COVID-19 Bulletin: October 26

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices slumped in response to rising COVID-19 infections globally. In early trading today, the WTI was down 2.5% at $38.87/bbl and Brent was off 2.3% at $40.82/bbl. Natural gas was 1.9% higher at $3.03/MMBtu.

- The Baker Hughes count of active oil and gas rigs in the U.S. and Canada rose by 6 to 211 last week but remains 564 below the comparable period last year.

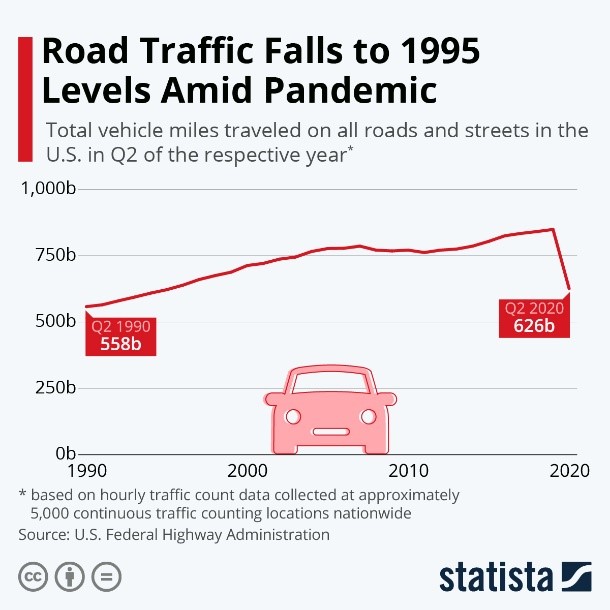

- U.S. road traffic fell to levels not seen since 1995 in the second quarter:

- Debt associated with U.S. oil and gas bankruptcies so far this year tops $89 billion, an all-time high.

- Canada’s Cenovus Energy has agreed to buy Husky Energy for $2.9 billion, which will create the country’s third-largest oil and natural gas producer.

- The Argentinian government will subsidize shale gas drillers to the tune of $5.1 billion over four years to revive production in the Vaca Muerta shale play. The subsidies are expected to be cheaper than importing liquified natural gas over the same amount of time.

- Libya could increase its oil supply to the market after warring factions signed a ceasefire on Friday, freeing the country’s oilfields for increased production.

- France delayed its plan to sign a 20-year deal to import $7 billion of U.S. liquefied natural gas from Texas, citing environmental concerns over production emissions.

- Saudi Arabian petrochemicals giant SABIC reported a 47% increase in third-quarter profits compared with the year-ago period.

- Last week, scientists discovered a new method of breaking down polyethylene using less heat than conventional methods along with no solvents or added hydrogen. The recycled material can be used for cosmetics, detergents, machinery lubricant and refrigeration fluids.

Supply Chain

- Tropical Storm Zeta, the 27th Atlantic storm of 2020, is expected to strengthen into a hurricane today before touching Mexico’s Yucatan Peninsula and hitting the U.S. Gulf Coast in the coming days.

- Louisiana’s governor is urging residents to prepare for Zeta’s touchdown by the middle of the week.

- PG&E, California’s largest utility, cut power to more than 350,000 homes and businesses near San Francisco Sunday as high winds and dry conditions increased the likelihood of wildfires. A record 4.1 million acres have already burned statewide in 2020.

- Typhoon Molave touched down in the Philippines for the fifth time today, prompting the evacuation of thousands.

- China, the world’s biggest commodity importer, is stocking up on grains, metals and other commodities in preparation for new supply chain disruptions resulting from rising COVID-19 cases among Western trading partners.

- Consumer demand has returned faster than supply chain capacity, creating shortages of a broad range of manufactured products, from cars to appliances to paint cans.

- Demand and lease prices for shipping containers are expected to remain high well into 2021, with container manufacturers unable to meet surging demand.

- FedEx is engineering reverse logistics technology in its partnership with Happy Returns, which will open more than 2,000 FedEx Office locations to returns of products even without a box or label.

- Self-driving truck company Plus announced its choice of Amazon Web Services as its cloud provider, evidence of Amazon’s growing presence in the up-and-coming autonomous trucking industry. Next year Plus will start mass producing Level 3 self-driving trucks, which still require human intervention.

- A California appeals court ruled that Uber and Lyft must classify their drivers as employees rather than independent contractors, a decision that threatens the companies’ viability in the state.

- The Northwest Seaport Alliance, which provides a gateway between the ports of Seattle and Tacoma, experienced its busiest month in almost a year in September, but was still down 11.1% in 20-foot equivalent units (TEU) containers year over year, with officials saying the pandemic will continue to disrupt supply chains countrywide.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

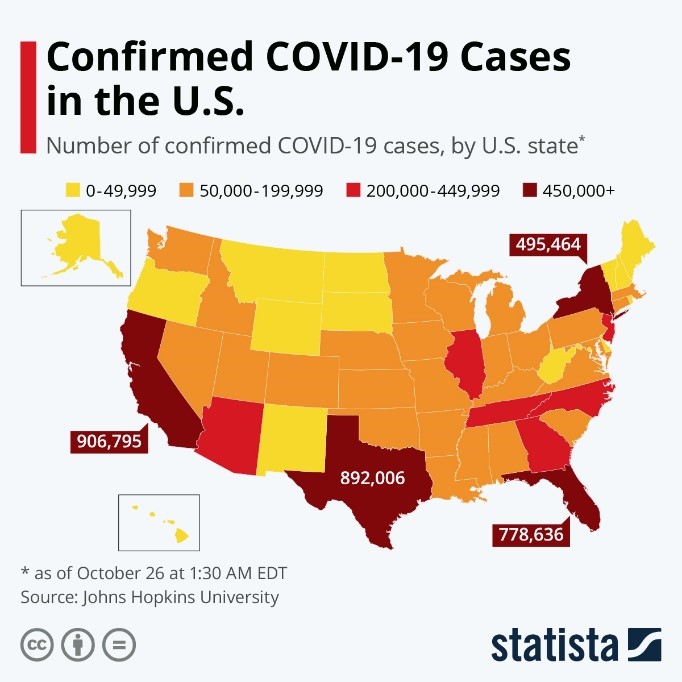

- The U.S. broke a record for single-day COVID-19 infections with 83,757 on Friday followed by 83,718 on Saturday. The country has logged more than 8.6 million cases in total, with more than 225,000 deaths.

- The seven-day average of new COVID-19 infections in the U.S. hit a record 68,767 yesterday.

- Thirty-eight states have rising infection trends this week.

- The vice president’s top staffer is quarantining after contracting COVID-19, while at least four other aides or advisors have also tested positive for the infection.

- The daily infection rate in Florida was up more than 36% last week from the prior week, just a month after the state dropped all social distancing restrictions.

- Illinois closed restaurants for dine-in service in four counties and warned half of the state’s counties that their COVID-19 infection metrics exceed at least two of the state’s warning thresholds.

- With COVID-19 hospitalizations up 40% in the past month, healthcare officials are struggling with hospital capacity constraints in many states, including Idaho, Missouri, Tennessee and Utah.

- El Paso, Texas, is converting a convention center into a field hospital after experiencing a 300% increase in hospitalizations in less than a month.

- With ICU beds near capacity in Utah, the state government is preparing a rationing plan, and hospital workers face the prospect of selecting which patients will receive intensive care.

- U.S. policymakers, including officials from the Federal Reserve, are urging the government to approve a jolt of economic stimulus, citing a fear that the current economic rebound is too uneven.

- Meanwhile, stimulus talks between the White House and Congress remain stalled. While a bill could make it through the House, it is unlikely to pass the Senate by election time.

- The pandemic has cost U.S. colleges and universities an estimated $120 billion so far, forcing institutions large and small to cut staffing and programs in what may be a permanent reshaping of higher education.

- One in five companies canceled their internship programs this summer; M. Holland was among those adapting to virtual internships.

- The U.S. is among regions of the world most vulnerable to steep drops in commercial real estate values, posing a threat to the banking industry.

- A third of respondents in a National Geographic survey said they have “no clue” when they’ll fly on a plane again.

- Credit card companies are raising spending on marketing to win new customers as the pandemic pummels card usage. American Express reported worse-than-expected quarterly results last week on a 20% drop in revenues.

- Walmart is focusing on supply chains as part of its long-term goal of decarbonization. The company will increasingly use power purchasing agreements to buy long-term green energy from suppliers.

- Spurred by the pandemic, beauty companies are refining their retail strategies toward cleaner products and greater flexibility with brick-and-mortar shelf lineups.

- P&G Beauty has created a reusable, refillable aluminum bottle and recyclable refill pouch to sell in its European market in 2021. The bottles will allow consumers to refill their shampoo, the first step in the company’s efforts toward a 50% reduction in virgin plastic usage in shampoo and conditioner bottles.

- Even with holiday retail sales expected to drop, investors are driving up the prices of retail stocks.

- The Tennessee Titans were fined $350,000 for a COVID-19 outbreak that infected 24 people, including 13 players, last month.

International

- Global cases of COVID-19 have now passed 43 million with over 1.15 million deaths.

- India has lowered its daily COVID-19 case count to below 50,000, or less than half the daily count just one month ago. The country reported 50,129 cases Sunday, with total infections of 7.9 million, second only to the U.S.

- The governor of India’s central bank tested positive for COVID-19.

- The 48-year-old president of Poland is the latest world leader to be infected with COVID-19. Meanwhile, Polish officials put the country’s 40 million citizens under the highest level of restrictions Saturday, with bars and restaurants instructed to close.

- Italy announced new restrictions after a record 21,273 cases were announced Sunday.

- France tallied a one-day record of 52,010 new COVID-19 cases over the weekend. The country is fifth in total cases behind the U.S., India, Brazil and Russia.

- Spanish officials declared a state of emergency due to rising COVID-19 infections.

- An outbreak of 137 asymptomatic COVID-19 cases in China’s Xinjiang province has led officials to roll out free testing for almost 5 million people in the region.

- Mexican authorities have acknowledged that the country’s COVID-19 death rate could be more than double the current number of 89,000, due to faulty or nonexistent testing.

- The four provinces comprising Atlantic Canada, which formed a COVID-19 bubble early in the pandemic with strict lockdowns and restrictions, are faring better than the rest of the country economically.

- Melbourne, Australia, is lifting lockdown restrictions after experiencing no new COVID-19 infections or deaths yesterday for the first time in four months.

- The business climate index in Germany fell for the first time in six months, indicating growing pessimism about the economic outlook among business leaders.

- The global airline industry is on pace to burn $77 billion in cash in the second half of the year as the pace of recovery stalls.

- Food prices in the U.K. could start to rise as the country approaches the deadline for leaving the European Union without a trade deal in place. Negotiations between the two sides continue this week.

- In his first policy speech to parliament today, Japan’s new prime minister is set to announce the country’s target of carbon neutrality by 2050.

Our Operations

- If you registered for MAPP and missed our breakout session last week, watch it here.

- Global Healthcare Manager Josh Blackmore will be a featured speaker on Thursday, October 29 at 10:00 am ET during the Plastics in Healthcare Virtual Edition, sponsored by Plastics News. The title of his talk: Applying the Lessons from the First Wave of COVID-19 to Successfully Navigate the Second.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.