COVID-19 Bulletin: December 3

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The U.S. Energy Department reported that crude inventories shrank last week, giving oil prices a boost yesterday, though gasoline inventories rose. Oil prices were up in mid-day trading today, with the WTI 0.2% higher at $45.57/bbl and Brent up 0.4% at $48.36/bbl. Natural gas 9.2% lower at $2.52/MMBtu.

- Seadrill Partners is the latest offshore driller to file for bankruptcy in the U.S.

- ConocoPhillips is cutting 500 jobs in Houston, a fifth of its headquarters workforce.

- LyondellBasell finalized its deal to take a 50% ownership stake in Sasol’s recently completed Lake Charles, Louisiana, petrochemicals complex and will operate the polyethylene assets.

- Ascend has declared force majeure on nylon 6/6 due to a fire at its Florida plant.

- Mexico’s National Centre for the Control of Natural Gas has cut off the natural gas supply to Braskem Idesa, forcing the company to shut down polyethylene production and threaten legal action in a continuing dispute over ethane contracts.

- Mexico’s state-owned oil company has exited the Oil and Gas Climate Initiative, the largest climate-focused organization within the global oil and gas industry.

- A pandemic-induced decline in virgin plastic resin prices has made recycled plastic comparatively more expensive, adding challenges to an already struggling plastics recycling industry.

- Green hydrogen, if successful, could revolutionize global renewable energy prospects and become a $1 trillion industry.

Supply Chain

- The surge in e-commerce has contributed to long delays at many of the nation’s ports, especially on the West Coast, with nearby warehouses filling up as supply chains are overloaded with goods.

- Container rates from Asia to Europe have reached a 10-year high, partly due to strained shipping lanes as Western retailers restock ahead of year-end holidays.

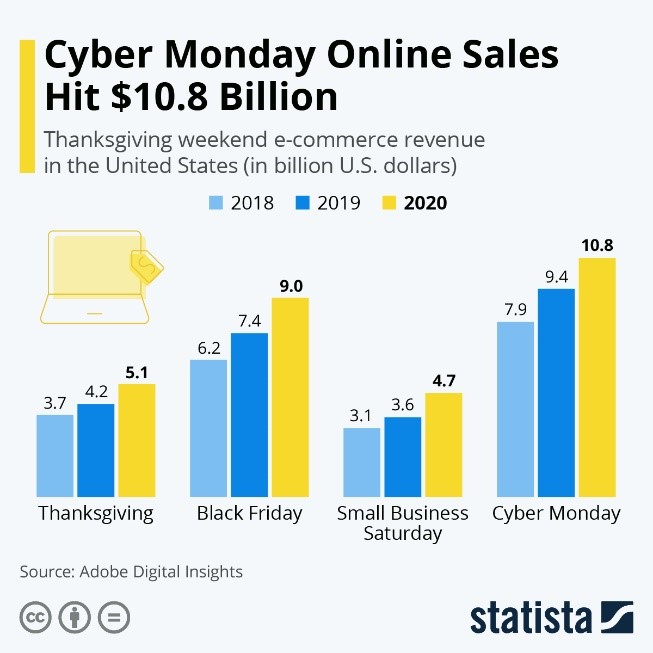

- Rising e-commerce activity is straining the capacity of delivery services, with UPS imposing restrictions on large retailers such as Gap and Nike in the wake of a record cyber Monday.

- The Logistics Manager’s Index, a gauge for business activity in the logistics industry, continued to grow in November with a reading of 70.8, where an LMI above 50 indicates industry expansion. The number is slightly lower than the 71.6 posted in October.

- Higher insurance premiums and coronavirus-related expenses have pushed vessel operating costs up 4.5% in 2020, the fastest increase in over a decade.

- The Supplier Deliveries Index rose to 61.7% in November on congestion at ports and rising coronavirus cases. A reading above 50 indicates slower deliveries, according to the Institute for Supply Management.

- Logistics giant XPO Logistics will spin off its contract logistics unit into a separate public company while keeping trucking and freight brokerage operations as a stand-alone business.

- We are seeing congested trucking and shipping conditions, backlogs at warehousing and packaging facilities, and tight packaging supplies. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

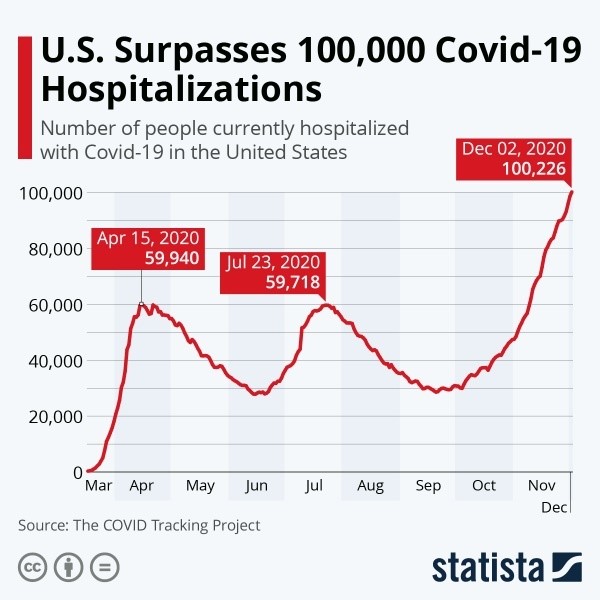

Yesterday, the U.S. suffered 2,157 COVID-19 fatalities, 200,070 new infections and over 100,000 hospitalizations.

- As official COVID-19 fatalities in the U.S. approach 275,000, the CDC estimates the real toll is closer to 400,000.

- The CDC has shortened the recommended two-week quarantine period to 7 to 10 days for people exposed to COVID-19.

- Federal officials are expecting to have enough COVID-19 vaccine doses to immunize 100 million higher-risk Americans by the end of February. New York will receive 170,000 Pfizer vaccine doses by December 15.

- CVS employees will soon be able to administer Eli Lilly’s COVID-19 treatment in people’s homes. The treatment, which helps to keep patients in early stages of the disease from developing serious symptoms, requires an hour-long infusion that jams hospitals and puts others at risk.

- Private sector job growth slowed in November, with ADP reporting 307,000 jobs were created, the lowest level since July and well below forecasts as a resurgence of COVID-19 infections shadows the economic recovery.

- There were 712,000 first-time jobless claims last week, lower than the prior week but more than three times weekly claims before the pandemic.

- Corporate bankruptcies were up 40% in November compared with the prior-year period, while overall bankruptcies were at their lowest level in 14 years as individuals benefited from stimulus programs and eviction moratoriums.

- The number of corporate “zombies” — major companies with less cash flow than their interest expenses — nearly doubled to 47 in the third quarter as the pandemic prolongs the cash burn in many sectors.

- JFK airport’s busiest terminal is delaying a $3.8 billion refurbishment project on projections that passenger numbers might not return to pre-pandemic levels until 2024.

- The Institute for Supply Management index of American manufacturing activity reached 57.5 in November, versus a two-year high of 59.3 in October, with anything above 50 indicating growth. Lean inventories suggest the manufacturing rebound will continue.

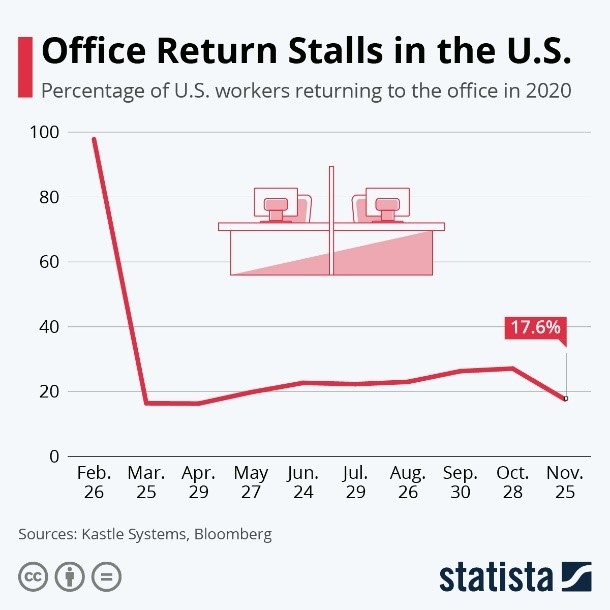

- Rising COVID-19 cases have stalled a return to offices:

- Home-appliance makers are tailoring their products to include better sanitization features, such as sterilizing lights in refrigerators and washing machines with extra high heat.

- Business school applications rose for the first time in five years this year, as more students turn toward higher education to weather the poor job market and many schools loosened testing requirements.

- Zoom and Microsoft Teams face increased competition from a $27.7 billion megadeal pairing CRM giant Salesforce with the collaboration app Slack, a duo that aims to provide wider opportunities for remote work.

- Walmart is doing away with free shipping minimums for subscribing customers in order to become more competitive with Amazon.

- With 30-year mortgage rates at record lows, a wave in refinancing is not expected to let up any time soon.

International

- In the wake of becoming the first Western nation to authorize a COVID-19 vaccine, the U.K. ended its national lockdown as new infections continue to fall.

- The European Union is criticizing the U.K.’s decision to approve Pfizer’s experimental COVID-19 vaccine, claiming research into the company’s late-stage trials was not thorough enough and urging more caution.

- Russia will begin a “large-scale” COVID-19 immunization campaign starting next week, with doctors and teachers set to be the first to receive a Russia-developed vaccine.

- Italy is shutting down Christmas midnight mass alongside travel between regions as the country continues to see more COVID-19 infections than its European peers.

- Germany is extending its partial lockdown for three more weeks.

- The Australian state of New South Wales recorded its first case of COVID-19 in 25 days after months of rigorous lockdowns nearly eradicated the disease in the region. Australia’s economy returned to growth in the third quarter after a 7% contraction in the second quarter during the lockdowns.

- The Asia-Pacific economy is leading the global recovery from the pandemic, with several trade powerhouses, including South Korea and Taiwan, posting elevated growth and export levels.

- Canada’s economy grew at a record-setting 40.5% pace in the third quarter, rebounding from historic declines in the first and second quarters, as businesses and stores reopened from COVID-19 lockdowns.

- Entering December, the U.S. dollar is sinking to multi-year lows against several foreign currencies.

- Volkswagen is dissolving its racing division to put more resources and employees in electric vehicle development roles.

- Japan may ban internal combustion vehicles by the mid-2030s.

- France threatened to veto a Brexit deal if European Union negotiators make further concessions to the U.K.

- A diplomatic row between China and Australia is deepening as Australian officials rejected a document from the Chinese government outlining 14 grievances.

Our Operations

- Our 3D Printing group has partnered with Advanced Laser Materials (ALM) and EOS North America to distribute selective laser sintering (SLS) materials. Click here to read more.

- We are pleased to introduce M. Holland’s new Application Development Engineer for Sustainability, Debbie Prenatt. With 20+ years in the plastics industry, Debbie will focus on developing our portfolio and expanding our expertise in the Sustainability segment to better serve our clients.

- Our latest Founders Series video is a tribute to Joan Holland, co-founder and matriarch of M. Holland, who recently passed away.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.