COVID-19 Bulletin: September 30

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- After dipping below $40/bbl yesterday, the WTI crude price was up in early trading at $39.64/bbl, while Brent was modestly lower at $40.81/bbl. Natural gas was lower at $2.54/MMBtu.

- Royal Dutch Shell plans to lay off up to 9,000 employees by the end of 2022 as it transitions to alternative energy sources.

- Marathon Petroleum, the country’s largest oil refiner, is cutting hundreds of refinery employees in response to weak demand.

- Total joined BP in forecasting the world is near “peak oil,” predicting that industry expansion will end by 2030 despite long-term growth in energy demand.

- NextEra Energy was rebuffed in an approach to acquire Duke Energy, which would create a $200 billion behemoth electrical utility in the Southeast.

Supply Chain

- Wildfires claimed Napa Valley’s Restaurant at Meadowood, a Michelin three-star restaurant, and several refineries. An erratic jet stream promises more hot weather in the Western U.S. for the next week.

- Amazon is introducing Amazon One, allowing users to link their credit cards with their palm and make payments with a sweep of their hand at Amazon stores.

- Injuries at Amazon’s robot-equipped warehouses are higher than at those without robots.

- Trucking capacity remains tight throughout the U.S., and spot pricing remains elevated.

- Clients are advised to provide expanded lead times on orders to help ensure delivery dates will be met.

Markets

- COVID-19 infections in the U.S. jumped to 42,185 yesterday, while deaths more than doubled to 914 from Monday.

- COVID-19 infections in 31 states are trending higher this week.

- North Dakota’s per capita infection rate is as high as Florida’s at the peak of its surge as COVID-19 cases rise in the Midwest.

- The CDC urged colleges to take greater measures to protect students amidst growing infection rates on campuses throughout the country.

- U.S. GDP shrank at a 31.5% annualized rate in the second quarter, with the leisure and restaurant sectors suffering the worst.

- The Conference Board’s index of consumer confidence rose from 86.3 in August to 101.8 in September, the highest level during the pandemic.

- Disney will lay off 28,000 workers, mostly part-time employees, at its U.S. theme parks.

- ADP reported that private employers added 749,000 jobs in September, but private employment remains 10 million below pre-pandemic levels.

- One in four women is considering withdrawing from the workforce or downshifting their jobs because of the pandemic, according to a McKinsey/LeanIn study, with most citing burnout as the cause.

- The average price of a new car hit a record $35,655 in September as sales increased to a 15.7 million annualized pace.

- A moratorium on job cuts in the airline industry expires today, leaving tens of thousands of airline workers facing imminent layoff.

- Mall owner Brookfield Properties is cutting 20% of its workforce.

- Regeneron reported promising early tests of its COVID-19 therapeutic cocktail in treating non-hospitalized patients.

- The Treasury Department said it has loaned billions of dollars to seven airlines under a previously approved $25 billion relief fund — Alaska Airlines, American Airlines, Frontier Airlines, JetBlue Airways, Hawaiian Airlines, SkyWest Airlines and United Airlines.

- Boeing will cease manufacturing of its Dreamliner 787 in Washington and consolidate assembly in South Carolina as it responds to moribund demand.

- More than 10,000 retail stores have been permanently shuttered through August, a record, and 29 retailers have filed for bankruptcy this year, a pace rivaling 2010 when there were a record 48 retail failures.

- Home prices nationally rose 4.8% in July year over year.

- Spice maker McCormick said it expects home cooking trends to continue as it reported a 26% jump in consumer sales in the second quarter.

- A virtual commute feature is among new functions being added to the Microsoft Teams videoconferencing tool to assist users in marshaling their time.

- A survey of international business executives finds that a majority believe the pandemic has permanently changed their business models, with 60% indicating they have accelerated their digital transformations.

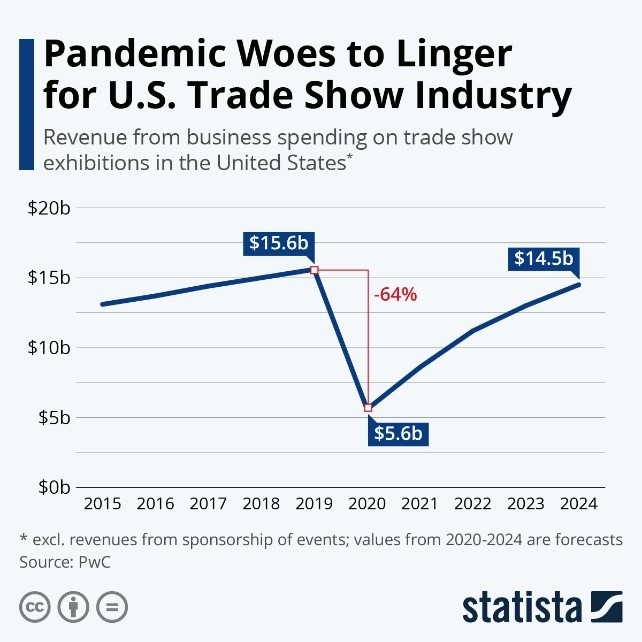

- The trade show industry is expected to take years to recover from the pandemic:

- Financially strapped cities are struggling keep up with waste collection in the face of a surge in household garbage due to the pandemic.

- Dick’s Sporting Goods will collaborate with the Closed Loop Partners’ Center for the Circular Economy and the Consortium to Reinvent the Retail Bag in order to eliminate single-use plastic bags by 2025.

- The NFL has postponed Sunday’s scheduled game between the Tennessee Titans and Pittsburgh Steelers after several Titans players tested positive for COVID-19.

International

- German retail sales rose a higher-than-expected 3.7% year over year, fueled by record government stimulus earlier during the pandemic.

- South Korea experienced triple-digit new infections leading up to its thanksgiving holiday. Many South Koreans welcomed government warnings not to travel for the country’s biggest and most stressful holiday.

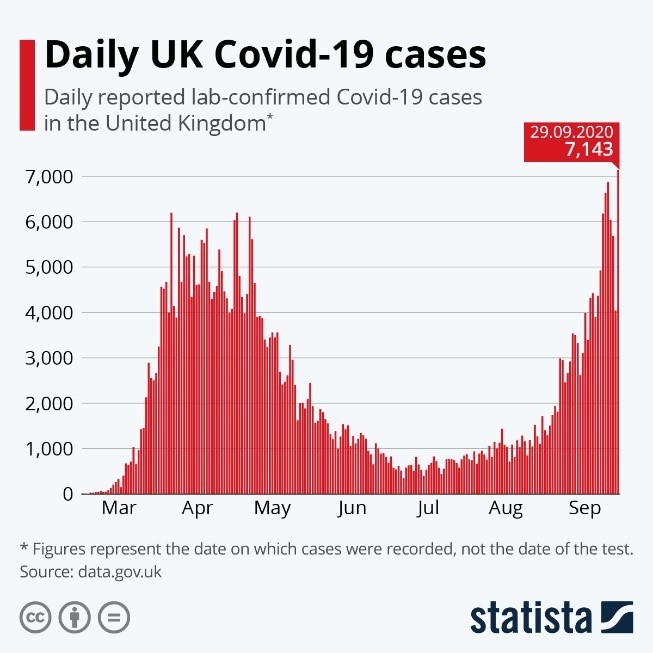

- The U.K. COVID-19 infection rate hit a record high yesterday:

- Canada’s seven-day average infection rate jumped 29% in the past week as daily infections approached peak levels in April, prompting a return to lockdowns and social distancing restrictions in some areas.

- Canada’s GDP rose 3% in July and 1% in August, raising economic activity to within 5% of pre-pandemic levels.

- The International Monetary Fund warned Spain that its economic recovery is in peril due to the second COVID-19 wave affecting the country.

- Becton Dickinson received approval for the use of its rapid COVID-19 test in Europe, which can return results in 15 minutes.

- Novartis AG’s CEO predicted that a vaccine will not be widely available until the end of next year and that therapeutics will be necessary to taming COVID-19. Results of the large-scale study of the company’s anti-inflammation treatment is due in October or November.

Our Operations

- To access 3D Printing training, order parts and seek technical assistance, visit our new online resource.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.