COVID-19 Bulletin: October 29

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices were down more than 5% Wednesday on news of rising COVID-19 cases in the U.S. and Europe.

- Crude prices fell further in early trading today, with the WTI down 3.9% at $35.93/bbl and Brent down 4.1% at $37.54/bbl. Natural gas was up 1.4% at $3.34/MMBtu.

- PBF Energy’s 160,000-barrel-a-day refinery in New Jersey will idle operations due to the collapse in fuel demand. The company also plans to lay off 250 workers.

- Russian crude oil exports dropped 7.9% year over year between January and August, a report from Russian customs shows.

- China is building a $20 billion petrochemical and refining complex in the northern coastal province of Shandong, which could produce 400,000 bpd along with 3 million tonnes of ethylene per year.

- In Alaska, a ConocoPhillips-led oil exploration project was approved by the federal government, which could eventually yield 160,000 barrels of crude per day.

- Officials from Trinidad and Tobago said an idled oil tanker in the Gulf of Paria is at “minimal risk” of an oil spill as Venezuelan authorities began transferring oil from the vessel, a process that could take over a month.

- Oil and gas supermajors face a challenging task of strategically investing in renewables to keep their presence in the electric grid, as exemplified by BP’s recent partnership with Equinor in a large offshore wind investment.

- With a new deal to integrate renewable energy to power its Nickel West operations in West Virginia, BHP plans to supply “sustainable nickel” to companies such as Tesla to produce batteries.

- India added 883MV of rooftop solar capacity in the first nine months of 2020, spurred in part by government incentives.

Supply Chain

- With winds of 110+ mph, Hurricane Zeta struck Louisiana near New Orleans, leaving in its wake at least three people dead, a major levee breach, and 2 million people without power. The state has suffered a record five hurricanes or tropical storms this year.

- California lifted some evacuation orders as subsiding winds allowed firefighters to gain control of blazes in Orange County.

- Orders for new rail cars more than doubled in the third quarter from the second quarter but remain lower than figures for 2019.

- Ocean carrier capacity in the Transpacific lane is up 20% year over year.

- UPS is encouraging customers to order early and even avoid shipping when possible to prepare for a hectic online shopping season.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- U.S. COVID-19 infections of 78,981 yesterday were the third highest on record, with the two highest days occurring in the past week. Deaths yesterday increased to 994.

- COVID-19 infections are trending higher in 45 states this week.

- Rising COVID-19 infection rates in New York state pushed total cases above 500,000, with hospitalizations in nearby New Jersey more than doubling since the start of October.

- Newark, New Jersey, facing rising positive test rates, imposed tighter restrictions on bars and restaurants, including curfews and mandatory temperature tests of patrons.

- Officials in Colorado, Idaho, Massachusetts and Texas are imposing new restrictions on schools, businesses and gatherings as they fight rising infection and hospitalization rates.

- The nation’s top infectious disease doctor warned that the U.S. may not return to “some semblances of normality” until 2022, even if a vaccine is approved soon.

- While not a vaccine, results from late-stage clinical trials show Regeneron’s antibody COVID-19 treatment can reduce virus levels and the need for further medical care.

- Doctors are just beginning to understand the common long-term effects of COVID-19 infections, which include fatigue, chest pain and heart inflammation that could last for months.

- A new study finds that many recovered COVID-19 patients can suffer long-term cognitive issues equivalent to the brain aging 10 years.

- COVID-19 is disproportionately impacting health insurance for younger workers, with 30% of Gen Z and millennial respondents to a recent survey indicating the pandemic has affected their coverage.

- Federal agencies, including the FBI, issued warnings yesterday of imminent cyberattacks by foreign hackers aimed at disrupting the U.S. healthcare system.

- Third-quarter GDP increased by a record 33.1% after suffering its worst drop in history in the second quarter — down 31.4%, fueled by government stimulus and the lifting of lockdowns.

- First-time jobless claims remained persistently high last week with 751,000 new filings.

- U.S. stocks suffered their worst losses in four months on Wednesday, with the S&P 500 down 3.5%, on concerns about the spreading virus and its economic consequences.

- Earnings reports from credit card companies indicate consumers have resumed spending near pre-pandemic levels but are not funding it with added debt, suggesting uncertainty about the economic outlook.

- Boeing cited the pandemic in its decision to lay off another 7,000 employees by the end of next year, bringing the total number of layoffs to 27,000. The collapse of the airline industry has cost around 100,000 jobs so far in 2020, with 220,000 more at risk.

- Ford more than doubled its third-quarter earnings from the same time in 2019, beating Wall Street expectations on stronger-than-expected demand.

- Toyota experienced its first year-over-year sales growth in nine months in September, while Honda saw its first year-over-year growth in 13 months.

- Volkswagen returned to profitability in the third quarter, helped by strong sales in China.

- Harley-Davidson reported a 39% increase in Q3 profit on a decrease of 8% in sales, a result of scaling back its international operations and bike models.

- Amazon will hire 100,000 seasonal workers to keep up with soaring e-commerce demand during the holiday season.

- Ship salvagers are booming as cruise lines reduce their fleets and turn idle vessels over for recycling.

- Cruise lines have doubled their lobbyists in Washington as they argue to lift moratoriums on cruise ships at U.S. ports.

- The pandemic has created havoc and uncertainty for the cheese industry, currently enjoying a price spike, as lockdowns and restaurant closures have created volatile demand for the often-perishable product.

- Major League Baseball is investigating the Los Angeles Dodgers’ Justin Turner after the veteran third baseman stormed onto the field to celebrate a World Series win with teammates after being pulled from the game due to a positive COVID-19 test.

International

- France and Germany imposed monthlong lockdowns, acknowledging they have lost control of the COVID-19 virus, which is propagating at a speed “even the most pessimistic forecasts had not anticipated.”

- Germany registered a record 23,552 COVID-19 infections yesterday.

- France reported a one-day record of COVID-19 cases over the past 24 hours, while Spain declared a state of emergency that includes increased nighttime curfews and travel bans to stop the virus’ spread.

- Italy and Greece registered record numbers of new COVID-19 cases in the past 24 hours, while the U.K. recorded almost 25,000 new cases.

- Some health workers in Belgium have been asked to continue working even after testing positive for COVID-19 as long as they are asymptomatic. With high hospitalizations, the country is facing a shortage of medical staff.

- Switzerland is imposing new lockdowns that include a curfew on bars and restaurants and stricter mask mandates.

- Poland reported a record 18,820 new COVID-19 infections Wednesday, as some overrun hospitals have been forced to turn patients away.

- Portugal recorded a record number of one-day COVID-19 cases at 3,960.

- To better track the recent surge of cases, at least 10 European nations are looking at buying millions of COVID-19 rapid-result antigen tests made by Abbott and Roche.

- Melbourne, Australia, ended a three-month lockdown on Wednesday after reporting no new COVID-19 cases Monday and Tuesday.

- Taiwan has gone 200 days without a locally transmitted COVID-19 infection thanks to strict border controls, contact tracing and a mask mandate.

- With one of the lowest COVID-19 death counts in the world — only 460 since the start of the pandemic — South Korea’s president declared the virus contained on Wednesday.

- While India’s national daily COVID-19 cases are slowing, the country’s capital reported a record number of cases Wednesday. The nationwide case count surpassed 8 million yesterday, second only to the U.S with 8.8 million.

- Iran’s parliament speaker tested positive for COVID-19, as the country reported a record death toll of 415 Wednesday.

- South Africa’s president is self-quarantining after exposure to someone infected with COVID-19 at a dinner party.

- A Reuters poll of 500 economists across 43 economies evidenced a high risk that the global economic recovery could be interrupted in the fourth quarter by the resurging pandemic.

- Japan’s central bank said it will maintain interest rates at or below zero for the foreseeable future, and that it is prepared to intervene if the COVID-19 pandemic interrupts the nation’s economic recovery.

- Japan’s cabinet announced its plan to use public funds to distribute free COVID-19 vaccines to the public. The country has struck deals with Pfizer and AstraZeneca for millions of doses.

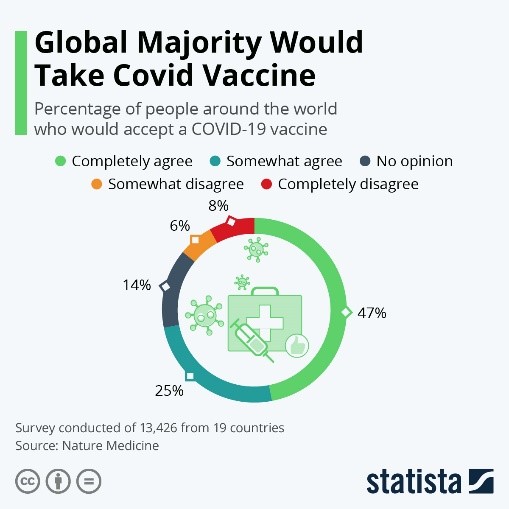

- A majority of people globally are inclined to take a vaccine when it is available:

- The central bank of Brazil, Latin America’s largest economy, will keep interest rates at historic lows for the foreseeable future and raised its projection for inflation.

Our Operations

- Reminder: Daylight saving time takes effect this Sunday, November 1, at 2:00 a.m.

- Global Healthcare Manager Josh Blackmore was a featured speaker today during the Plastics in Healthcare Virtual Edition, sponsored by Plastics News. The title of his talk: Applying the Lessons from the First Wave of COVID-19 to Successfully Navigate the Second.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.