COVID-19 Bulletin: June 16

Good Afternoon,

More COVID-19 news relevant to the plastics industry:

Supply

- Oil prices climbed for the second day in a row in mid-day trading today, with the WTI up 2.1% to $37.90/bbl and Brent up 2.3% to $40.65/bbl.

- The International Energy Agency expects oil demand to rebound by 5.7 million bbl/d in 2021, compared with a drop this year of 8.1 bbl/d.

- Banks are reducing their exposure to shale drillers, slashing credit lines and asset-backed lending as the industry struggles with weak demand and low prices.

- Shale pioneer Chesapeake Energy is expected to file for bankruptcy this week.

- FuelsEurope, an association of some of the world’s largest petrochemicals companies, endorsed major investment in low-carbon liquid fuels (LCLFs) to help Europe meet its carbon neutrality goal by 2050. Developing the synthetic fuel will require an estimated $731 billion.

- Calgary-based Enbridge Inc., which transports a fourth of North America’s crude oil production, is looking to diversify into natural gas and renewable energy sources.

- Sasol, pursuing asset sales to raise needed cash, has multiple bids from major petrochemical companies for a piece of its Lake Charles complex in Louisiana.

Supply Chain

- The pandemic revealed major flaws in supply chains, which must be rebalanced to provide greater flexibility and security in adjusting to sudden demand changes, according to a Michigan State paper that compares current supply chain weaknesses to the vulnerability of banks during the Great Recession.

- Our Gold Standard logistics and transportation partners continue to operate without disruption.

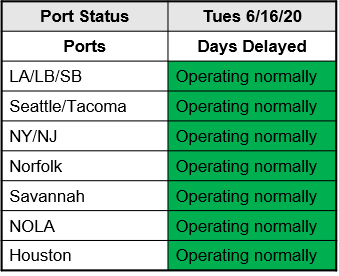

- Ports are operating normally:

Markets

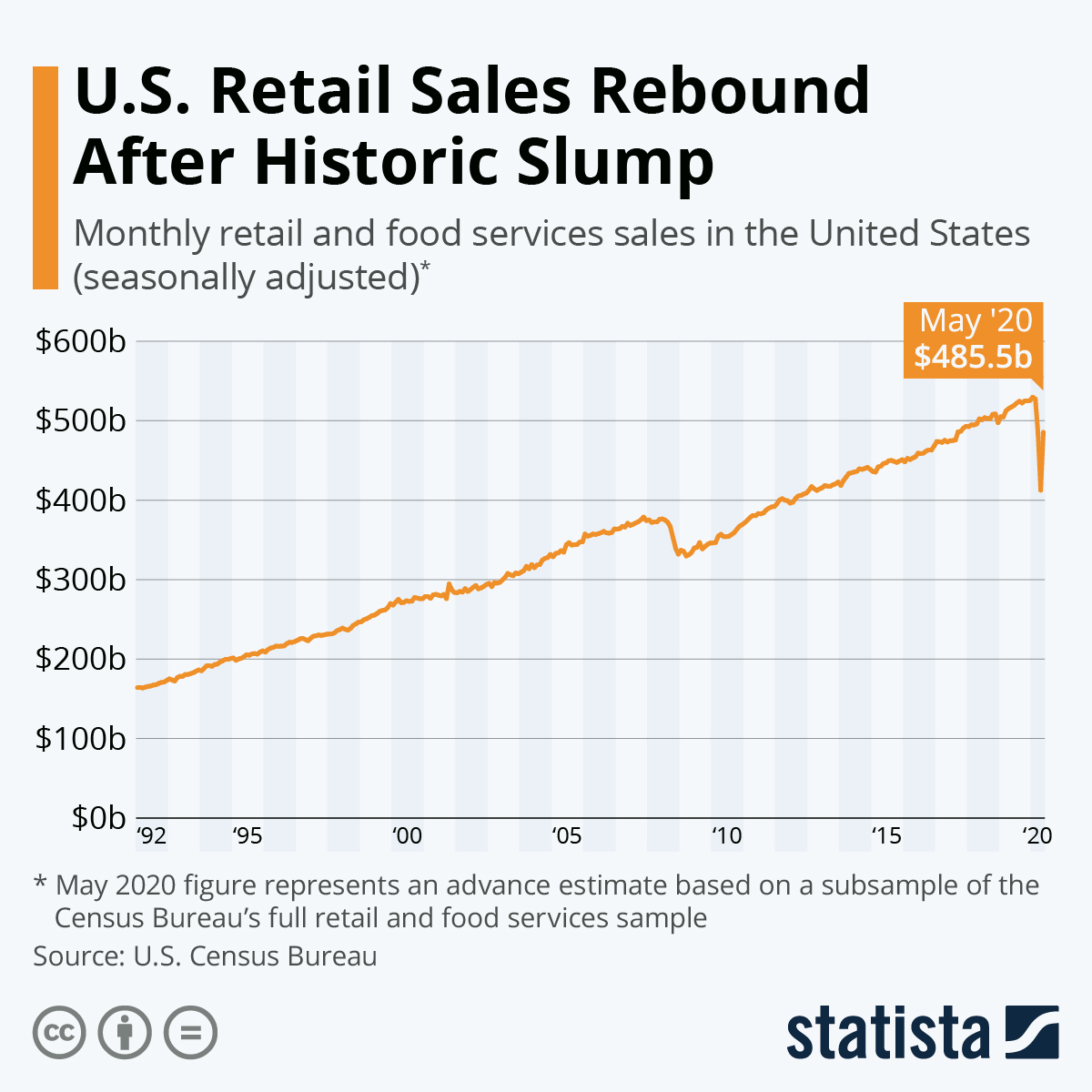

- Retail sales jumped an unexpectedly strong 17.7%, twice economists’ estimates:

- The Federal Reserve will commence buying up to $750 billion in corporate bonds as part of its previously announced Main Street Lending Program to stimulate the market and suppress interest rates. Stock markets jumped from losses to gains on the news.

- Despite lofty equity markets, investors are sitting on record amounts of cash with $4.6 trillion parked in money markets.

- The White House is considering a $1 trillion infrastructure initiative to help boost the economy.

- Tesla appears interested in locating a new assembly plant in the Austin, Texas, area.

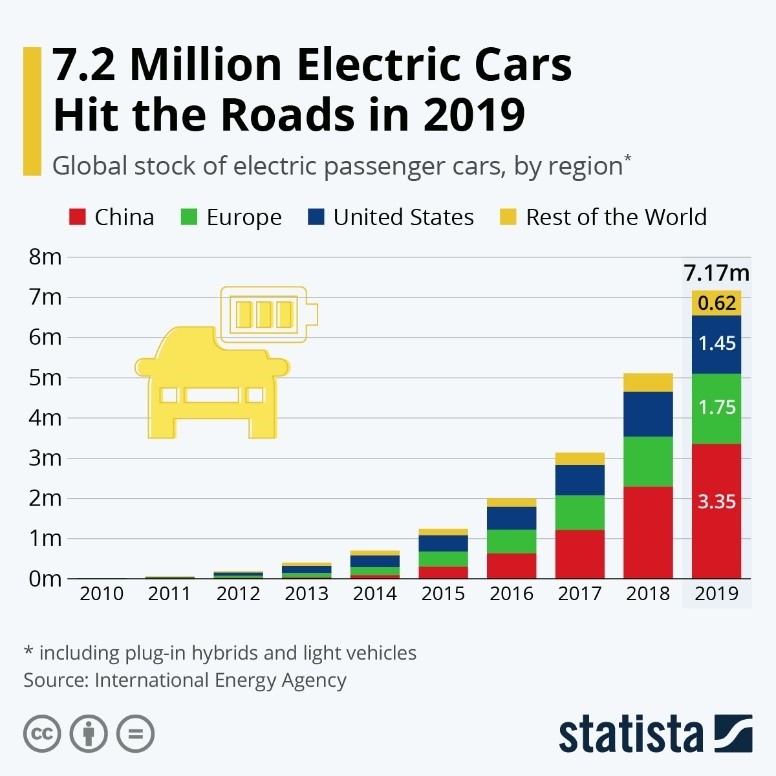

- The electric component market is expected to grow at a nearly 30% compounded rate through 2025 with the growth in electric vehicles and the supporting infrastructure:

- The housing market around New York is booming as city dwellers seek to move to suburbs that may be safer in the event of a second COVID-19 wave.

- The pandemic could put a permanent dent in business air travel as executives are discovering that videoconferencing can be as effective as personal meetings.

- The COVID-19 crisis spawned at least 164 3D printing initiatives between mid-March and mid-May to help solve shortages of personal protective and medical equipment.

- Spending on advertising is expected to fall 13% this year, with cuts in business advertising partially offset by political ad spending.

- The University of Washington’s Institute for Health Metrics and Evaluation raised the estimated death toll from COVID-19 to 200,000 by October 1, an increase of 30,000 from last week.

- Twelve states are experiencing rising infection rates as the U.S. death toll from COVID-19 passed 116,000.

- People with underlying conditions are 12 times more likely to die from COVID-19.

- One in five people have underlying conditions that can trigger severe symptoms from COVID-19.

- Global COVID-19 cases passed 8 million.

International

- Consumer spending and industrial production in China rose in May as the nation continues its recovery.

- An official in Beijing said the risk of a second COVID-19 wave is high after a recent cluster from a food market expanded to more than 100 infections.

- U.K. and European leaders held their first Brexit talks in months since the pandemic suspended high-level negotiations.

- Africa, initially slow to succumb to the pandemic, is experiencing accelerating infection rates, a doubling in just 18 days, and risks becoming the next global epicenter.

Our Operations

- Our 3D Printing team has designed innovative tools to assist us in eventually reopening our offices, including a hands-free dispenser for hand sanitizer, a low-contact thermometer, and a multi-purpose tool for opening doors and completing other tasks.

- Our white paper on materials selection for medical devices, referenced during last week’s webinar, is available here.

- For clients seeking the convenience of accessing order status, order history, invoices, bills of lading and other information online, contact Tara Cutaia, Director of Client Experience, to sign up for our proprietary MHX app.

- Our Color & Compounding team has introduced an expanded linecard of pulverized products for compounders.

- To access 3D printing training, order parts and seek technical assistance, visit our new online resource.

- Resource Center: M. Holland offers a host of resources to clients, prospects and suppliers. To arrange a videoconference or meeting, contact:

- Automotive: Market Manager Matt Zessin.

- Color & Compounding: Market Manager Scott Arnold.

- Electrical & Electronics: Market Manager Carlos Aponte.

- Flexible Packaging: Senior Technical Development Engineer Todd Stevens.

- Healthcare: Global Healthcare Manager Josh Blackmore.

- Rotational Molding: Product Manager Pete Nutley.

- Wire & Cable: Director Todd Waddle.

- 3D Printing: Market Manager Haleyanne Freedman.

- For Regulatory advice, contact Regulatory Specialist Christopher Thelen.

- For Technical questions, contact Paul Lorigan, Manager of the M. Holland Technical Innovation Center.

- M. Holland’s official status statement is available here.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.