COVID-19 Bulletin: June 15

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices fell 8.3% last week, ending a six-week rally, on fears of a second wave of COVID-19 infections.

- Prices were higher in mid-day trading today, with the WTI up 1.4% to $36.77/bbl and Brent up 2.0% to $39.50/bbl.

- BP now estimates that Brent will average $55/bbl through 2050, down from its previous assumption of $70/bbl. The company will take a $13 billion write-down on the value of its reserves and could leave oil “stranded” in the ground.

- With North American working rigs down to 305 from more than 800 a year ago and oil production off by over 3 million barrels a day, the auction market for drilling equipment is booming.

- OPEC, which is leading efforts to curtail global production and restore oil prices, could emerge from the current market turmoil stronger and with higher market share.

Supply Chain

- Staples has teamed with Instacart to provide same-day delivery of office supplies to businesses and homes.

- Supply chain disruptions have upended the illicit drug trade, causing shortages of workers and precursor chemicals, a plunge in coca leaf prices, and the collapse of some rural economies in Latin America and Asia.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

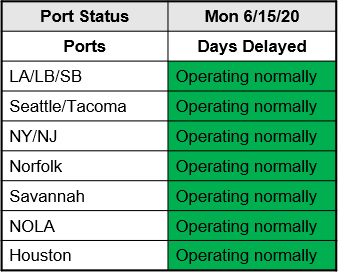

- Ports are operating normally:

Markets

- The White House is seeking a Phase 4 recovery tranche worth $2 trillion aimed at supporting manufacturing. The Senate is pressing for a $1 trillion plan, and the House of Representatives is proposing a $3 trillion package.

- With U.S. government debt expected to exceed 130% of output this year, higher than during WWII, policy makers may be forced to employ the same post-war strategy of “financial repression” to address the debt load, where interest rates are held low for a prolonged period.

- The University of Michigan’s index on consumer sentiment improved to 78.9 the week ended June 10, compared with an average of 72.3 for the prior four weeks.

- The net worth of U.S. households fell a record 5.6% in the first quarter.

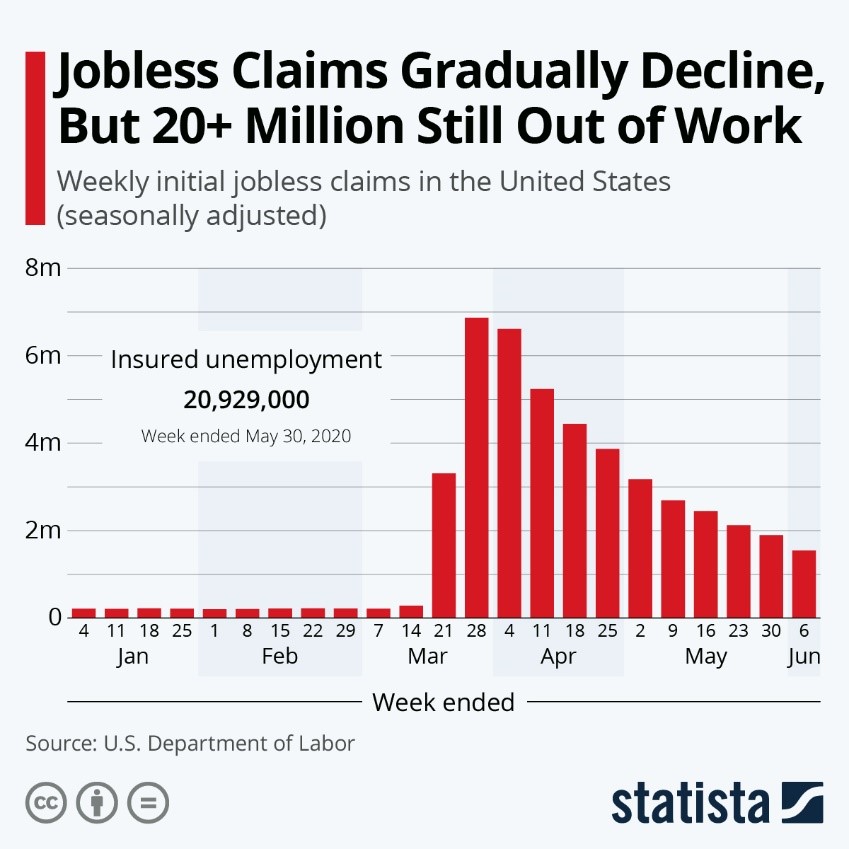

- Though jobless claims are declining, 30% of job losses could be due to “reallocation shock” and may be permanent, according to Bloomberg Economics.

- The unemployment rate among lower wage earners, disproportionately minority, climbed as high as 35% by mid-May, compared with just 5%-15% for higher wage workers, according to the Federal Reserve.

- Payment processors such as PayPal and Square are exacerbating cash flow challenges for some companies by delaying access to deposits out of concern for customer returns and cancellations.

- The U.S. automotive industry is reportedly just a few weeks away from running at full strength. However, call offs by anxious auto workers and infections at factories are creating challenges for the reopening industry.

- Mexican auto plants, under pressure to raise production to support U.S. assembly operations, are scrambling to seek extensions of domestic content requirements in the new USMCA pact, which takes effect July 1.

- Rental car company Hertz, in bankruptcy, is selling tens of thousands of used cars at discount prices, aggravating an already overstocked used car market.

- 24 Hour Fitness filed for bankruptcy, the latest failure among fitness centers facing a 28% rate of membership cancellations, according to the International Health, Racquet & Sportsclub Association.

- Unilever committed to reduce carbon emissions to zero by 2039 and will begin labeling 70,000 products with the amount of greenhouse gases generated in their manufacture and shipment.

- Retailers with a more rural footprint, such as Tractor Supply, Lowe’s and Dollar General, have fared better than their more urban competitors and may continue to benefit if people relocate from densely populated cities.

- Rigorous cleaning protocols by companies reopening offices could expose employees to dangerous levels of unhealthy chemicals in disinfectants on an EPA-approved list.

- Some employees working remotely in another state could face double taxation if their company is in one of six states with “convenience” income tax rules: Arkansas, Connecticut, Delaware, Nebraska, New York and Pennsylvania.

- Some areas experiencing rising infection rates are extending restrictions as the CDC reports that COVID-19 fatalities in the U.S. could approach 140,000 by July 4. New York and Texas are threatening renewed lockdowns if case levels rise.

- Global COVID-19 cases are approaching 8 million.

International

- We are seeing high demand in export markets, with packaging facilities at capacity and logistics tight.

- Beijing closed a major food market and parts of the city in response to a new cluster of COVID-19 infections as China enforced its “zero tolerance” response to the virus.

- China has regained its position as the U.S.’s top trading partner.

- Brazil, now recording some 1,200 deaths a day, has suffered more than 41,000 COVID-19 fatalities, surpassing England with the second highest death rate behind only the U.S.

- Peru’s strict lockdown measures early in the pandemic backfired, driving citizens to crowded banks and markets in preparation and contributing to its current state of COVID-19 crisis.

- The U.K. has allowed the reopening of non-essential stores, closed since March 23.

Our Operations

- Our white paper on materials selection for medical devices, referenced during last week’s webinar, is available here.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.