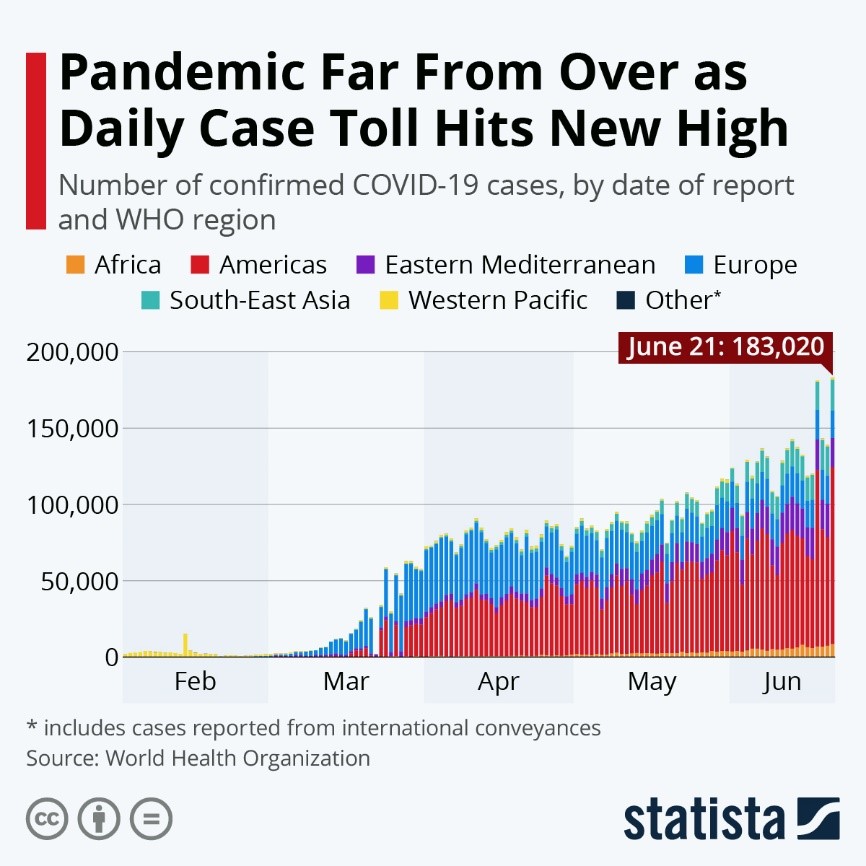

- Global COVID-19 infections are accelerating and broke the 9 million mark yesterday:

International

- A 7.4 magnitude earthquake struck southern Mexico this morning, shaking buildings 300 miles away in Mexico City. Preliminary damage and injury reports were not yet available.

- Last week, new cases in Latin America rose more than 120% from the prior week, with Brazil, Peru and Chile among the ten nations with the highest infection rates globally.

- Volkswagen said 2% of returning workers at its Puebla, Mexico, operations have tested positive for COVID-19.

- The Eurozone’s Purchasing Managers Index jumped to 47.5 in June from 31.9 last month, higher than expected but still in contraction territory.

- The European Automobile Manufacturers’ Association called for government support of Europe’s car industry as it projected sales will fall 25% this year to 9.6 million units.

- Electric vehicles are expected to get a boost from the COVID-19 crisis in their competition with traditional vehicles, with countries in Europe and Asia making electric vehicle charging stations part of infrastructure stimulus programs.

- With European stock prices slumping, the U.K. is considering new proposals to block foreign takeovers of British firms, following Germany, Italy and Spain in adding protectionist measures.

Our Operations

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.