COVID-19 Bulletin: October 6

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- On Monday, oil prices saw their biggest daily gain since May, with the WTI up 5.9% at $39.22/bbl and Brent up 5.1% at $41.29/bbl. Natural gas prices jumped nearly 10% to $2.679/MMBtu.

- Oil and gas prices continued their climb in mid-day trading today, with WTI up 3.0% at $40.38/bbl and Brent up 2.5% at $42.33/bbl. Natural gas was off 2.2% at $2.56/MMBtu.

- The dramatic changes are tied to optimism about the U.S. president’s health and a potential economic stimulus deal.

- Oil exploration in Norway has dropped by a third, a sign of oil and gas companies’ reluctance to spend on new projects.

- In addition, six Norwegian offshore oil and gas fields were shut as more workers joined a strike over pay. The shutdowns are expected to decrease Norway’s total output by 8%.

- Financially stressed Premier Oil plc will merge with Chrysaor Holdings to form the largest independent oil producer in the U.K. North Sea.

- The U.S.’s market share of oil sales in China increased from 0.6% to 7% since January. The increase comes at the expense of Middle Eastern suppliers such as Saudi Arabia, whose market share in China fell 4% during the same period.

- Weak demand for oil pipeline capacity has prompted some companies to slash transportation rates.

- An abandoned ship containing more than 1.1 million barrels of oil is decaying off the coast of Yemen, causing world leaders to worry about the threat of environmental catastrophe in the region.

- Spain’s Cabinet approved a $10.5 billion plan to expand its hydrogen industry.

- Rotterdam-based Vitol Group, the world’s largest independent oil trader, is diversifying into the used car business in anticipation of slowing demand for fossil fuels and the arrival of peak oil by 2030.

Supply Chain

- In the Caribbean, Tropical Storm Delta intensified into a hurricane Monday evening, and is expected to reach the U.S. Gulf Coast Thursday or Friday.

- California has more than doubled its previous record for most land burned in wildfires during a single year. The fires have spread to an area larger in size than the state of Connecticut.

- Northern California’s August Complex wildfire, which spans seven counties, is the first single fire in history to destroy 1 million acres, twice the previous record.

- The U.S./China trade war is undoing decades of global economic integration and creating two dominant supply chains, one for China and one for the rest of the world.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- After spending three nights at the hospital, the president has returned to the White House, where he will resume treatment after contracting COVID-19.

- Lawmakers are attempting to put together a fifth COVID-19 relief package. Talks between the U.S. house speaker and treasury secretary stalled Monday but will be picked up again today.

- COVID-19 guidelines updated yesterday by the CDC confirm that the virus may spread through the air at distances greater than 6 feet.

- COVID-19 rates are increasing in the Midwest and Northeast. Weekly infection averages have increased in 34 out of 50 states since last month.

- Schools in nine zip codes in Brooklyn and Queens will switch exclusively to remote learning today, a day earlier than planned.

- A contact tracing app developed six months ago by an Apple-Google partnership is gaining adoption, with New York and New Jersey joining 10 other states in making it available. The app provides a push notification to users if they’ve been in proximity to someone infected with COVID-19.

- Four out of five COVID-19 victims suffer prolonged neurological effects, including many who suffer relatively minor symptoms when positive for the virus.

- More than half of U.S. shoppers expect to spend less this holiday season due to the pandemic and economic conditions, according to a recent Harris poll.

- Some Silicon Valley tech giants are telling employees they may never have to return to the office, but relocating to a less expensive location may include a pay cut.

- With demand for air travel down 70% compared to one year ago, Southwest Airlines is asking its labor unions to take a pay cut to avoid layoffs.

- Airbus unveiled its new corporate jet, hoping that private jets sales will strengthen as safety-minded businesses avoid commercial air travel during the pandemic.

- Driving miles probably will not recover beyond 90% of pre-pandemic levels due to permanent work-from-home arrangement and growing use of delivery services, according to a KPMG study.

- Volkswagen’s Bugatti brand is canceling a high-performance car program due to pandemic pressures impacting niche brands and growing emissions concerns with large internal combustion engines.

- Daimler said it will cut R&D spending, capital expenditures and fixed costs by 20% over the next five years in response to the pandemic and as it shifts to electric vehicles.

- Hyundai plans to put flying cars in city skies by 2028. Models are being created to carry five to six people with “drivers” from transportation companies like Uber.

- Food makers such as Campbell Soup and Kellogg are increasing production and hiring as a result of continuing strong demand during the pandemic.

- Spending by teenagers is at a two-decade low, down 9% from a year ago.

- Biodegradable and compostable products are often misunderstood.

- The Biodegradable Products Institute issued guidelines on recycling and biodegradability of food packaging, including labeling and identification strategies.

International

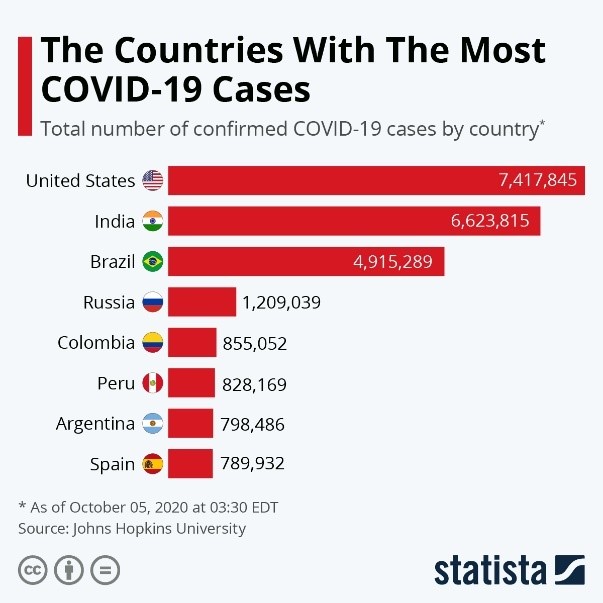

- With more than 60,000 new COVID-19 cases yesterday, India is on pace to overtake the U.S. with the most infections globally:

- The second COVID-19 wave in Europe is shifting from young people to older people, prompting fears of rising hospitalizations and deaths and warnings for seniors to exercise extra caution.

- Germany registered 3,100 new COVID-19 infections today, the highest since mid-April.

- Italy plans to tighten restrictions to stave off a rising rate of COVID-19 infections, including an outdoor face mask mandate.

- After recording record COVID-19 infections on Saturday, Poland is expanding social distancing restrictions and face mask mandates.

- Russia registered its highest daily COVID-19 infections since May today.

- European regulators will conduct rolling reviews of trial data for experimental vaccines from Pfizer and BioNTech to expedite the approval process.

- Citing a “shaky” economic recovery and second wave of COVID-19, the head of the European Central Bank expressed the possibility of more economic stimulus, including a further reduction in interest rates, which already are below zero.

- The Business Twenty, an organization of leading CEOs from around the world, yesterday proposed 25 recommendations for dealing with what it labeled the “worst (economic) state in a century,” including measures to promote more inclusivity, reduced carbon emissions and advances in digital technology.

- Australia’s government proposed a stimulus budget for next year that includes tax cuts and spending increases that will result in a record budget deficit, warning that the deficit will be greater if a COVID-19 vaccine is not widely available.

- The Philippines has allowed malls and other businesses to reopen to counter a 6.6% projected economic contraction this year.

- The seven-day average of confirmed COVID-19 cases in Canada has risen 29% from the previous period, leading to a second round of lockdowns and more restrictions.

- Mexico witnessed a record jump in COVID-19 cases and deaths Monday, mostly due to a change in the way cases have been counted since June. Leaders called the jump a “one-off” event.

- The International Monetary Fund warned of “exceptionally high and multifaceted risks” with Brazil’s economy due to the pandemic.

- Finland reported record new infections today.

- Sweden, which resisted social distancing restrictions and suffered higher COVID-19 infections and death rates than its neighbors, appears headed for a softer economic landing this year and stronger recovery next year.

Our Operations

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, and Jacob Fallon, Braskem’s Technology Engineer for 3D Printing, will co-host a webinar on Polypropylene Advancements in 3D Printing at 1:00 p.m. CT tomorrow. Learn more and register here.

- Stop by M. Holland’s virtual booth at IWCS to meet our team of Wire & Cable experts. The M. Holland team is exhibiting October 15-16 from 8-1 pm ET. Click here to learn more.

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.