COVID-19 Bulletin: May 7

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- After dipping yesterday, global oil prices rose early today on news of increasing Chinese imports, with the WTI up 11% and Brent up more than 5%. But the optimism was short-lived as prices settled back to register small losses, with WTI at $23.56/bbl in mid-day trading and Brent at $29.68/bbl.

Supply Chain

- The Logistics Manager’s Index fell to an all-time low of 51.3 in April after spiking in March. A reading above 50 indicates the industry is still expanding, albeit at a slow pace.

- Lead times from China increased by an average of 20 days since December 19, portending an increase in late shipments, which tend to lag production delays by about 30 days, according to one expert. As Chinese industry returns to normal, similar patterns are expected in the U.S. and Europe as they emerge from lockdowns.

- Stagflation, a combination of stagnant growth and rampant inflation last experienced in the 1970s, could re-emerge when the COVID-19 crisis ends if a surge in pent-up consumer demand collides with emaciated supply chains.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

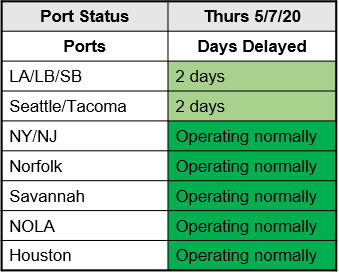

- U.S. ports continue to operate smoothly:

Markets

- There were 3.2 million new unemployment claims last week, a lower number than in recent weeks. Total claims for the past seven weeks stand at more than 33 million, negating all the job gains of the past decade.

- The U.S. Treasury Department said it will borrow an estimated $3 trillion in the second quarter, five times its peak quarterly borrowing rate in the Great Recession.

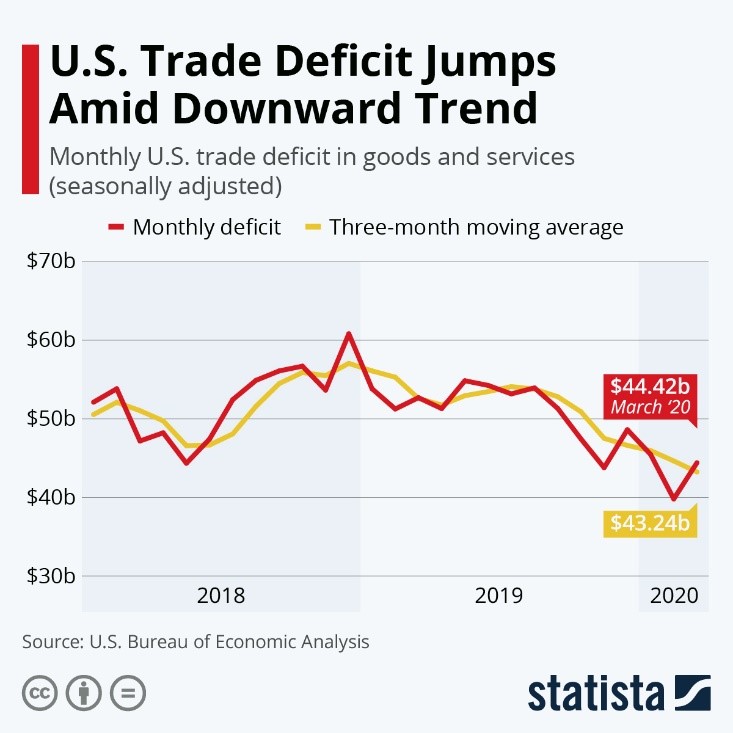

- The U.S. trade deficit broke a downward trend in March, widening 11.6% as a decline in exports far exceeded a decline in imports:

- Neiman Marcus filed for bankruptcy today to become the first major department chain to succumb to COVID-19.

- Consumer bankruptcy filings fell 47% in April from a year earlier, and commercial bankruptcies were down 35% thanks to government rescue efforts, court closures and relaxed forbearance by lenders. Business filings to reorganize under Chapter 11 of the bankruptcy code were up 26%.

- Law firms are gearing up for a surge in bankruptcies in coming months after a decade of declining filings.

- Corporate spending on cloud computing rose an estimated 34% in the first quarter to support remote work, but businesses are deferring long-term digital investments.

- U.S. automobile companies are being forced to delay and defer many initiatives, including new model introductions and investments in electric and self-driving vehicles.

- CVS Health said people are delaying doctor visits and refilling prescriptions, portending a possible surge in non-COVID-19 health issues in coming months.

- COVID-19 is a setback for the gig economy, with car-share services Uber and Lyft and home-share network Airbnb announcing large staff and spending cuts and seeking to adjust their business models to long-term changes in their markets.

- Industry leader Waste Management, Inc., in announcing steady revenues in the first quarter, reported a 25% increase in residential trash collections in April that was offset by a 16% drop in commercial collections.

- More than half of states now reopening their economies still have rising infection rates, failing to meet White House guidelines.

- Most U.S. states are in some stage of reopening their economies.

International

- As Germany relaxes pandemic restrictions, it offers a successful playbook in how to continue industrial production in the COVID-19 era by mandating social distancing and face masks and using widespread testing and contact tracking.

- Some European countries are preparing for a second wave of COVID-19 amid warnings from health experts that many nations and U.S. states are reopening while infection rates are still increasing and without adequate preparation.

- Wealthy nations must join in helping developing countries address COVID-19 or face a boomerang effect of the pandemic, according to a U.N. official.

Our Operations

- Our Healthcare team is offering video conferences for clients seeking advice on medical material selection, manufacturing and regulations. To schedule a meeting, contact Global Healthcare Market Manager Josh Blackmore.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.