MH Daily Bulletin: January 19

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- 2022 was a difficult year for supply chains, with 3D printing, Color & Compounding and Rotational Molding all weathering challenges to keep inventories up-to-date. Click here to read what M. Holland’s market managers had to say about their predictions for the three industries in 2023.

Supply

- Oil fell about 1% Wednesday on growing worries of a U.S. recession this year.

- In mid-morning trading today, WTI futures were up 0.7% at $80.00/bbl, Brent was up 0.9% at $85.72/bbl, and U.S. natural gas was down 1.3% at $3.27/MMBtu.

- U.S. crude stocks likely rose by 7.615 million barrels last week, according to the American Petroleum Institute. Government data is due today.

- U.S. oil refiners are planning twice as many refinery overhauls this spring as part of an effort to resume maintenance delayed by the pandemic.

- A shortage of workers and the exhaustion of sweet spots, among other factors, could significantly reduce growth in U.S. shale output this year, analysts say.

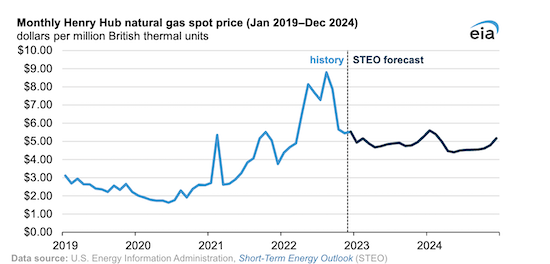

- Dry natural-gas production in the U.S. will outpace market demand this year and next, sending the average benchmark lower than in 2022, the administration says.

- The global oil market will face a supply glut of about 1 million bpd this quarter even as China continues to reopen its economy, the International Energy Agency predicts.

- Russia remained Europe’s top seaborne crude supplier in 2022 despite its crude exports to the bloc falling by 12%.

- Britain’s largest oil and gas producer in the North Sea will cut jobs as a result of the nation’s new windfall taxes on energy producers.

- The U.K. shelled out over $100 million to wind farm operators last month to constrain their output and prevent the nation’s energy grid from being overwhelmed.

- Boeing received a $425 million award from NASA to continue developing a full-scale low-emissions aircraft by 2028.

- The U.S. administration is proposing new regulations to streamline offshore wind development that it says will save developers around $1 billion over a 20-year period.

Supply Chain

- The average U.S. diesel price fell to $4.52 per gallon this week, about $1.20 less than last year’s June highs.

- Trucking and logistics giant J.B. Hunt reported a 17% decline in profit and lower-than-expected revenue growth in the latest quarter after shipping demand slowed during the holidays.

- More trucking companies folded in December than in any month since 2005, according to FTR Transportation Intelligence.

- Freight payments group Cass Information Systems says U.S. domestic shipping prices are on track to fall 5% this year, while loose capacity and lower fuel costs could send costs even lower.

- Spot container rates rose for the first time in 43 weeks to start the year, according to data firm Xeneta.

- Prologis, the world’s largest developer of logistics properties, saw revenue rise by more than a third in the fourth quarter as occupancy rates continued to edge higher.

- Google Cloud says it developed an artificial intelligence tool that uses videos and images from retailers’ ceiling-mounted cameras, among other devices, to better track merchandise on shelves.

- Tanker owner International Seaways expects to report record results for the fourth quarter.

- Over 100 ships, many of them carrying grain, are halted in Turkish waters as they await travel approval and inspections.

- Taiwan Semiconductor Manufacturing Co. saw quarterly revenue rise 26.7% even as demand slackened and customers adjusted their inventory. The firm expects revenue to fall in 2023.

- Global spending on business IT devices is projected to fall 5.1% this year after dropping more than 10% in 2022, according to research firm Gartner.

- Portland-based Schnitzer Steel, a scrap steel recycler, took the title as the world’s most sustainable company in rankings from research firm Corporate Knights.

- In the latest news from the auto industry:

- Shell is moving forward with the $169 million acquisition of U.S.-based Volta, an electric-vehicle network operator.

- Mexico’s truck makers boosted production by 20.6% last year on a surge in orders for heavy-duty vehicles from the U.S.

- Czech automakers expanded production by 10% last year and expect to keep growing in 2023 as the country’s key industry recovers from shortages of energy and computer chips.

Domestic Markets

- The U.S. reported 127,694 new COVID-19 infections and 1,574 virus fatalities Wednesday.

- First-time unemployment claims hit a four-month low last week, down 15,000 to 190,000, indicating the jobs market remains robust.

- The Federal Reserve’s Beige Book of anecdotal economic evidence showed that U.S. economic activity was relatively flat to start the year and that businesses were pessimistic about growth in the months ahead.

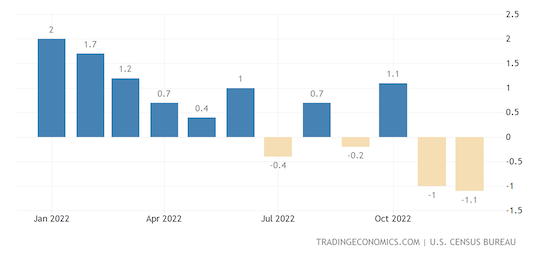

- The 1.1% drop in U.S. retail sales in December, the most in a year, portends a weaker growth path for the economy in 2023.

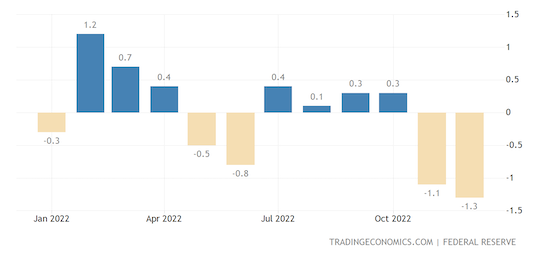

- U.S. manufacturing output fell 1.3% last month, the steepest drop in 22 months, suggesting the sector was rapidly losing momentum amid weakened demand for goods.

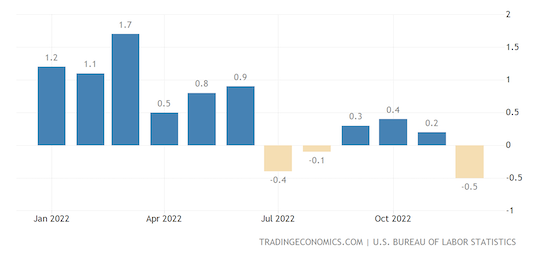

- U.S. producer prices fell by a surprise 0.5% last month, the most since April 2020, as the costs of energy products and food declined, offering more evidence of receding inflation.

- U.S. business inventories rose 0.4% in November as higher interest rates depressed sales, boosting the inventory-to-sales ratio to the highest level in nearly two years.

- Microsoft said it will take a $1.2 billion charge related to the elimination of 10,000 jobs announced yesterday as cloud customers reassess spending and the company braces for a potential recession. Amazon, meanwhile, began the first of 18,000 job cuts Wednesday.

- Southwest Airlines’ pilot union called for a strike authorization vote over pay and conditions, coming just weeks after a tech meltdown at the carrier left tens of thousands of passengers stranded across the U.S.

- United Airlines and Delta Air Lines reported higher-than-expected quarterly earnings on resilient consumer demand, while American Airlines lifted its profit outlook for the year.

- A national shortage of accountants is prompting small and midsize firms to hire overseas for the first time as they seek workers to prepare business and individual tax returns.

- Emerson Electric, after eight months of courting National Instruments, went public yesterday with a acquisition bid for nearly $7 billion.

- Confidence among U.S. single-family homebuilders improved for the first time in more than a year in January, signaling the housing slump may have reached its low point.

- Weather events and citrus disease have laid waste to Florida’s orange crop this year, which is down 50% from last year and the smallest in 90 years.

- The average U.S. mortgage rate dropped to 6.23% last week, its lowest level since September following news of slower inflation growth.

International Markets

- In the latest China news:

- China could see as many as 36,000 COVID-19 deaths per day during the Lunar New Year holidays, according to forecasting firm Airfinity.

- China’s president called for more efforts to fight COVID-19 in a rare video speech admitting the severity of the nation’s latest outbreak.

- Early indications suggest it could take several months for travel from China to rebound, according to aviation data firm OAG.

- Luxury retailers are optimistic that consumers in China will start spending again, helping to offset three years of upheaval from the government’s COVID-19 lockdowns.

- Britain’s annual rate of inflation fell to 10.5% in December, the second straight monthly decline.

- Producer prices in Canada fell by 1.1% in December on lower prices for refined petroleum products and softwood lumber.

- Amsterdam’s Schiphol, one of Europe’s busiest airports, plans to end daily passenger limits by the end of March, the start of the summer season.

- Spending on business air travel across the globe is expected to recover to 80% of 2019 levels this year, up from 65% last year.

- Bayer plans to boost its radiology business with the upcoming acquisition of Blackford Analysis, a British developer of artificial intelligence that helps diagnose disease from medical images.

Some sources linked are subscription services.