COVID-19 Bulletin: May 26

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- After dipping Friday, oil prices were higher in early trading today, with the WTI up 2.6% to $34.12/bbl and Brent up 1.6% to $36.08/bbl.

- The head of the International Energy Agency said the world has not yet reached “peak” oil consumption.

- Shale producers have idled about two-thirds of active drilling rigs, sending the active rig count to its lowest level since 2009 and investor interest fleeing. Prospects have faded for a return to pre-COVID-19 production levels in the next few years.

- Short production lives of shale wells are the industry’s “Achilles’ heel,” requiring a constant high rate of drilling to maintain production levels.

- Deutsche Bank, citing an improving polyethylene market, raised its rating on LyondellBasell stock.

Supply Chain

- European shipping companies, who have criticized state bailouts of Asian shippers in the past, are now espousing state aid after the global industry suffered the cancellation of 25% of scheduled sailings in the past three months.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

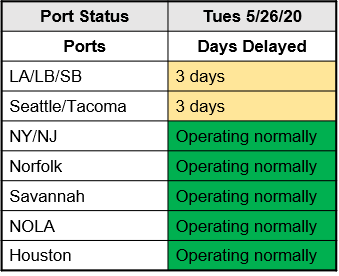

- We saw delays at ports in California and Washington extend from two days to three days:

Markets

- Global trade fell 4.3% in March compared with the prior-year period, the biggest monthly decline since 2009.

- The World Trade Organization projects global trade could fall between 13% and 32% in 2020, potentially rivaling the one-third drop experienced over three years of the Great Depression.

- Consumer spending in the U.S. fell 11% in March, with wide disparities in how COVID-19 impacted various sectors.

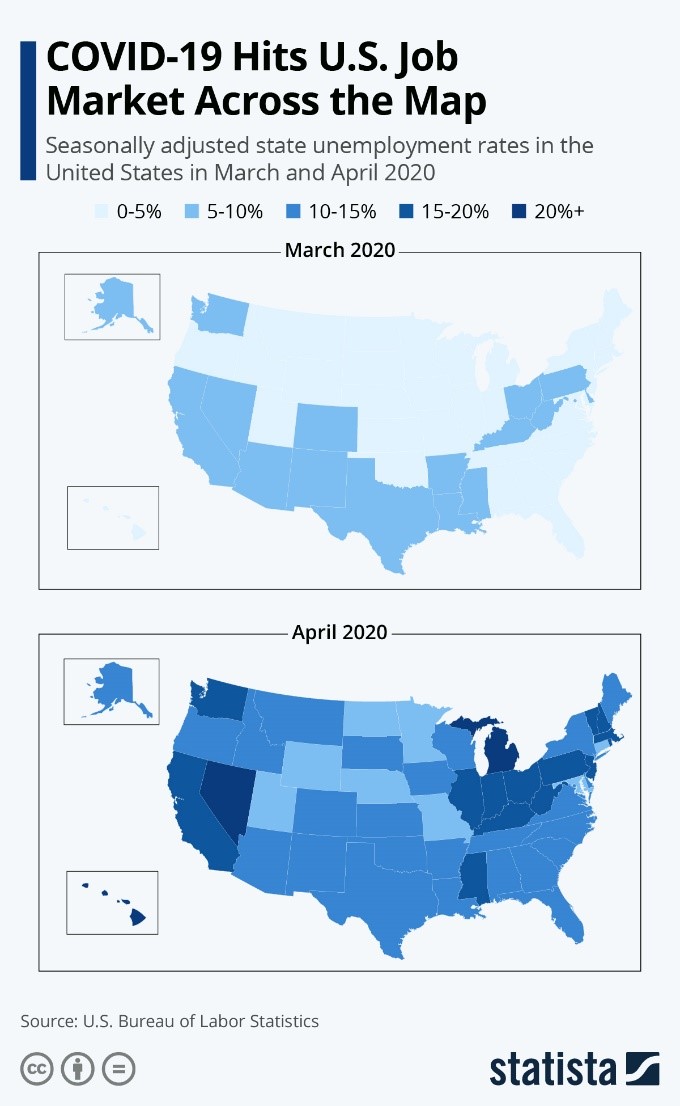

- Forty-three states have historically high unemployment rates; the top two are Nevada (28.2%) and Michigan (22.7%).

- Summer internships are one more casualty of COVID-19.

- Medical device maker Becton Dickinson, in its second quarter report, provided a segmented overview of COVID-19’s impact on its business, with delays in elective surgery, R&D activity, non-COVID-19 testing, and capital and equipment installations offsetting spikes in virus-related tests and equipment.

- Part shortages from Mexico are interfering with GM’s resumption of production of pickup trucks, its most profitable products, forcing delays in worker callbacks.

- Nissan, which has slashed spending by $3 billion and laid off 15,000 since last July, is expected to announce another $3 billion in expense cuts and a one-million-vehicle capacity reduction.

- John Deere foresees a 10% to 15% drop in sales of agricultural equipment and a 30% to 40% decline for construction equipment this year.

- Hertz became the first major car rental company to file for bankruptcy reorganization.

- “Covid camper” sales are surging as fearful vacationers look to recreational vehicles as a safe method to get away while maintaining social distancing.

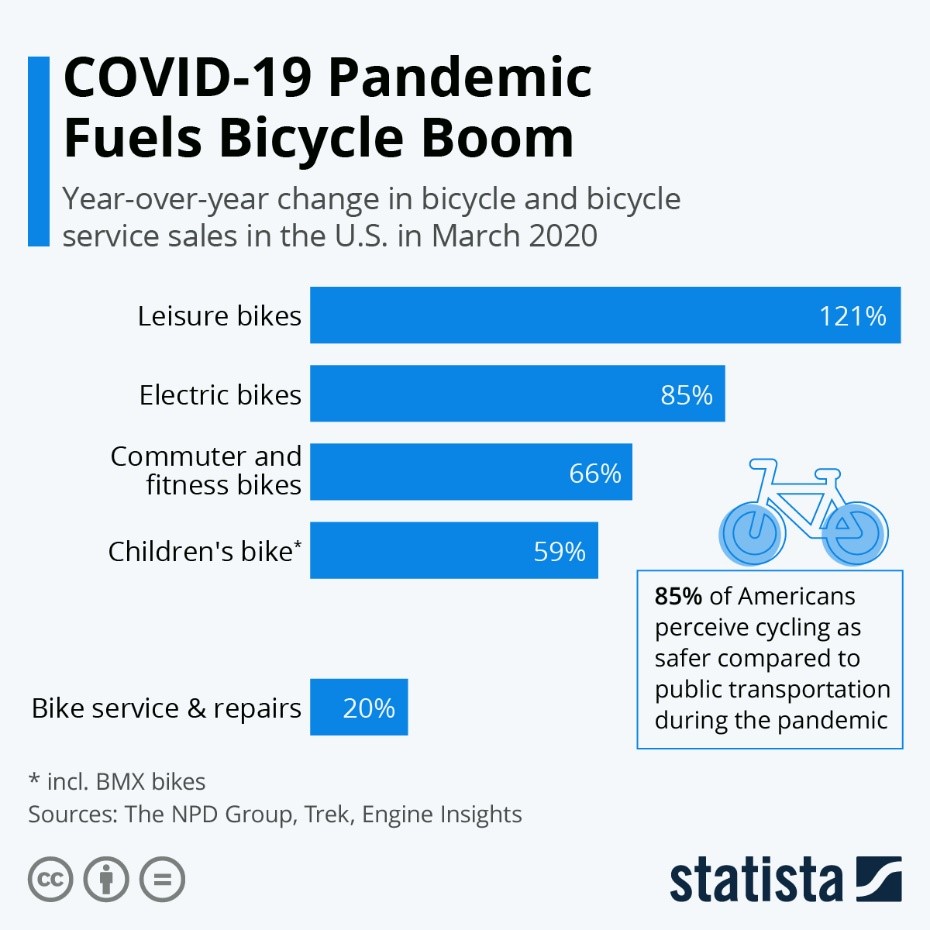

- Bicycles also have seen a surge in demand:

- Companies attempting to test returning employees are encountering cost and logistics challenges, with tests costing up to $100 each and taking several days for results.

- COVID-19 has stretched repair crews for telecom companies, creating concerns for the upcoming hurricane season, which is expected to be active.

International

- Brazil surpassed Russia in COVID-19 infections with the second highest rate behind the U.S.

- The White House will block most non-citizens from entering the U.S. from Brazil.

- Argentina will begin talks with creditors after defaulting on its sovereign debt.

- LATAM Airlines, South America’s largest carrier, will reorganize under bankruptcy protection two weeks after another of the continent’s major carriers, Avianca Holdings, also filed for bankruptcy.

- Germany will take a 20% stake in the airline Lufthansa as part of a $9.8 billion rescue package.

- Japan lifted the state of emergency in Tokyo, the last area of the country under restrictions imposed on April 7.

Our Operations

- Out of an abundance of caution for the safety of our people, we will leave offices closed and maintain remote work arrangements at least through July.

- M. Holland Company has entered a distribution partnership with leading polyolefin producer Braskem to distribute a new line of innovative polypropylene filaments, powder and pellets for 3D printing.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- M. Holland is fully operational and prepared to meet client needs for materials, material selection, logistics services and technical support.

- We have issued the following status statement:

In accordance with the guidance provided by the U.S. Department of Homeland Security Cybersecurity & Infrastructure Security Agency (CISA), M. Holland Company is considered a member of a critical infrastructure industry and will therefore remain operative. As such, with any necessary accommodations made to ensure the health and safety of our staff and business partners, we will continue to fully perform our normal business operations.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.