COVID-19 Bulletin: December 16

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were modestly higher in mid-day trading today, with the WTI at $47.65/bbl and Brent at $50.92/bbl, while natural gas was lower at $2.68/MMBtu.

- The head of OPEC emphasized that the cartel should not rush to increase output early next year, with energy demand still fragile amid rising global COVID-19 cases.

- Iran is estimated to have nearly doubled oil exports to China and other countries in recent months, circumventing U.S. sanctions while providing a lifeline for its struggling economy.

- Low jet fuel demand will account for nearly 80% of next year’s projected 3.1 million bpd gap in oil demand compared to pre-pandemic levels, according to the International Energy Agency.

- BP has taken a majority interest in Finite Carbon, which helps farmers sell forested land as “carbon sinks” to create carbon credits for sale to companies seeking to meet their carbon reduction goals.

- The number of Americans taking road trips for Christmas is set to decline by as much as 25% this year, potentially weakening the demand for gas in a traditional period of high activity.

Supply Chain

- A foot or more of snow could blanket the Mid-Atlantic and Northeast today, alongside up to two feet in eastern Pennsylvania and western New Jersey in the heaviest December snowfall in a decade.

- Ports in the New York area are setting shipment records, with a record 18%, or 430,000, more cargo containers arriving in September and October from the year-ago period.

- The Federal Maritime Commission will meet with the CEOs of six ocean carriers this week to discuss operational changes that could ease pandemic-induced problems with congestion and container returns.

- Record spot rates to the tune of $10,000 per 40-foot high-cube container from Asia to North Europe are causing a rush of cancelled orders and leading some freight companies to raise cancellation fees.

- Vaccine distribution efforts will boost cargo rates for Asia-Pacific carriers in 2021, supporting a recovery in airlines with a high cargo exposure that have been hard hit by declining passenger rates.

- Vaccine rollouts in the U.S. depend on a tight network of refrigerated-truck operators, the only companies with the experience and equipment needed to deliver fragile vaccine doses intact on critical sections of transport.

- With UPS and FedEx curtailing service to some retailers, the U.S. Post Office is overwhelmed with e-commerce package deliveries and experiencing increasing delays as the holiday approaches.

- Workers at the Port of Los Angeles are reportedly plucking containers of toys off ships and out of massive stacks of backlogged cargo to get holiday gifts under trees in time for Christmas.

- Hyster-Yale and Capacity Trucks announced a collaboration to develop electric and hydrogen fuel cell powered material handling equipment for ports, terminals and distribution centers.

- Logistics conditions continue to deteriorate, with trucking demand exceeding availability, growing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 198,357 new COVID-19 infections and 3,019 deaths in the U.S. yesterday.

- New York City’s mayor is calling for another shutdown to be imposed after Christmas, with the state recording its highest level of COVID-19 fatalities in weeks.

- Facing a shortage of nurses, doctors and medical staff, California’s governor is looking overseas to hire additional healthcare workers to deal with a 30,000+ daily case count of new COVID-19 infections.

- Hispanic Americans are suffering disproportionately from the effects of the latest COVID-19 surge, with infection rates per 100,000 people in majority Hispanic communities 32.6% higher than the national rate.

- Pfizer/BioNTech’s COVID-19 vaccine rollout continued on Tuesday, with doctors and nurses inoculated at many U.S. locations for the first time. About 2.9 million doses are set to be delivered by the end of the weekend to more than 1,000 locations.

- The second major U.S. COVID-19 vaccine could start shipping as soon as this weekend after federal regulators found Moderna’s drug to be “highly effective” in preventing infections, setting the stage for emergency use authorization later this week.

- The U.S. government is spending $250 million on a vaccination publicity campaign to encourage the public to get inoculated once vaccine supplies increase early next year.

- A White House official predicts the general public will be able to receive COVID-19 vaccines by the end of February into March.

- The first over-the-counter home COVID-19 test gained clearance from the FDA. The test, developed by Ellume USA, delivers results in 15 minutes.

- U.S. lawmakers have tentatively agreed to a package of tax incentives for wind and solar projects that would appear in a $908 billion economic relief bill that is yet to be passed. The proposed bill also includes $17 billion in U.S. government aid to airlines to recall furloughed workers and cover short-term payrolls. Top Congressional leaders say they are inching closer to an agreement on the bill after months of stalled talks.

- U.S. industrial production increased for the seventh straight month in November on gains in mining and manufacturing, led by a 5.3% increase in car and parts production. Hope for the U.S. manufacturing industry in 2021 and beyond is bolstered by three tailwinds: a quick recovery from the recession, localization of supply chains, and tech advancements that allow greater competition with countries with lower labor costs.

- Excluding gas, auto and food services, 2020 could turn out to be one of the best years in the overall retail sector in the past 20 years, with sales rising 6.4% in the first 10 months compared to 2019.

- The resurging pandemic is taking a toll on holiday sales, with consumer spending expected to fall 0.3% in November following six consecutive months of increases.

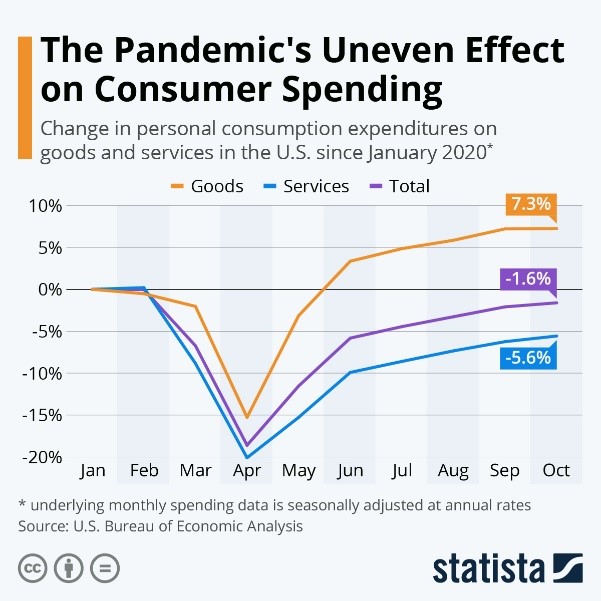

- There’s been a disparate return of consumer spending during the pandemic…

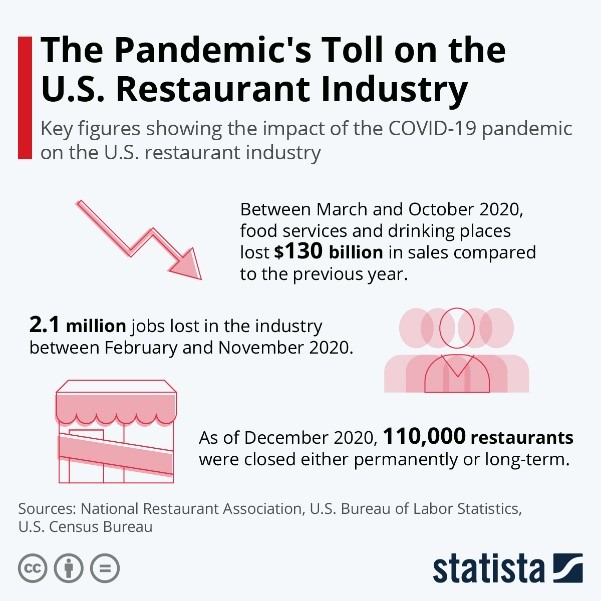

- … with restaurants among the hardest hit sectors:

- With public school employment down 8.7% from February, many U.S. school districts face a growing shortage of teachers due to the pandemic.

- Co-working and other forms of flexible, short-term office space leasing is pushing office vacancies in big cities to levels not seen in decades, threatening the commercial-property sector’s traditional reliability.

- Local governments looking to house the homeless during the pandemic have increasingly taken to renting out or even buying hotels, a small boon in one of the hardest-hit sectors of the pandemic. In a sign of the industry’s weakness, Marriott announced layoffs of 850 employees at its Times Square hotel, adding to 1,200 layoffs already announced in March.

- Retail shortages of Clorox disinfectant wipes are likely to persist to mid-2021 on unprecedented demand for the product.

- Electric vehicle battery costs have fallen nearly 90% in the past decade, bringing the cost of electric vehicles near parity with their conventional counterparts, with further cost reductions expected.

- Demand for greater speed among high frequency stock traders has spurred the development of hollow-core fiber optic cable that can transmit data at a third the speed of regular fiber optic cable.

- There will be no public audience for New York City’s Times Square New Year’s celebration this year due to risks of spreading COVID-19.

International

- The global COVID-19 case count topped 73 million on Tuesday.

- Germany reported record COVID-19 deaths, prompting government warnings that the strict four-week lockdown that starts today may extend beyond January.

- New COVID-19 infections in India have stayed below 30,000 for the third straight day, a welcome sign in the country with the second highest number of infections in the world behind the U.S.

- COVID-19 cases and hospitalizations are declining in France as the country replaces a second national lockdown with a nightly curfew.

- Two of the U.K.’s most prominent medical journals are urging government leaders to scrap plans to allow household mixing over Christmas, a plea to protect the national hospital system from being overwhelmed.

- Italy’s prime minister said the country needs new restrictions to avoid a third wave of COVID-19, which could be more severe than the first two.

- The Danish government has plans to extend regional lockdowns into a single, national lockdown in the face of rising COVID-19 cases.

- Sweden’s capital is considering halting all non-essential healthcare services to free up resources needed to tackle rising COVID-19 infections.

- European drug regulators are speeding up the bloc’s review of Pfizer/BioNTech’s COVID-19 vaccine ahead of a holiday season that poses increased transmission risks.

- China has secured 100 million doses of Pfizer/BioNTech’s COVID-19 vaccine as the country seeks overseas shots in conjunction with locally-made ones.

- Saudi Arabia is beginning a three-phase COVID-19 vaccination program where people aged over 65 or those with chronic ailments will be first in line to receive Pfizer/BioNTech’s vaccine, followed by people above age 50 in the second round.

- Japan’s central bank is tapping $6 billion from a government account to ensure it has enough funds to combat any market disruptions caused by a recent uptick in COVID-19 cases. Falling exports in the country in November indicate a slower pace of recovery for the world’s third-largest economy.

- The euro is up 9% this year to the highest exchange rate against the dollar since 2017 on optimism about the region’s economic recovery.

- Affecting a “significant subset” of users, Google’s Gmail service suffered an outage for the second day in a row, this one lasting about two hours on Monday afternoon.

- Volkswagen’s top shareholders and union leaders publicly backed the company’s new strategy to refocus operations on the development and production of electric vehicles.

- Toshiba and Fuji Electric are investing a combined $1.9 billion to increase production of power-saving chips for electric vehicles, citing sharpened focus on electric vehicles from governments around the world.

- Air passenger demand has rebounded past pre-pandemic levels in Australia, with airlines posting record numbers of planned flights early next year.

Our Operations

- M. Holland will be closed on Thursday and Friday, December 24 and 25, for the Christmas holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.