COVID-19 Bulletin: November 16

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices were higher in mid-day trading today, with the WTI up 3.1% at $41.37/bbl and Brent up 2.8% at $43.99/bbl. Natural gas was 8.1% lower at $2.75/MMBtu.

- Oklahoma City-based Gulfport Energy filed for Chapter 11 bankruptcy after being hit especially hard by the collapse in oil demand after a series of acquisitions.

- The International Energy Agency lowered its forecast for crude demand in the coming months, citing rebounding Libyan supply and a return to normal production for Gulf Coast producers slowed by a series of hurricanes in October.

- The price for acreage in the Permian Basin has declined by two-thirds since 2018, exacerbated by the pandemic.

- Increased prices and a lack of supply of glass for solar panels are challenging China’s plans to accelerate a shift to clean power.

- Sasol announced that it has completed its $12.8 billion petrochemicals project near Lake Charles, Louisiana.

- Mexico’s state-owned oil company PEMEX said it will cancel its ethane supply agreement with Braskem-Idesa.

Supply Chain

- Iota, the 30th named storm of the season, strengthened to a Category 5 hurricane this morning as it headed for Central America.

- Titus MRF Services is shuttering its 1,200-ton-per-year secondary materials recovery facility in Los Angeles because of low commodity prices and reduced volumes from Material Recovery Facilities (MRFs) that have been impacted by the pandemic.

- Walmart is expecting 30% of its holiday volume to be shipped from 42 new “pop-up” locations, which section off portions of existing distribution centers for individual, e-commerce SKU fulfillment.

- Walmart in recent weeks has announced the divestment of retail operations in Argentina, Brazil, Japan and the U.K. as it shifts to a focus on e-commerce.

- DHL announced plans to increase its parcel rates across the board, breaking with an earlier strategy of relying on surcharges. The company also said airfreight rates will remain high with a surge in e-commerce and strains on capacity.

- For the first time in 15 years, insurance premiums have emerged as a top-10 cost for trucking companies, a result of higher volumes of vehicles on the road and increased insurance costs on newer vehicle models.

- American agricultural exporters report getting locked out of foreign markets, as a surge in demand for Chinese goods creates a shortage of available containers.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help assure delivery dates.

- M. Holland published its view of how COVID-19 has disrupted the already complicated logistics network of plastics distribution. Click here to read our view on the future of logistics.

Markets

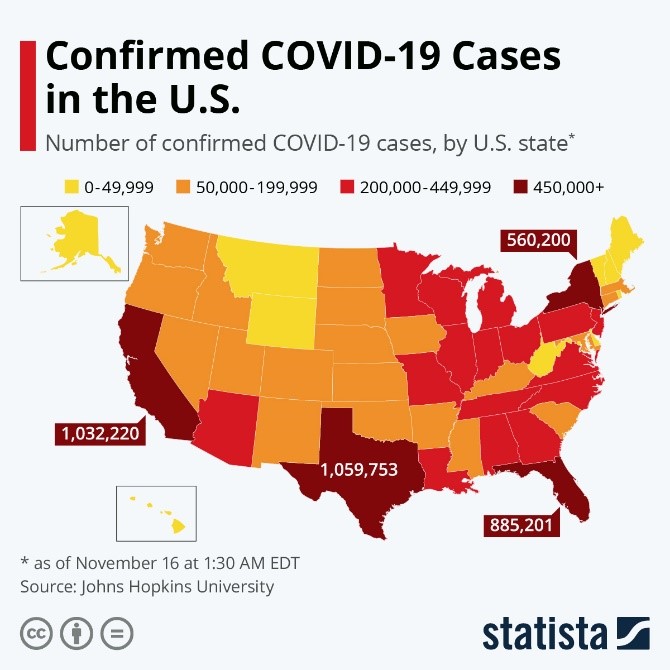

- The U.S. surpassed 11 million cases of COVID-19 over the weekend, with a rolling seven-day average of more than 144,000 cases per day.

- The country hit an all-time high for daily cases on Friday, reporting 177,224, a 10% increase from the day before. More than 1 million new cases were recorded in just six days.

- Hospitalizations in the U.S. also set a record over the weekend of 69,455, of which 13,341 are ICU admissions.

- More than 2,200 fatalities were reported in the U.S. on Friday, a record number, in large part driven by the Midwest and select hotspots including El Paso.

- Data shows an increase of 300,000 U.S. deaths in 2020 compared to a normal year, suggesting that the pandemic could have caused more fatalities than official numbers suggest.

- Improved treatment has dropped the COVID-19 fatality rate by nearly a third since April, a new report says.

- Illinois became the state recordholder for new infections in a 24-hour period, reporting 15,415 on Friday.

- Michigan’s governor imposed a partial three-week shutdown on Sunday, including closing in-person dining, limiting gatherings and requiring online learning for high schools.

- Oregon and New Mexico issued partial lockdowns in the face of spiking COVID-19 infections.

- New Jersey reported record high daily infections of 4,395 on Saturday.

- California is experiencing the fastest growth rate in new cases, with a 47.1% increase in the seven-day case count since the beginning of November.

- Florida reported its highest daily case number since the middle of summer.

- The state of Washington imposed new curbs, including a ban on indoor dining and limits on grocer capacities.

- The governor of Puerto Rico has activated the National Guard to help enforce restrictions aimed at containing spread of the coronavirus, including curfews, beach closures and capacity limits at restaurants, casinos, gyms and churches. The U.S. territory has recorded more than 75,000 cases along with almost 1,000 fatalities since the start of the pandemic.

- With virus cases rising in 49 states last week, hospitals are poised to start taking unorthodox measures to accommodate patients, including using hallways or improvised spaces for ICUs and making triage decisions about who can be saved.

- Moderna reported that its experimental COVID-19 vaccine was 94.5% effective in recent trials.

- Johnson & Johnson received a further $1 billion in aid to develop its Janssen COVID-19 vaccine, and is set to begin final stage trials of the vaccine in Britain.

- COVID-19 is upending the traditional assumption that people hit hardest by the disease are the most likely to have long-lasting symptoms. In many cases, virus patients with mild initial symptoms have a chance of becoming “long-haulers.”

- An estimated 16,000 medical practices have permanently closed this year as the difficulties of practicing during the pandemic prompt doctors to retire early or change career direction.

- Fannie Mae and Freddie Mac are extending by one month several measures created during the pandemic to make it easier to receive mortgage loans, the organizations said Saturday.

- The pandemic is changing the way grocers, food makers and consumers approach Thanksgiving this year, where hefty side dishes could make up for smaller turkeys, and gatherings could be limited to just a few people.

- American consumers are flush with cash, helped by stimulus money, low interest rates and lower spending during the pandemic.

- Two Congressional programs to help citizens manage the financial impacts of the pandemic are set to end January 1, potentially leaving many of the unemployed unable to pay mortgage or auto loans.

- An array of gadgets, webcams and apps can bolster the quality and ease-of-use of video calling, an increasingly critical factor for professionals and businesses.

- The U.S. birth rate is expected to fall by up to 500,000 next year due to the pandemic and economic uncertainties, casting a cloud on makers of baby products.

- Homebuilders are beginning to design more houses with multigenerational living in mind, a worrying trend for senior housing and nursing homes but a boon for backyard housing and mass builders.

- Tyson Foods is emblematic of the extent to which some companies are going to protect employees from widespread outbreaks at manufacturing plants and other facilities, using advancing virus tracking algorithms along with redesigning with a social distancing focus.

- Coca-Cola is ending its agreement to receive PET plastic from Loop Industries’ yet unfinished joint-venture facility in South Carolina. Loop retains agreements to sell PET to PepsiCo and cosmetics maker L’Oreal.

International

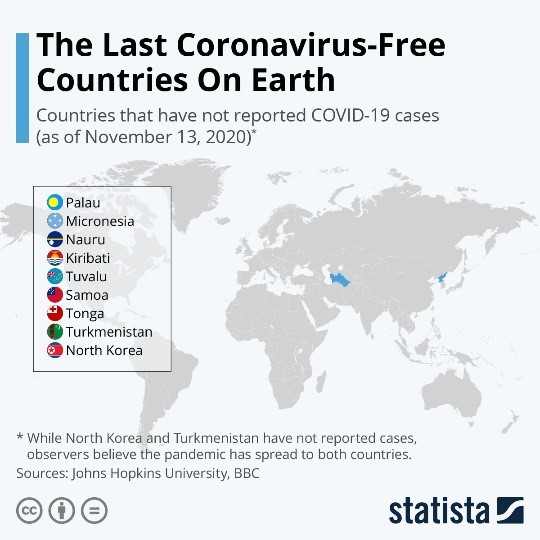

- Only nine nations have reported no COVID-19 infections:

- Mexico became the 11th nation with more than 1 million cases of COVID-19.

- Austria is imposing a nationwide lockdown in response to rising COVID-19 cases. The country is finalizing plans to test its entire population for COVID-19 before the holidays.

- Partial lockdown measures in Germany will likely last for many more months, a German minster said.

- Russia reported record daily infections over the weekend as the country’s capital faced new restrictions, including overnight bans on restaurants and bars.

- Shutdowns in Istanbul will likely be imposed soon, as the capital city accounts for more than 50% of virus cases in all of Turkey.

- The World Health Organization has raised $2 billion to buy and distribute COVID-19 shots to poorer countries.

- The British economy is set to be the weakest performer among European peers, as the country faces trade hurdles in its impending break with the European Union. The U.K. prime minister is in isolation after contacting someone infected with COVID-19, hampering his ability to deal with the nation’s multiple crises.

- Fifteen Asia Pacific nations, including China, Japan and South Korea, signed the world’s largest new free-trade agreement. The Regional Comprehensive Economic Partnership includes almost a third of the world’s population and GDP.

- Asian economies are poised to become the fastest to recover from the pandemic, aided by increased demand from Western consumers along with successful measures to contain the virus’ spread.

- Industrial output in China rose a higher-than-expected 6.9% in October.

- Japan emerged from recession, reporting that GDP grew 5% in the third quarter.

- GDP in Israel jumped a better-than-expected 37.9% in the third quarter after suffering a historic drop in the second quarter.

- Peru’s new president resigned after just six days amid demonstrations and threats of violence. His predecessor was impeached in part for his response to the pandemic.

Our Operations

- Craig Shell from our Wire & Cable team delivered a product presentation on cable tapes and gels at the recent the IWCS International Cable & Connectivity Symposium. Click here to access this talk.

- Greg Watkins, senior manager of talent acquisition and development at M. Holland, spoke at the recent MAPP Benchmarking and Best Practices Conference on recruiting the next generation of talent in a post-pandemic world. Click here to view this presentation.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.