COVID-19 Bulletin: June 8

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices were lower in mid-day trading, with the WTI down 2.9% to $38.41/bbl and Brent off 2.9% to $41.07/bbl.

- Twenty-three nations in the OPEC+ coalition agreed to extend the current level of production cuts through July.

- Mexico withdrew from the production-cut coalition.

- Formosa’s Sunshine Project in Louisiana, due to open in 2029, is a nearly $10 billion bet that the growth in plastics will overcome single-use plastics bans long term.

Supply Chain

- Up to 400,000 shipping crew members are stranded on vessels or by border restrictions, threatening a labor shortage and disruption to global trade.

- The trucking industry continued to experience job losses in May, despite a surprising 2.5 million gain in overall U.S. employment.

- 3D printing is helping oil companies overcome COVID-19-related supply chain glitches as companies establish “digital inventor(ies)” of parts that can be made in emergencies.

- Establishing “redundancy by design” can mitigate supply chain risks during times of unforeseen disruption.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

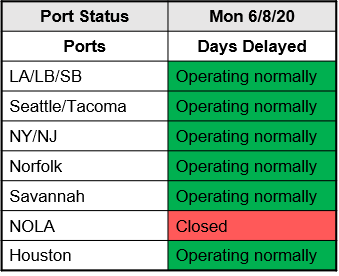

- Tropical Storm Cristobal has closed the Port of NOLA, with an expected reopening tomorrow. Other ports are operating normally:

Markets

- A University of California, Berkeley study estimates that shutdown orders prevented 60 million COVID-19 infections in the U.S.

- New York City, the epicenter of U.S. infections that has suffered nearly one-fifth of the country’s COVID-19 deaths, begins reopening today after 100 days of lockdown.

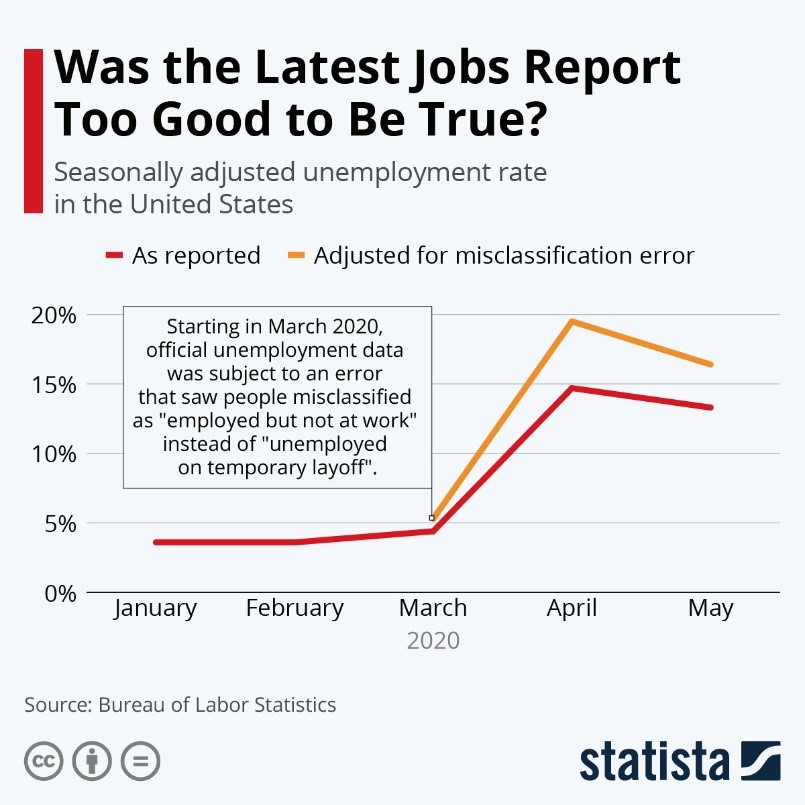

- A misclassification error by the Bureau of Labor Statistics has understated the unemployment level for the past three months. The actual jobless rate in May should have been about three percentage points higher than the 13.3% that was reported last week.

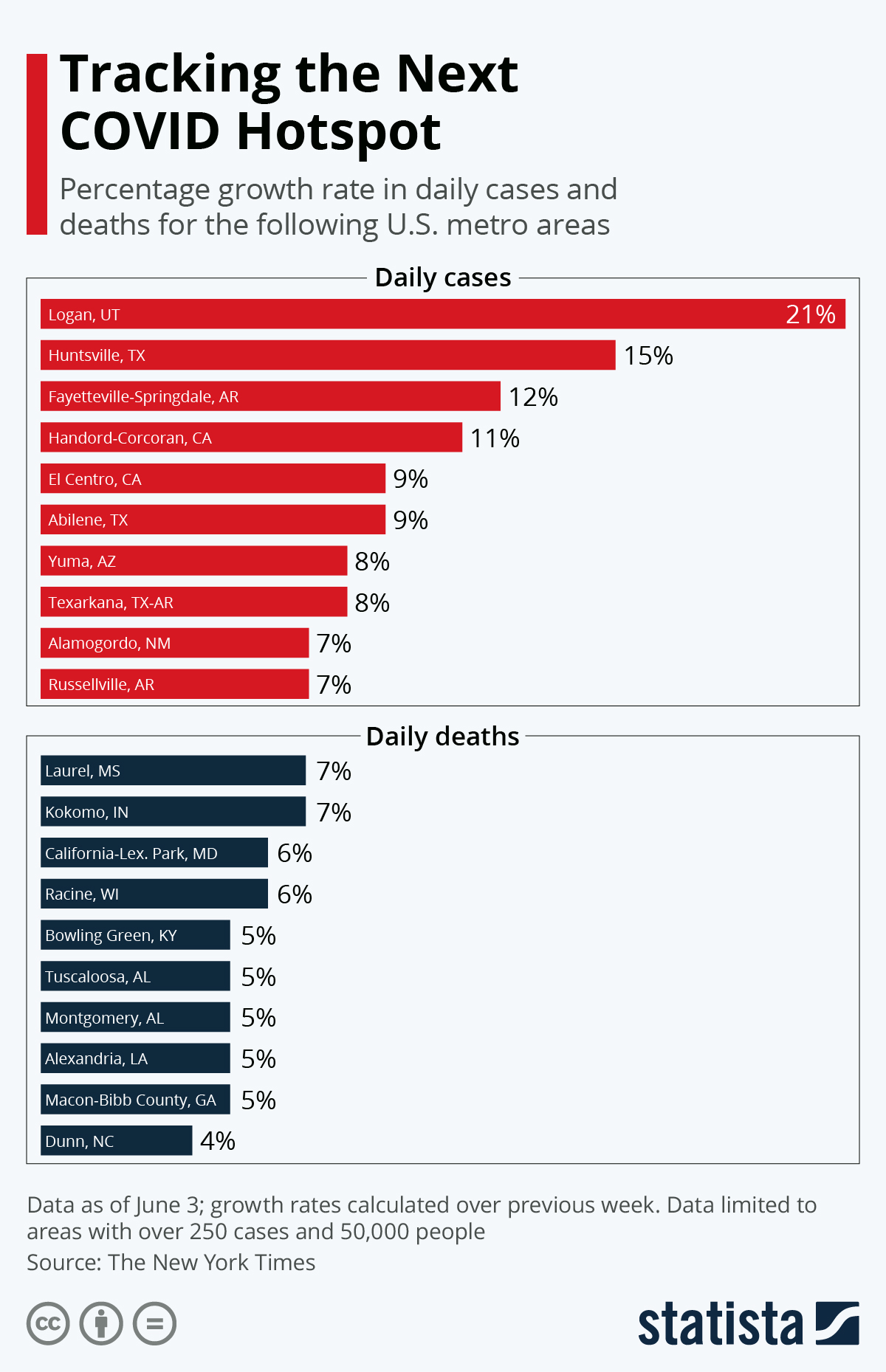

- The national infection rate eased in May from April’s pace, but infections spiked last week in many states that relaxed social distancing early. In addition, there are growing concerns that racial demonstrations could prompt a national spike in coming weeks.

- Many workers returning to their jobs are encountering fewer hours, lower pay and challenging working conditions.

- Companies are wrestling with how to preserve the office culture and collaborative innovation as remote work is extended and, in some cases, made permanent.

- Many companies are offering new perks to stay-at-home workers, including online fitness and mental health classes, fitness center memberships and snack delivery services.

- Sales of new homes jumped 21% in May from the prior year after falling 22% in April.

- Other signs pointing to a pickup in housing markets include increases in inventories and prices of existing homes.

- More than $25 billion in rescue funding will not prevent airlines from idling an estimated 20% of their fleets and significantly downsizing their workforces.

- Automobile sales will total 13.6 million vehicles this year, a 20% decline from 2019 levels, and will likely not recover to pre-pandemic levels for at least five years, according to consultant AlixPartners.

- Tents and plexiglass are in high demand as restaurants expand outdoor dining.

- Wearable technology such as Fitbits, Apple Watches and Oura rings could help detect COVID-19 symptoms and support return-to-work protocols for businesses while assisting in virus tracking.

- The plastics industry has mobilized to promote its critical role in promoting hygiene since the pandemic, causing angst for some environmentalists.

- Global COVID-19 infections surpassed 7 million, global deaths exceeded 400,000, and U.S. deaths topped 110,000.

International

- Canada joined the U.S. in registering unexpected job gains in May, adding nearly 300,000 jobs versus an expected drop of 500,000. The unemployment rate rose to 13.7% from 13.0% as more people returned to the job market.

- New Zealand, which imposed tough measures to combat the pandemic, is experiencing no new infections and will end social-distancing requirements but maintain border controls, requiring anyone entering the country to quarantine for 14 days.

- Brazil’s government faced a public backlash after ceasing the publication of COVID-19 infection and fatality rates and removing data from a government website. The country ranks second behind the U.S. in infections and deaths.

- German industrial output fell 17.9% in April and will be down 7% for the year, with 78% of companies reporting they have postponed or canceled capital projects.

- Car buyers in China, lured by dealer and government incentives, boosted unit sales by 1.9% in May, the first monthly increase in nearly a year.

- Passport origin may determine where and under what conditions people can travel internationally, with many now seeking dual citizenship in countries with low COVID-19 infection rates.

Our Operations

- Our Healthcare team, in collaboration with Plastics News, will host a webinar on materials selection for medical applications on June 11. Click here to register.

- Our Business Development Market Managers are available for videoconferences with clients seeking advice on material selection, manufacturing, regulations and other aspects of specialty markets:

- To schedule a meeting regarding Automotive, contact Market Manager Matt Zessin.

- For Color & Compounding, contact Market Manager Scott Arnold.

- For Electrical & Electronics, contact Market Manager Carlos Aponte.

- For Flexible Packaging, contact Senior Technical Development Engineer Todd Stevens.

- For Healthcare, contact Global Healthcare Manager Josh Blackmore.

- For Rotational Molding, contact Product Manager Pete Nutley.

- For Wire & Cable, contact Director Todd Waddle.

- For 3D Printing, contact Market Manager Haleyanne Freedman.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.