COVID-19 Bulletin: November 10

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Energy prices were higher in afternoon trading today, with the WTI up 2.8% at $41.41/bbl, Brent up 3.0% at $43.66/bbl, and natural gas up 3.8% at $2.96/MMBtu.

- Worldwide oil demand will reach more than 105 million bpd within the next decade, up from an expected 90.3 million bpd this year, according to the CEO of Abu Dhabi National Oil Company.

- Toronto-Dominion Bank will start rejecting work on oil and gas projects in the Arctic as part of the company’s goal of reaching net-zero CO2 emissions in its financing by 2050.

- Greenhouse gas emissions from U.S. power plants, manufacturing sites and other large facilities fell 5% from 2018 to 2019, evidence of a decade-long shift toward renewables and cleaner-burning natural gas.

- The United Nations’ climate envoy backed a proposed plan to hold companies accountable to climate goals by subjecting environment strategies to annual shareholder votes.

- Sasol, owner of a coal-to-fuel plant that is the world’s biggest single-site emitter of greenhouse gases, rejected proposed shareholder resolutions concerning setting climate goals.

Supply Chain

- Tropical Storm Eta caused heavy rains, strong winds and potential flooding in south Florida on Monday.

- Despite a pandemic that has cost 87,000 pilots their jobs, the worldwide civil aviation industry will require an estimated 27,000 new pilots by the end of 2021 due to aged-based retirements and attrition.

- Rising e-commerce activity has exacerbated the decade-long shortage of truck drivers, which will grow from a 10,000-driver shortfall in 2011 to an expected 160,000 shortage in the next eight years.

- China’s growing ban on Australian products and commodities is disrupting port activities, causing vessel backlogs and ship reroutings.

- Container shipping in the trans-Pacific market is projected to increase by double-digit percentages in coming weeks, an indicator at the Port of Los Angeles shows.

- Air freight volume, down 8.8% through September, is experiencing a strong rebound, driving prices higher. Recent air freight rates between the U.S. and China are nearly double the year-ago period.

- Two cranes able to accommodate ultra-large container vessels began operation in the Port of Virginia last week, part of the port’s $450 million effort to handle larger ships and increased volumes.

- Virgin Hyperloop completed its first passenger test of a super high-speed levitating pod system that the company hopes will disrupt the human and cargo transportation industry.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. recorded 111,433 new COVID-19 infections yesterday, the fifth highest on record.

- COVID-19 hospitalizations are expected to set a record this week, with rates soaring throughout the Midwest and Texas, where El Paso has more hospitalizations than 29 states and has set up its sixth mobile morgue and requested four more.

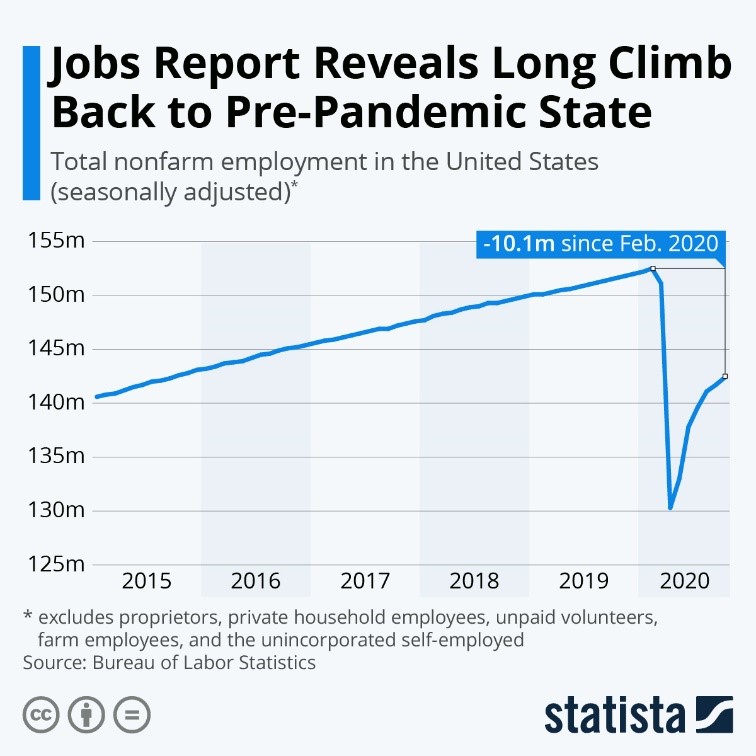

- The pace of U.S. job gains is slowing:

- With the announcement of a 90%-effective vaccine from Pfizer, the company is still several weeks away from getting necessary approvals to distribute vaccines to the public.

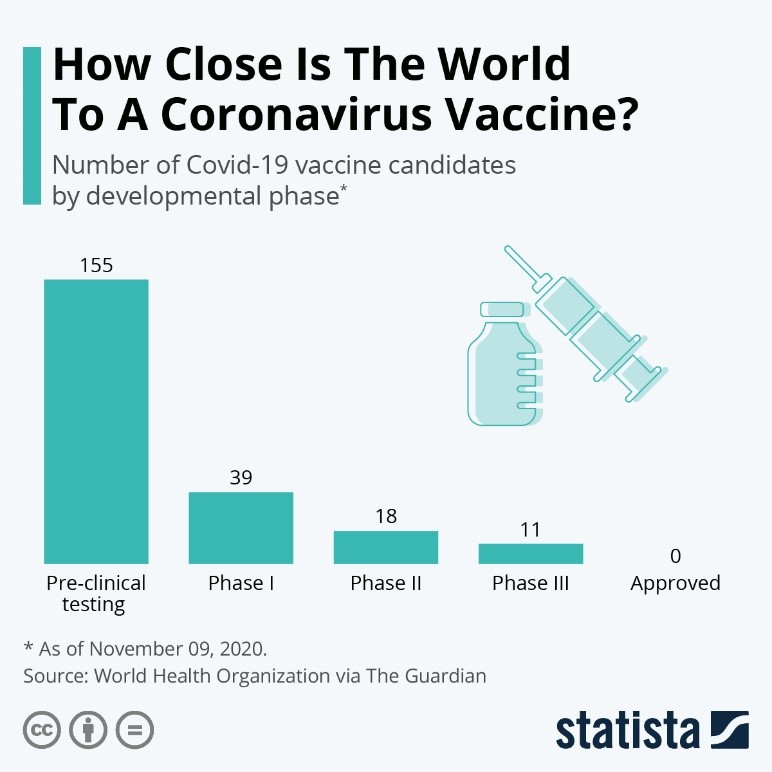

- Pfizer is one of many companies in final testing of experimental vaccines:

- Companies that make tests for COVID-19 instantaneously lost $38 billion of market value following promising news about the Pfizer vaccine.

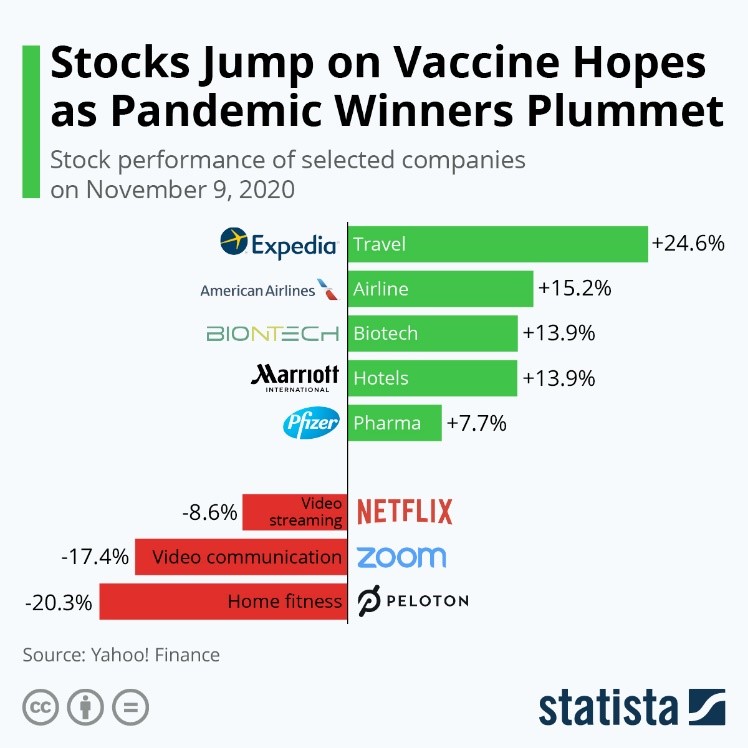

- Stocks of Zoom (down 17.4%), Teledoc (down 13.7%), Shopify (down 13.6%) and other beneficiaries of pandemic lockdowns sank on news of a possible imminent vaccine, while pandemic laggards rose sharply:

- After receiving “fast-track” approval from the FDA, Novavax will begin a late-stage study of an experimental vaccine in the U.S. later this month.

- The FDA approved Eli Lilly’s antibody treatment for COVID-19 for use by people who have just been infected and are at risk of developing severe symptoms.

- Some 20% of COVID-19 victims later suffer new symptoms of mental illness.

- With the weekly average of new COVID-19 cases exceeding 100,000, consumers are beginning to clear shelves at grocery and other convenience stores again, stockpiling essential items.

- Rising home prices and a continuing economic rebound have prompted JPMorgan Chase to relax requirements for home mortgages.

- Ford will invest $100 million in a Kansas City, Missouri, assembly plant to build an electric version of its cargo transit van and will increase production of its electric F-150 pickup truck.

- General Motors announced a plan to hire 3,000 engineers, designers and IT employees to help develop its electric vehicle platform.

- Nissan is pouring resources into a “complete, end-to-end” digital experience to sell cars, a byproduct of consumers’ reluctance to enter showrooms.

- Southwest Airlines announced its first layoffs in 49 years, a late victim of the pandemic pressure that has forced many other airlines to take similar measures.

- Standard Chartered bank has ambitious plans for its post-pandemic workplace, including a hub-and-spoke design and “near home” office renting for more than half of its 85,000 employees, but the logistics are proving challenging.

- Freshman college attendance fell nearly 16% in 2020, leaving challenges and questions for many of the nation’s students who have dropped out or taken a gap year due to COVID-19.

- Companies are taking an increasing direct role in college education, providing funding and training opportunities that boost school resources in an era of declining enrollment.

- Holiday ad campaigns are revealing a marked shift in strategy, incorporating realities of the pandemic into messages of optimism and remembrance.

- Hershey has gained presence in the candy market after capitalizing on pandemic trends, such as pinpointing localities where people were under lockdown and producing more chocolate for s’mores.

- Companies are introducing creative solutions to counter work-from-home burnout, including surprise days off, shortened workweeks and mental health counseling.

International

- Worldwide COVID-19 cases are approaching 51 million.

- While not new, the coronavirus mutation discovered in Denmark’s mink population could pose problems for a potential vaccine. Israel announced a plan to test travelers arriving from Denmark for the mutated strain.

- The U.S. and Europe are poised to be the first recipients of the reportedly effective COVID-19 vaccine developed by Pfizer, as the company mulls ways to distribute its currently small stock to other countries in need.

- Peru’s legislature ousted its president over his handling of the nation’s COVID-19 response and alleged corruption, throwing the country into political chaos. Peru ranks fourth in South America for total COVID-19 infections with more than 900,000.

- Brazil stopped testing an experimental Chinese vaccine after a test subject suffered a “severe adverse event.”

- Children in Latin America are falling behind in educational post markers due to setbacks related to COVID-19, having lost four times as many days of schooling as children from the rest of the world.

- In a bid to decrease the potential for spreading infections, China will begin disinfecting all overseas shipments of cold-chain products.

- The unemployment rate in France jumped to 9.0% in the third quarter from 7.1% in the second quarter, the biggest quarterly spike since 1975, as the latest COVID-19 wave shut down parts of the economy.

- A gauge of investor confidence in Germany fell in November to its lowest level since April.

- The European Union will begin imposing $4 billion in tariffs on U.S. goods starting today, an escalation of a dispute over government subsidies given to aircraft-makers Boeing and Airbus.

- Airbus’s A220 jetliner program received its largest setback after Air Canada canceled orders for 12 aircraft.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.