COVID-19 Bulletin: September 17

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- With Hurricane Sally largely bypassing Gulf Coast refineries, crude prices eased in early trading today, with the WTI at $39.92/bbl and Brent at $42.05/bbl.

- The natural gas price was lower at $2.20/MMBtu.

- A drop in demand for oil from emerging market countries, which offer the greatest growth potential, is cause for concern for oil producers.

- Leading coal producer Murray Energy emerged from bankruptcy as American Consolidated Natural Resources.

- Despite government policy support, the coal industry continues to shrink, with renewable energy outpacing coal for energy production last year for the first time since 1880.

- BHP, the world’s largest mining company, has frozen salaries of its executive team as the pandemic has closed mines and required costly safety measures.

- Austrian packaging company and recycler Alpla Group is building a 15,000-ton post-consumer HDPE recycling facility in Toluca, Mexico, as it expands its global footprint.

Supply Chain

- The U.S. Post Office closed post offices in California, Oregon and Washington due to wildfires and hazardous air conditions.

- New York City is under a haze of smoke from still-raging fires in Western states. Smoke from the wildfires has been detected as far away as Europe.

- The apple crop in Washington, which produces 65% of the nation’s apple supply, will be down 10% due to fire and wind damage.

- Hurricane Sally weakened to a tropical storm as it inundated Gulf coastal areas with torrential rain and flooding.

- Tropical storm Teddy strengthened to a Category 2 hurricane in the open Atlantic and is expected to grow into a major hurricane.

- East Coast ports are gaining market share over West Coast ports due to growing trade tensions between the U.S. and China.

- The container shipping industry is showing surprising resilience, with many competitors poised to emerge from the pandemic disruption stronger than before.

- Although material supplies are tight due to force majeures, we’re seeing many warehouses at storage capacity with operators opening satellite/overflow warehouses.

- We’re seeing railcar capacity challenges in the Charlotte, North Carolina, area.

- Trucking capacity remains tight throughout the U.S., and spot pricing remains elevated.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

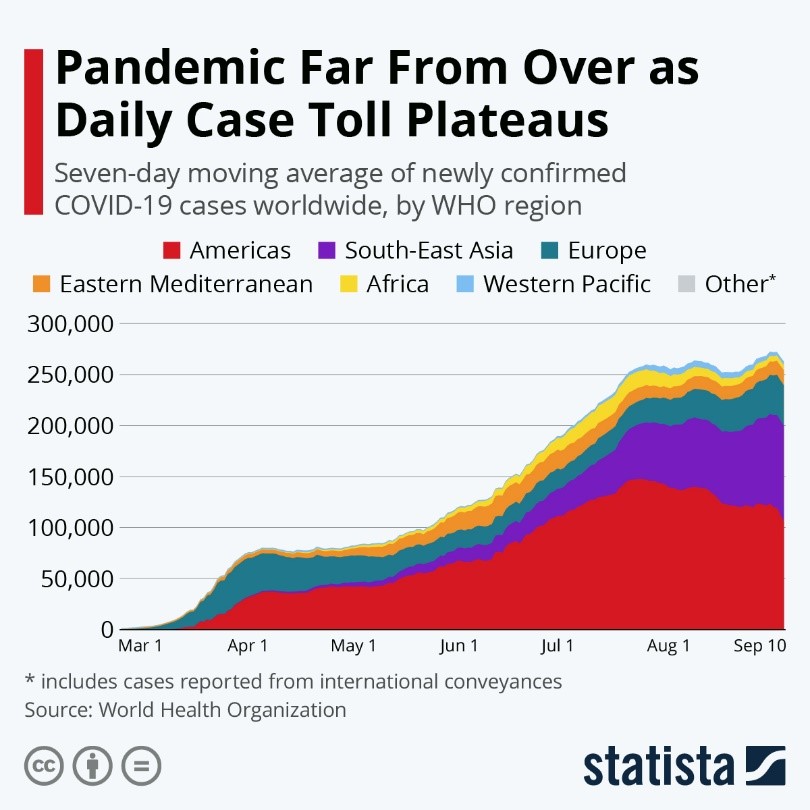

- COVID-19 infections in the U.S. eased to 38,410 yesterday with 1,014 reported fatalities.

- COVID-19 infection rates are trending higher in 31 states this week.

- There were more than 860,000 new jobless claims last week, down slightly from the prior week. Another 659,000 contractors and gig workers filed claims under the Pandemic Unemployment Assistance program.

- The head of the CDC said there may be an effective vaccine by year end, but it would not be available for broad distribution until the third quarter of 2021.

- Operation Warp Speed officials announced plans for the rapid distribution of an eventual vaccine, which will be free to all Americans.

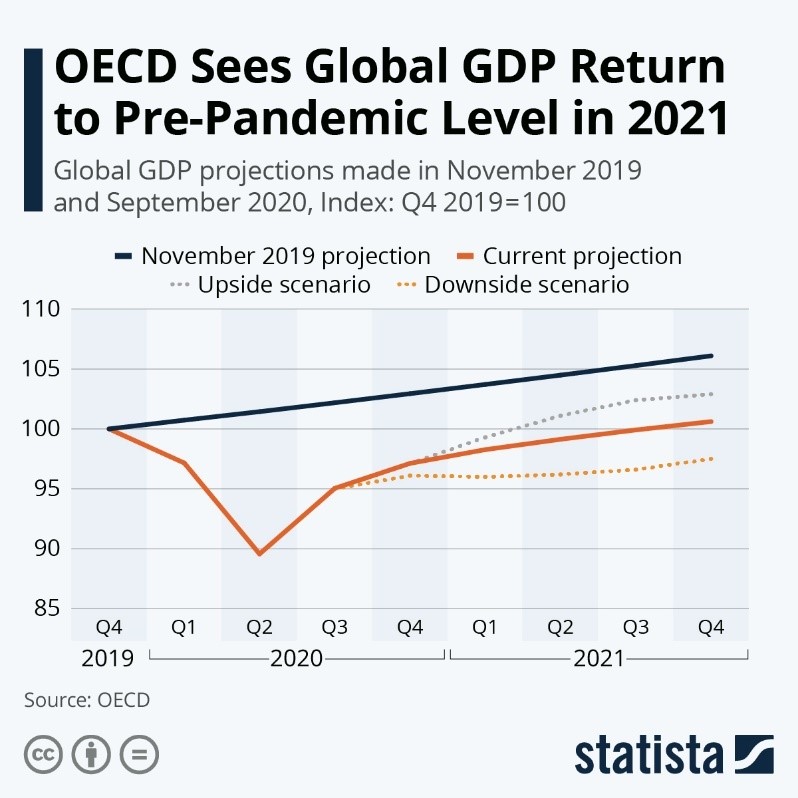

- The Federal Reserve expressed greater optimism about the economy after its monthly meeting yesterday, raising its outlook for GDP contraction this year from 6.5% to 3.7% and projecting that unemployment will fall to 5.5% by the end of 2021.

- The central bank plans to keep interest rates near zero for the next three years.

- Half of U.S. manufacturers say they’re having trouble staffing the factory floor due to childcare issues impacting employees, threatening the manufacturing recovery.

- While JPMorgan is pressing employees to return to offices, Deutsche Bank extended work-from-home protocols for U.S. workers until July 2021.

- New York City’s mayor imposed a week of furloughs on himself and his staff to help address budget deficits caused by the pandemic.

- Southwest Airlines will continue leaving middle seats open through November as it pares its flight schedule for the third quarter, when it expects to lose $17 million a day.

- Ford said its new electric F-150 truck, due to be built in 2022, will be more powerful and have half the cost of ownership of the gasoline-powered version.

- GM is developing a wireless battery that conveys energy through antennae and could be used across a variety of electric vehicles without costly connections and wiring harnesses.

- Delayed movie releases are creating havoc and financial pain for toy companies.

- Fourteen Big Ten colleges voted unanimously to resume playing football on October 23 after canceling the fall season in August, putting pressure on the PAC 12 conference to follow suit.

- The Cleveland Clinic announced the creation of the Center for Global and Emerging Pathogens Research, which is dedicated to the research of future pathogens and their treatment and cure.

- The move to remote work has led to increases in both the frequency and damage of cybersecurity attacks, with the severity of ransomware invasions up 47% during the pandemic.

International

- The Organization for Economic Cooperation and Development raised its outlook for the global economy from a 5% contraction this year to a 4.5% contraction and projected 5% growth in 2021.

- In a study of the recovery rates of 75 economies, Latin American countries occupied 18 of the 25 bottom rankings.

- Global COVID-19 cases are approaching 30 million.

- India recorded nearly 98,000 COVID-19 infections yesterday, a daily record while total cases in India surpassed 5 million, just 11 days after hitting the 4 million mark.

- In Italy, Spain and the U.K., COVID-19 deaths per capita are now running higher than in the U.S. as Europe braces for a fall resurgence of the virus.

- Eastern European countries, early stars in fighting the pandemic, relaxed restrictions too soon and are now facing a resurgence of COVID-19.

- European auto sales tumbled 18.9% in August, dashing hopes for a steady industry recovery that appeared to be underway.

- German automotive supplier Mahle is cutting 7,600 jobs due to the downturn caused by the pandemic.

- South Africa is reopening borders and lifting pandemic restrictions after gaining control of its COVID-19 epidemic.

- The Bank of England held interest rates at a record low 0.1% yesterday and said it may consider negative rates in the future.

- Customs and Border Protection reopened its Global Entry offices on September 8 after a six-month hiatus, but appointments are hard to schedule because of a huge backlog of applications.

- Europe’s Circular Economy for Flexible Packaging consortium is recommending that packaging design shift from multilayer structures to mono-materials to ease recyclability.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.