COVID-19 Bulletin: October 23

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Energy prices were lower in mid-day trading today, with the WTI down 1.8% at $39.91/bbl and Brent down 1.5% at $41.79/bbl. Natural gas was down 1.2% at $2.97/MMBtu.

- While official moves have not yet been announced, Russia’s president indicated his support of halting OPEC’s planned production hikes at the start of the new year.

- China’s national offshore oil and gas producer CNOOC reported a 27% drop in third quarter revenues from a year ago. The company plans for natural gas to make up half of total output by 2035.

- Western Canada oil production has rebounded faster than the rest of the world, with more than 700,000 bpd brought back online after a 1 million bpd cut in the spring. The U.S., in comparison, is averaging about 9.9 million bpd, down from a high of 13.1 million bpd in mid-March. The rebound is aided by Canada’s federal government, which announced a $100 million contribution to assist oil and gas commercialization and sustainability.

- The accelerating pace of consolidations in the U.S. oil industry is creating anxiety in Houston, the nation’s energy capital, which already has seen 17,500 lost oil and gas drilling jobs in the past two years.

- ExxonMobil told employees it must reduce its workforce after initially rejecting staff cuts early in the pandemic.

- Europe’s largest gas pipeline is positioning itself to be front and center of the hydrogen market, investing $39 million in a British producer of electrolyzer technology.

- With several states and local governments legally mandating a transition to renewable or carbon-free electricity, some industry leaders are saying the U.S.’s “peak oil” has been reached.

- Natural gas, long forecast for multi-generational growth, may be headed for “peak gas” sooner than expected as states and utilities accelerate moves to alternative energy.

- Formosa is suspending construction on its $9.4 billion petrochemicals project in St. James Parish, Louisiana, until there is a vaccine for COVID-19 and infection rates subside.

- The market for biodegradable plastic is forecast to grow to $6 billion by 2023, a response to increasing environmental concern from industry and consumers.

Supply Chain

- Hurricane Epsilon, which wobbled eastward and missed Bermuda yesterday, is expected to cause dangerous surf conditions along the Atlantic coast of the U.S. and Canada.

- Colorado’s East Troublesome Fire expanded by 100,000 acres in just one day, a result of droughts and record heat at a time of year when snow is usually falling in the region.

- As spot rates in the trucking market remain high, railroad company CSX is courting shippers to switch to intermodal, having already raised intermodal volume by 7% year over year in the third quarter.

- Partly due to a rise in e-commerce fulfillment, warehouse rental prices are expected to continue increasing with more leases being signed, according to data from real estate firm Prologis.

- Toyota’s Hino Motors is teaming up with electric vehicle maker BYD to provide commercial electric trucks and buses to the Asian market by the first half of the decade.

- High demand and supply chain constraints continue to plague the appliance market, with refrigerators in shortest supply. Appliance shortages are taxing the appliance repair industry.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

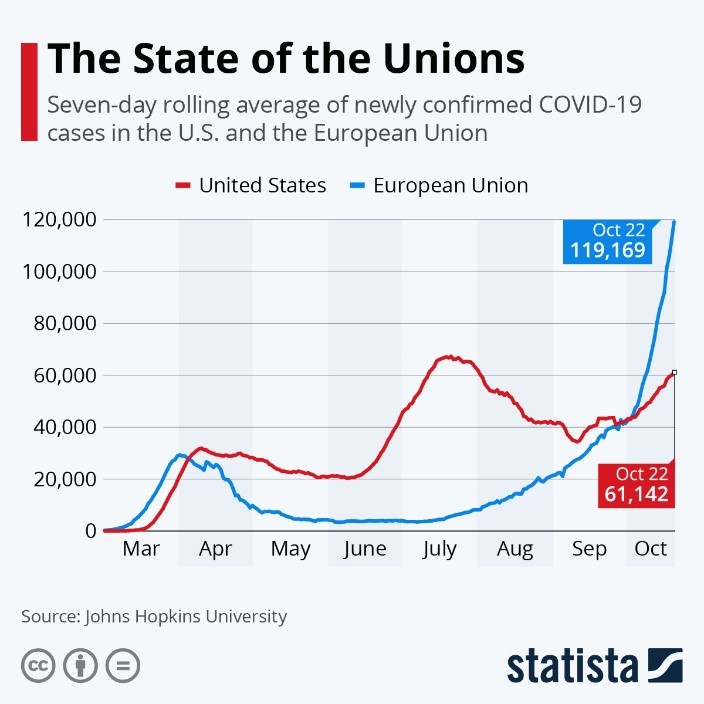

- COVID-19 infections in the U.S. soared to 71,671 yesterday, the highest since July 24 and third highest daily infection rate on record.

- Thirty-seven states have rising COVID-19 infection trends this week.

- Illinois, Ohio and North Dakota have hit daily COVID-19 records in the past two days, as the seven-day average of U.S. deaths hit the highest in a month.

- Amid a second surge of COVID-19 in Chicago, officials are urging residents to stay home and have placed a 10 p.m. to 6 a.m. curfew on all non-essential businesses for two weeks.

- Los Angeles County recorded some 2,000 new COVID-19 cases yesterday, the highest level in two months and twice recent daily averages, despite a decline in testing. Hospitalizations and deaths also are on the rise.

- Gilead Sciences’ remdesivir became the first anti-viral therapy to win approval by the FDA for treatment of COVID-19. It previously has been used under an emergency use authorization.

- Moderna enrolled 30,000 patients in the final stage of its vaccine trial, with results expected as early as November.

- As negotiations between the Speaker of the House and Treasury Secretary dragged on yesterday, growing opposition in the Senate lowered hopes for a new stimulus bill before the November election.

- Previously owned home sales in the U.S. rose 9.4% to their highest level in 14 years in September, a result of continued low mortgage rates and a desire for larger personal space.

- A report from the Bipartisan Policy Center says Social Security funds are likely to be depleted by 2030, five years earlier than expected.

- A new study finds that 4 in 10 women are considering leaving the workforce because of increased family and parenting responsibilities during the pandemic.

- The pandemic and associated layoffs in the airline industry have stalled progress for women as commercial pilots, where they comprise barely 5% of cockpit crews.

- Southwest Airlines reported a quarterly loss in the third quarter on a 68% drop in revenue and predicted the airline industry will “remain fragile” until vaccines for COVID-19 are widely available. The company is ending its practice of leaving center seats open.

- Delta Air Lines is the only major American carrier still blocking center seats on flights as a safety precaution against COVID-19.

- Toyota said it operated in September at 93.7% of production capacity, almost as high as the year-ago period.

- Merchants are increasingly using “unattended retail,” which often provides a faster, lower-cost and contactless method for consumer purchases. Examples include soda fountains that consumers control through an app, and smart vending machines that sanitize themselves, refill bottles of common household liquids, or distribute products to multiple people at once.

- Target is introducing online reservations to shoppers, allowing them to avoid holiday crowds.

- Shopping malls, garages and other retailers are capitalizing on the outdoor space provided by parking lots to attract vendors, businesses and events.

- Online consumers spent 52% more between March and September compared to the same time last year, boosting investment into highly valued e-commerce marketers.

- Amid the surge in online purchasing, Gap is hiring 1,400 new workers at a New York distribution center to prepare for the holiday season. The company has pledged a return to profitable growth with the shuttering of 350 stores by 2024.

- Legislation in Seattle considers classifying Amazon’s high-speed e-commerce warehouses as more costly than the meatpacking or logging industries for workplace injury claims.

- After strong sales in the first half of the year, chipmaker Intel’s revenues dropped 4% in the third quarter as consumers flock to cheaper laptops.

- Several electric vehicle startups went from small staffs and no revenues to multi-billion-dollar valuations in mere months in 2020, as investors seek to find the next titans of the electric car industry.

- Burger King will start offering reusable containers for sandwiches and drinks next year.

- Ocean Spray packaging will be 100% recyclable, reusable, compostable or biodegradable by 2025, the company said Thursday. The plan includes a partnership with a waste management firm to recycle packaging into new products for retailers, such as benches and picnic tables.

International

- Europe’s per-capita infection rate surpassed that of the U.S. yesterday, with 235 cases per 1 million people vs. 181 per 1 million people in the U.S.

- France reported a single-day record of more than 40,000 COVID-19 cases on Thursday. A nighttime curfew will take effect at midnight today. The country also joined a list of six others with more than 1 million total cases.

- Greece reported a record number of COVID-19 cases Thursday, prompting officials to implement a mask mandate and new nighttime curfews in several cities, including Athens.

- Slovakia is shutting down schools for a month and requiring the population to stay home except for work, essential shopping and trips to nature. The country will also provide nationwide free testing to its 5.5 million residents.

- For fear of a nationwide health system collapse, the Czech Republic is again imposing strict lockdowns and mask mandates as the country’s per-capita infection rates are among the world’s highest.

- Poland reported a record 12,107 new COVID-19 cases Thursday, with officials imposing new restrictions.

- Denmark reported a record 760 new COVID-19 cases, bringing the country’s total infection count to 37,763.

- New COVID-19 cases in India, which has seen falling infections in recent weeks, spiked today to 54,366.

- Under growing public pressure, Australia is raising the number of citizens it will allow to return from abroad under its strict quarantine program for those reentering the country.

- The Purchasing Managers’ Index (PMI) for the Euro zone slipped to 49.4 this month, a four-month low and below the threshold of 50 indicating growth, suggesting the economy is contracting again as COVID-19 cases rise.

- Germany’s PMI slipped to 54.5 in September with manufacturing activity continuing to rise and service activity backsliding.

- The U.K.’s PMI fell to 52.9 in October, a four-month low. Retail sales in the quarter ended September 30 were 4.7% higher than the prior-year period after rising for four consecutive months.

- France’s PMI fell to 47.3, a five-month low, indicating economic contraction.

- Consumer prices in Japan fell for the second straight month, raising concerns the ailing economy could be entering a period of sustained deflation.

- The International Monetary Fund predicts a slow recovery for Africa, with the continent’s economy not returning to pre-pandemic levels until 2022.

Our Operations

- During IWCS this week, our Wire & Cable team presented on innovative gels and tapes for the telecommunications industry. Click here to watch the session.

- For registered attendees of the MAPP 2020 Benchmarking and Best Practices Conference, stop by M. Holland’s virtual booth and watch our recorded breakout session here.

- Global Healthcare Manager Josh Blackmore will be a featured speaker at the Plastics in Healthcare Virtual Edition, sponsored by Plastics News, October 26-30. The title of his talk: Applying the Lessons from the First Wave of COVID-19 to Successfully Navigate the Second.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- Sustainability: Market Manager Lindy Holland.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.