COVID-19 Bulletin: November 2

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Rising oil production clashed with pandemic-suppressed demand, sending the WTI crude price below $35/bbl in early trading today.

- Crude prices recovered some in mid-day trading, with the WTI up 1.8% at $35.45/bbl and Brent up 1.8% at $38.63/bbl. Natural gas was 2.9% lower at $3.26/MMBtu.

- Despite weak oil and gas demand, the Baker Hughes count of active rigs in the U.S. rose by 10 last week to 221.

- Exxon announced a third consecutive quarterly loss on Friday, a further example of the hits oil companies are taking from a 40% decline in benchmark crude from the start of the year. The company is assessing whether to take an impairment charge on $30 billion in natural gas assets in the U.S.

- The U.S. is largely absent from the investment push toward hydrogen as a major renewable energy source.

- The Kurdistan region of Iraq halted oil exports on Friday, two days after an attack on a crude oil pipeline that caused disruptions.

- IAG SA, parent to British Airways, lost $1.9 billion on fuel hedging in the third quarter, prompting an internal review of its hedging policies.

Supply Chain

- Typhoon Goni, the strongest typhoon of 2020, hit the Philippines on Sunday. More than a million people were evacuated from the south of the country’s main island.

- Rain-heavy tropical storm Eta is expected to strengthen into a hurricane today before it targets Nicaragua and Central America. The storm ties the record for the most named storms in an Atlantic hurricane season.

- A magnitude-7.0 earthquake struck off the coast of Greece and Turkey Saturday, flooding coastal areas and flattening some residential buildings.

- More than 100 UPS pilots have contracted COVID-19, a risk to the company’s performance during peak season.

- The warehousing market has rebounded to pre-pandemic levels of utilization, according to a report from real estate firm Prologis.

- Walmart is foraying into the fulfillment center business by turning four of its stores into “laboratories” that blend the digital side of the business with the brick-and-mortar operations.

- Freightliner Werner Enterprises saw a strong rebound in demand in the third quarter, with profits up but revenues down 5% due to fleet capacity constraints and driver shortages, while USA Truck reported a return to profitability after suffering a loss in the year-ago period.

- The spot freight market showed signs of leveling off from recent highs last week with load volumes down for the fourth consecutive week.

- Some drone delivery startups are vying for a role in the complicated distribution of an eventual COVID-19 vaccine.

- A commodity trader and an engineering company are teaming up to install large wing sails on the decks of some bulk carriers, which could reduce a ship’s CO2 emissions by 30%.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- New COVID-19 cases in the U.S. hit 81,493 yesterday, a high for a Sunday and fifth highest daily total, after setting a single-day record for any country on Saturday of 99,321.

- New COVID-19 cases in the U.S. last week rose 25.4% from the prior week with rates in 49 states and territories trending upward, three holding steady and three declining. Thirty-one states set daily infection records during October.

- South Dakota has suffered five straight days of more than 1,000 infections per day.

- New York revised its rules for visitors, now requiring most arriving travelers to get COVID-19 tests before entering the state and again after a three-day quarantine. The new protocol replaces a 14-day quarantine requirement.

- Men comprise about two-thirds of COVID-19 fatalities, possibly due to weaker immune systems and higher rates of pre-existing conditions.

- More than 150 vaccines are currently being developed around the world with unprecedented support from governments and organizations. In the past, the fastest-ever vaccine development took four years.

- A study in Houston suggests that COVID-19 may be mutating to become more contagious.

- U.S. consumer spending increased for the fifth straight month in September, rising by 1.4%. The gain, while positive, is still far less than the increases of late spring.

- Consumer sentiment edged higher in October but remains well below pre-pandemic levels.

- The Federal Reserve reduced the minimum amount of small- and mid-sized business loans it will back through its Main Street Lending Program from $250,000 to $100,000. The change is to encourage more use of the $600 billion in funds available through the program, of which businesses have only borrowed about $3.7 billion.

- The former president of the New York Federal Reserve warned that the central bank may be running out of methods to prop up the economic recovery, with interest rates still at historic lows and other options unavailable.

- The disproportionate dropout rate of women from the labor force during the pandemic has set back female participation in the workforce by three years and threatens the economic recovery.

- In an attempt to boost the number of passengers by ensuring their safety, United Airlines is offering free COVID-19 testing at Newark airport for flights to London.

- Airlines are resorting to buy-one-get-one-free strategies to entice reluctant flyers.

- The CDC lifted its sailing ban on U.S. cruise ships, announcing new guidelines aimed to get the industry running while preserving passenger safety.

- Inspire Brands will acquire Dunkin’ Donuts in the second-largest restaurant industry deal ever.

- Friendly’s Restaurants, an iconic brand in the eastern U.S., became the latest chain to file for bankruptcy.

- Volkswagen reported higher-than-expected profits in the third quarter but warned that virus resurgences and new lockdowns threaten the automakers’ rebound.

- Toyota reported an 11.7% increase in global production last week, propelled by high demand in China.

- The stock of electric car maker Fisker, which went public Friday in a reverse merger, rose 17% in its first day of trading.

- Kraft Heinz expects sales to continue to rise into next year as more people cook at home.

- Coca-Cola is cutting 200 product lines, half of its brands.

- Online beer sales are skyrocketing — Molson Coors Beverage reported online sales of its Miller Lite brand doubled since January, while Anheuser-Busch InBev is expanding its global online platforms.

- Online retailer Etsy reported that year-over-year sales doubled in the third quarter, largely due to the sale of 24 million masks on the site.

- Handbag sales are up during the pandemic as women shift to larger bags to carry bottles of sanitizer and wipes.

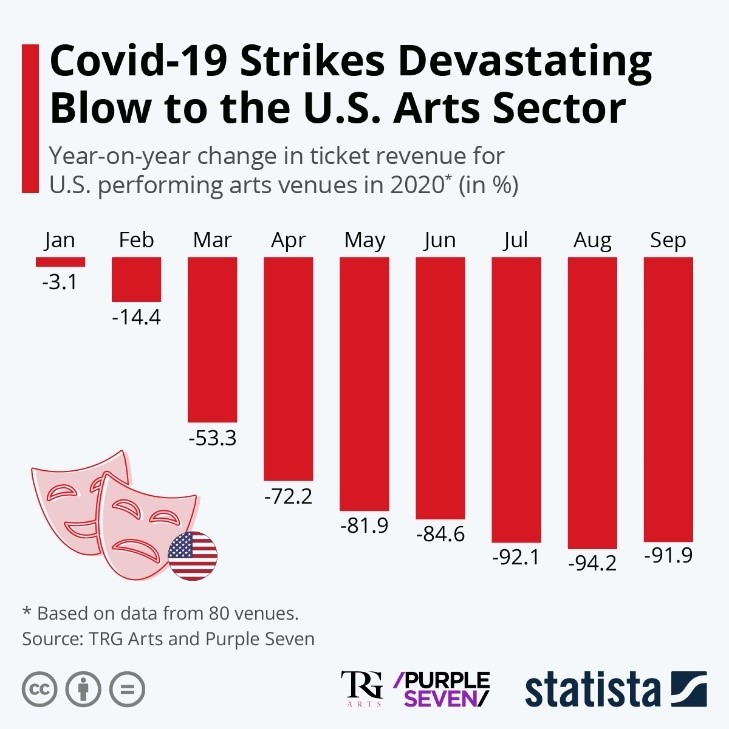

- The pandemic has virtually shut down the performing arts industry:

International

- Global COVID-19 fatalities passed 1.2 million today.

- Colombia joined Brazil and Argentina as Latin American countries with more than 1 million COVID-19 infections.

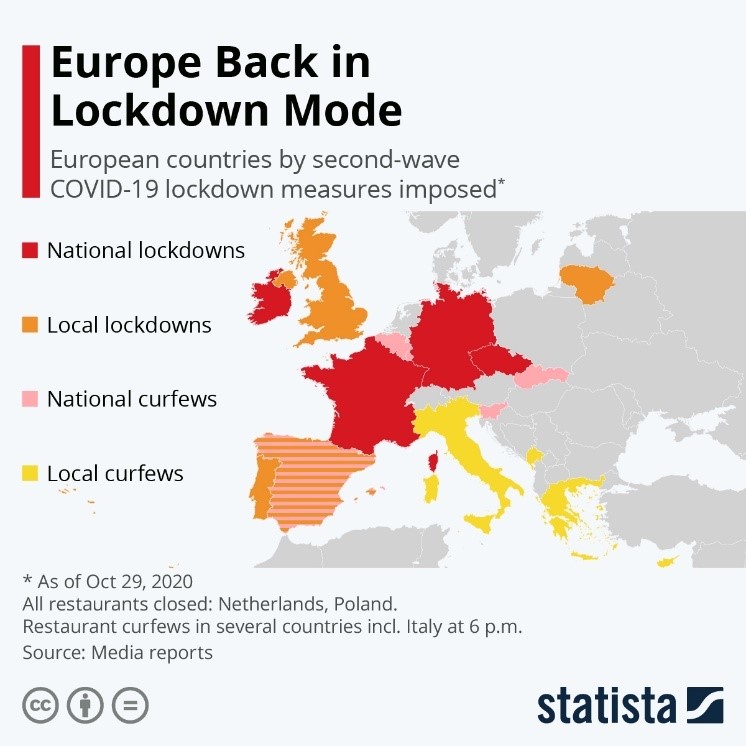

- A growing number of European countries are resuming lockdowns in the face of rising COVID-19 infection rates:

- Britain’s prime minister imposed a second, one-month national lockdown on Saturday, as advisers warned that the country’s hospitals could become overwhelmed in the coming weeks. A top minister in the government suggested the lockdown could extend past December.

- Austria imposed new lockdown measures after a surge in COVID-19 cases in recent weeks.

- Belgium imposed a partial lockdown along with a remote work mandate and travel and shopping restrictions.

- Geneva, Switzerland, imposed a partial lockdown to last until the end of the month, including the shutdown of non-essential businesses and restrictions on gatherings.

- Jakarta, Indonesia, is running out of burial space due to the high COVID-19 death rate.

- Australia reported no new cases of COVID-19 in a 24-hour span for the first time since June.

- China is responding to its worst COVID-19 outbreak since June-July in its far western Xinjiang region, where aggressive testing has revealed hundreds of asymptomatic infections.

- Many of the new infections in Europe’s recent surge of COVID-19 cases come from a new variant of coronavirus originating in Spain, according to researchers.

- Germany could start giving its citizens a vaccine before the end of the year and already has the structure in place to distribute the vaccine within hours of approval.

- The chief of the World Health Organization is quarantining after exposure to someone who tested positive for COVID-19.

- The annual Wire and Tube show scheduled for December in Dusseldorf was canceled due to rising COVID-19 rates.

- The Eurozone economy performed better than expected in the third quarter, with GDP rising by 12.7% from the second quarter. However, recently announced lockdowns in many countries threaten the recovery through the winter.

- New purchasing manager index (PMI) data shows a growing divergence between recovering manufacturing sectors and moribund service sectors across the globe.

- China’s PMI rose for the sixth straight month in October to its highest reading since 2011 on strong domestic demand and increased exports.

- Germany’s PMI for the manufacturing sector rose to its highest level since early 2018 in October, but expectations for manufacturing, a leading indicator, fell for the first time in seven months.

- India’s manufacturing sector rose in October at the fastest pace in a decade.

- Mexico’s third-quarter GDP increased from the second quarter but remains 8.6% below that of the same time last year.

- The U.K.’s new lockdown restrictions bar non-business travel from the country through December 2, creating a fresh crisis for the aviation industry.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.