COVID-19 Bulletin: September 16

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Hurricane Sally inched ashore as a Category 2 storm in Alabama and the Florida panhandle this morning, sparing the petrochemicals infrastructure along the Gulf Coast.

- Hurricane concerns and a larger-than-expected inventory draw last week sent crude prices higher.

- Crude prices were higher in early trading today, with the WTI up 2.2% at $39.13/bbl and Brent up 2.1% at $41.38/bbl.

- The natural gas price was lower at $2.35/MMBtu.

- Spot natural gas prices in Europe have jumped over 250% from their pandemic lows, providing relief to U.S. exporters.

- U.S. oil production, down about 40% since the beginning of the year, is expected to fall further to 7.6 million barrels per day next month, according to the Energy Information Administration.

Supply Chain

- Hurricane Sally has left hundreds of thousands without power in Alabama, Mississippi, Louisiana and Florida and is expected to drop record rainfall in a number of Southeast states.

- The Coast Guard reopened the Port of New Orleans and other ports in the region with restrictions.

- With the hurricane season barely half over and several tropical depressions swirling in the Atlantic, only one name remains from the World Meteorological Organization’s list of 21 names for 2020 storms, which may force a move to the Greek alphabet for names for only the second time in history.

- Western wildfires, fueled yesterday by gusty winds, have now scorched more than 5 million acres and caused hazardous air conditions that have closed airports, schools and businesses.

- FedEx cited a surge in residential deliveries as contributing to its better-than-expected 14% jump in revenues and 66% increase in profit in its latest quarter.

- To fulfill its two-day delivery pledge, Amazon has added nine cargo aircraft to its fleet since May and plans to add 1,500 small delivery centers in cities and suburbs throughout the country.

- Trucking capacity remains tight throughout the U.S., and spot pricing remains elevated.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

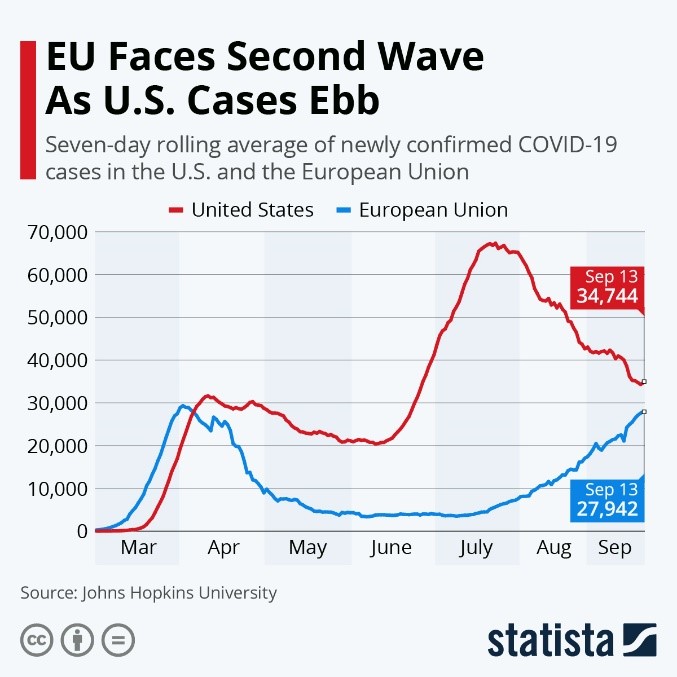

- COVID-19 infections jumped to 39,617 yesterday, compared with 34,079 Monday, while daily fatalities more than tripled to 1,293 from 422 on Monday. Confirmed cases in the U.S. approached 6.6 million.

- COVID-19 infection rates are trending higher in 31 states this week; just 11 had rising rates as of yesterday.

- The recovery of U.S. industrial production slowed to 0.4% in August, compared with jumps of 6.1% in June and 3.5% in July.

- U.S. retail sales rose 0.6% in August, versus analysts’ expectations of a 1.1% rise.

- The 50-member bipartisan Problem Solvers Caucus in the House of Representatives proposed a $1.5 trillion compromise relief package that includes more payments to households, unemployment subsidies, aid for small businesses and relief for schools and state governments.

- Respondents to a CNBC survey believe the Federal Reserve will maintain near-zero interest rates through early 2023 as the central bank concludes its monthly two-day meeting today.

- New York City is working with Columbia University and New York University to prepare for an expected surge in COVID-19 infections this fall.

- JPMorgan, which just ordered senior sales and trading managers back to its offices, had to send some employees home yesterday after a trader contracted COVID-19.

- Electric truck startup Nikola, which went public in June and recently entered a partnership with GM worth $2 billion, is under investigation by the Justice Department and Securities and Exchange Commission for misrepresenting its technology.

- Starbucks said its U.S. sales in August were down 11% year over year as offices in urban centers remain closed or partially staffed.

- Toymaker Lego plans to replace plastic box liners in its packaging with paper in response to request letters from children.

- Businesses have shifted from resistance to climate change initiatives to support, as evidenced by today’s policy declaration by the Business Roundtable supporting an 80% reduction in carbon emissions by 2050.

- With Rosh Hashanah, the Jewish New Year, starting Friday, and China’s borders closed to U.S. visitors, rabbis are being forced to use video tools to certify foods are kosher, a $19 billion market.

International

- China’s head bio-safety scientist said the country will have a vaccine for public use before year end.

- The White House lifted a 10% tariff on Canadian aluminum imposed last month, avoiding “perfectly reciprocal dollar-for-dollar tariffs” threatened by Canada, among the U.S.’s top trading partners.

- A COVID-19 resurgence, Brexit concerns and the expiration of stimulus measures are raising alarm about the fragile economic recovery in Europe.

- The U.K. is grappling with testing capacity limitations that could take weeks to resolve just as companies are attempting to reopen offices.

- Office space available for subletting in London has jumped 21% since June as workers resist returning from remote working.

- New Zealand’s economy has bounced back faster than expected from recent lockdowns, with a 16% contraction in the second quarter versus earlier government projections of a 23.5% drop.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.