COVID-19 Bulletin: May 28

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices recovered from early dips today, with WTI up 2.7% to $33.71/bbl and Brent up 2.5% to $35.61/bbl in mid-day trading.

- As Russia and Saudi Arabia reaffirmed their agreement to limit production, the American Petroleum Institute reported yesterday that U.S. stockpiles rose last week, sending oil prices lower.

- The International Energy Agency predicts that global investment in oil and gas will fall by 20% this year, and investment in shale will fall by half.

Supply Chain

- Amazon is shifting the 125,000 temporary employees it added to deal with the demand surge from COVID-19 to permanent status.

- We are experiencing some tightening of truck availability due to seasonal activity in the produce market, especially in the Southeast.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

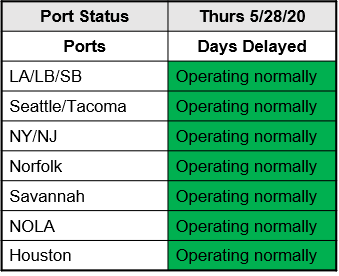

- Port delays we were seeing on the West Coast after the holiday have diminished, and all ports are operating normally:

Markets

- Last week’s first-time unemployment claims of 2.1 million were down for the eighth week in a row but were still 10 times above normal. More than 40 million people have filed for unemployment in the past 10 weeks.

- First-quarter GDP fell a higher than expected 5%, with all the decline attributable to March. The second-quarter contraction is expected to be much higher.

- In its latest Beige Book survey released yesterday, the Federal Reserve reported that the U.S. economy was still in decline in mid-May with businesspeople pessimistic about the pace of recovery. One bright spot: automobile sales were stronger than expected.

- According to a recent survey of 300 corporate decision-makers, two-thirds of executives expect the economy to recover within a year.

- With stock markets rebounding, the disparity between sentiments on Wall Street and Main Street continues to widen. One reason could be the surge in the money supply, which is lifting asset values.

- Tensions between the U.S. and China escalated on a range of differences, sending the Chinese currency near new lows yesterday, threatening the recent Phase 1 trade deal, and creating concerns about economic recovery efforts.

- While U.S. credit markets are robust with financially healthy companies padding their balance sheets, bankruptcies among major corporations (i.e., those with liabilities exceeding $50 million) in May were at the highest level since 2009.

- Merger and acquisition activity, down more than 70% in April, will revive unevenly, with more activity in healthy sectors, such as tech and healthcare, as well as in struggling sectors, such as energy.

- While consumers expect to spend more in coming months, their sentiments about entering retail stores and public venues have deteriorated across all categories, according to a recent survey.

- Contactless payment is moving from a trending convenience to a retailing necessity in the COVID-19 era, growing by an estimated 20% since the pandemic emerged.

- American Airlines will cut its management and administrative staff by 30% as it prepares for “operating a smaller airline for the foreseeable future.”

- Boeing unveiled the first steps in its downsizing program, a 13,000-employee force reduction, part of a previously announced plan to reduce its workforce by 10%. The initial cuts are larger than expected.

- “Zoom fatigue,” a phenomenon experienced with increased videoconferencing, is a real source of stress and exhaustion that can be countered by using smaller screens, distancing from the camera and turning off the self-image window.

International

- As the daily fatality rate from COVID-19 in Latin America hit a new high yesterday, the United Nations warned that 14 million people could go hungry because of the pandemic.

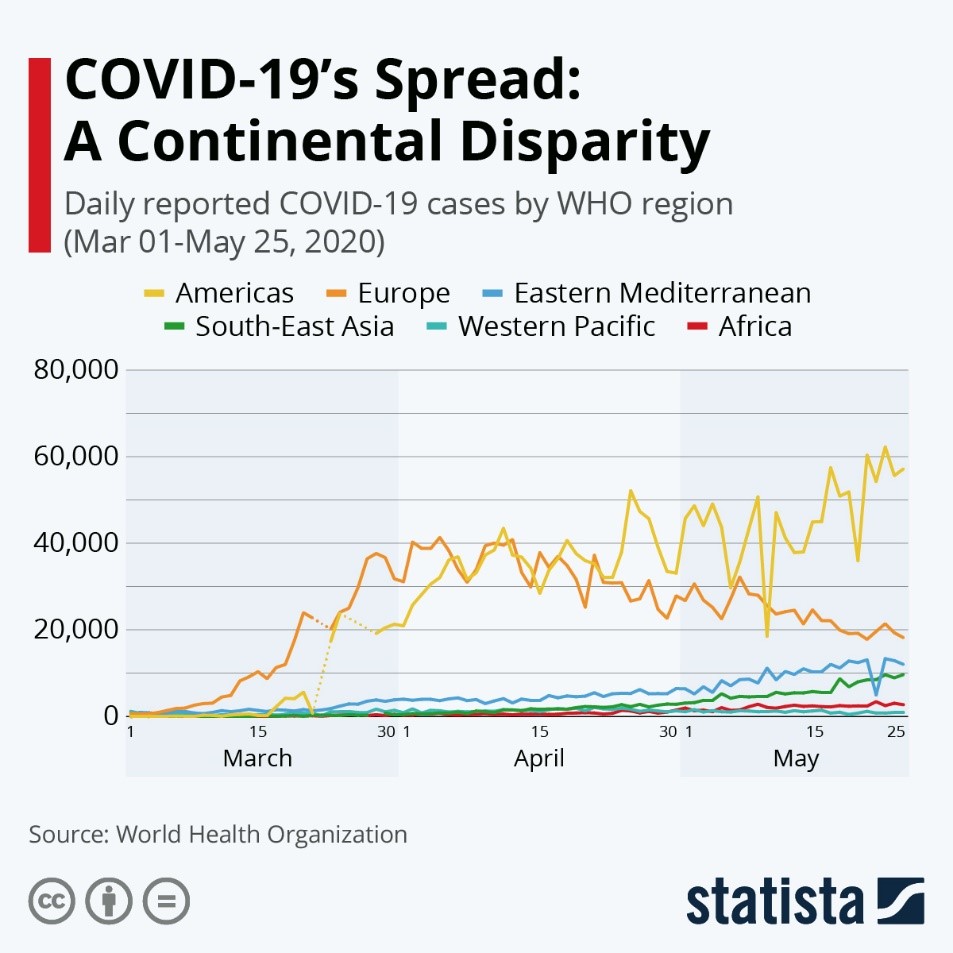

- The Americas have the highest rate of confirmed COVID-19 infections, raising questions about reporting accuracy in some other areas of the world:

- Mexico’s neglected health care system, which has seen more than 11,000 health care workers infected with COVID-19, is contributing to the country’s soaring death rate from the virus.

- South Korea, considered a model for its COVID-19 response, restored some restrictions after experiencing its highest infection rate in nearly two months.

Our Operations

- While we may be working apart these days, we’re all finding unique ways to connect. Plastics News recently shared our very own M. Holland lip dub video, which is an interpretation of this intro from an episode of “The Office.”

- M. Holland’s collaboration with Ford in the manufacture of medical safety equipment is featured in this just-published blog.

- Our Healthcare team is offering videoconferences for clients seeking advice on medical material selection, manufacturing and regulations. To schedule a meeting, contact Healthcare Market Manager Josh Blackmore.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.