MH Daily Bulletin: January 23

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- 2022 was a difficult year for supply chains, with 3D printing, Color & Compounding and Rotational Molding all weathering challenges to keep inventories up to date. Click here to read what M. Holland’s market managers had to say about their predictions for the three industries in 2023.

- M. Holland announced the restructuring of its leadership team to support accelerated growth and the next phase of the company’s evolution. Click here to read the full press release.

Supply

- Oil settled up about 1.5% Friday, notching a second straight weekly gain as China’s economic prospects brightened.

- In mid-morning trading today, WTI futures were up 0.6% at $82.09/bbl, Brent was up 1.0% at $88.54/bbl, and U.S. natural gas was up 6.9% at $3.39/MMBtu.

- Active U.S. drilling rigs fell by 10 to a total of 613 last week, the lowest since November, according to Baker Hughes.

- Global offshore drilling is booming again, with about 90% of rigs available for lease now working or under contract compared to about 63% five years ago.

- Oil companies are expected to increase upstream capital spending by 12% this year after several years of investment restraint.

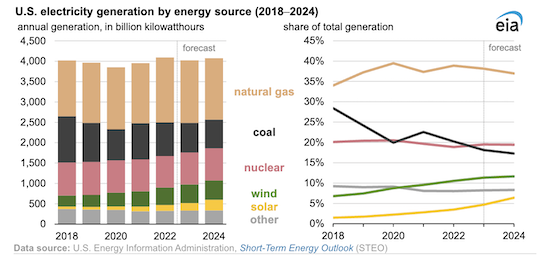

- Supply-chain and other regulatory snags are slowing developers’ plans to build an unprecedented number of U.S. wind and solar installations. Still, the U.S. administration expects renewables to gain share at the expense of coal and natural gas over the next two years:

- LNG spot prices in Asia have fallen 67% from record-highs reached in August due to the unusually mild winter in Europe.

- Oilfield services firm SLB, formerly Schlumberger, beat Wall Street expectations with a 26% gain in quarterly revenue, led by its North America and Latin America businesses.

- China’s biggest oil trader is making large purchases of oil, signaling an expected pickup in the country’s demand.

- More news related to the war in Ukraine:

- Russia’s seaborne crude exports dropped 22% in the week to Jan. 20, falling by 820,000 bpd, losing nearly all of the gains the nation accrued in the week prior and marking its smallest inflows since it began invading Ukraine last February.

- Germany’s economy ministry says it will need until 2026 to install 56 billion cubic meters of domestic LNG import capacity, enough to replace all capacity from Russia.

- The U.S. Treasury Secretary says that the G7’s price cap on Russian oil could save the 17 largest net oil-importing African countries $6 billion annually.

- Renewable power sources are expected to comprise over 50% of electricity generation in China for the first time this year.

- Germany unveiled plans to develop 30 GW of offshore wind capacity by 2030.

- Britain announced over $40 million in funding to help support the green energy transition in construction, mining, quarrying and other industries.

Supply Chain

- Severe weather in California over the past three weeks could end up costing $34 billion, experts say.

- South Africa’s government wants the nation’s cash-strapped power utility to suspend its biggest price hike in a decade as the nation faces two more years of rolling blackouts.

- Loaded container imports into the ports of Los Angeles and Long Beach fell 20.2% in December from the same time last year.

- Trans-Pacific container shipping demand will likely return to more normal patterns in the second half of 2023, according to U.S.-based shipper Matson.

- The growth of trans-Pacific container lines operating outside the main alliances is receding as high freight rates normalize.

- India proposed banning cargo vessels more than 25 years old from calling at the country’s ports, citing safety and emissions concerns.

- Ships equipped with scrubbers allowing for the use of low-quality bunker fuel saw their daily fuel savings double in 2022 compared with ships using very low-sulfur fuel.

- Union members at two CNH Industrial factories in Wisconsin and Iowa reached agreement over a new labor contract, ending an eight-month strike.

- In the latest news from the auto industry:

- GM is considering building a new mini electric pickup truck that would be part of the automaker’s lineup of affordable electric vehicles under $30,000.

- GM and LG Energy Solution scrapped plans to build a fourth U.S. battery cell manufacturing plant.

- Analysts say a glut of lithium supply this year will send prices sliding for the key material in electric-vehicle batteries.

- Colorado-based Outrider raised $73 million in a funding round backing its development of electric commercial trucks for use in distribution yards.

- Stellantis will halt production at its Atessa van making plant in Italy this week due to a parts shortage.

- U.S. power chip-maker Wolfspeed plans to build a factory in Germany for more than $2.17 billion.

- Italy remains a potential location for Intel to build a new semiconductor plant as part of the firm’s $87 billion investment plan for Europe.

- Amazon’s cloud services unit plans to invest another $35 billion by 2040 to expand data centers in Virginia.

- GXO Logistics, the world’s largest contract logistics provider, is looking for a $1-billion-plus acquisition to fill gaps in its business in Canada.

- The European Commission is stockpiling drugs and organizing joint procurement amid a Europe-wide medicine shortage.

- Pittsburgh-based aluminum maker Alcoa saw sales drop 20% last quarter on declining prices for the metal.

- Glencore’s major copper mine in Peru suspended operations Friday due to disruption caused by political protests.

Domestic Markets

- The daily average for new COVID-19 cases declined to 47,459 last week from 59,246 the week before, while average fatalities rose to 565 from 558.

- The XBB.1.5 Omicron subvariant is estimated to account for 83% of COVID-19 cases throughout the U.S. Northeast, according to the latest data from the CDC, while accounting for just under half of virus cases nationwide in the week that ended Jan. 21.

- A bipartisan group of U.S. lawmakers is preparing a plan to defuse a looming crisis over the nation’s debt ceiling by changing it from a fixed dollar amount to a percentage of national economic output.

- Fed officials in recent statements have indicated growing support for slowing the pace of interest-rate hikes to a more traditional quarter percentage point.

- The tech sector announced over 97,000 job cuts in 2022, up 649% compared to the previous year.

- Spotify became the latest tech company to announce staff cuts, reporting this morning it will lay off 6% of its workforce.

- Unemployed Americans across the U.S. are spending more time out of work as employers slow hiring, with the number of people seeking ongoing unemployment benefits now 26% higher than half-century lows reached last spring.

- U.S. existing home sales plunged 34% year over year to a 12-year low in December, concluding a historically weak year for the embattled housing market:

- Swiss engineering and technology company ABB will complete a downsizing of its business portfolio, announcing that it will sell its U.S.-based power conversion business to AcBel Polytech of Taiwan for $505 million.

International Markets

- In the latest China news:

- China’s chief epidemiologist said 80% of the population has likely been infected with COVID-19 in the current outbreak, equating to some 1.1 billion people. The country reported 13,000 virus fatalities last week.

- Investors poured a record $12.7 billion into emerging-market debt and equity last week, likely a response to China’s easing of its COVID-19 restrictions, Bank of America said. At the same time, China’s own investments into emerging-market projects are faltering under low-quality construction and other issues.

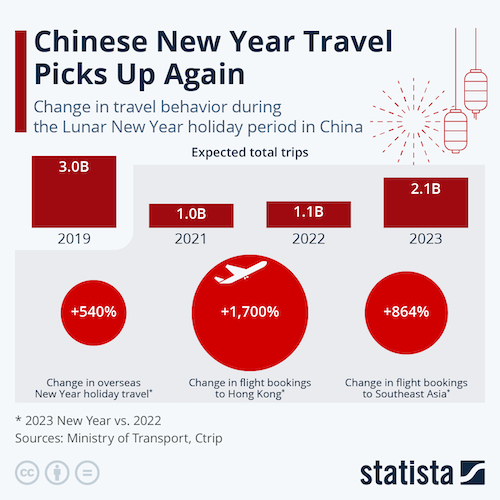

- China’s Lunar New Year will likely produce about 2.1 billion trips this year as COVID-19 risks continue to hamper travel activity:

- Tourist travel to Mexico set a record in 2022, exceeding pre-pandemic levels.

- The European Central Bank is set to raise interest rates by 50 basis points in both February and March and will continue to raise rates in the months after, top officials indicated.

- British retail sales unexpectedly shrank 1% in December as consumers cut back on spending due to persistent inflation.

- Germany’s annual producer inflation rate fell to 21.6% in December from 28.2% the previous month, marking the lowest level in over a year.

- South Korea’s exports fell 9.6% in December as global demand cooled, the latest data shows.

- Reliance Industries, India’s biggest company, took a bigger-than-expected hit to quarterly profit following the government’s windfall tax on fuel exports.

- Argentina and Brazil are in talks to renew decades-old discussions on forming a common currency for financial and commercial transactions.

- Less than 25% of 137 global firms plan to use carbon credits, despite more than 90% committing to reach net-zero emissions by 2050, according to the latest survey data.

Some sources linked are subscription services.